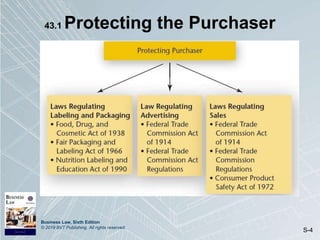

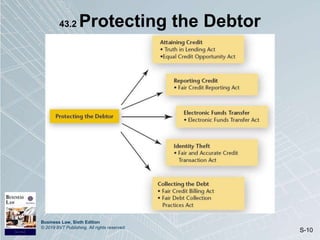

This document summarizes a chapter on consumer law from a business law textbook. It discusses laws protecting purchasers, including laws regulating labeling, packaging, advertising and sales. It also covers laws protecting debtors, such as the Truth in Lending Act, Fair Credit Reporting Act, Fair Debt Collection Practices Act and laws governing credit, debt collection, identity theft and electronic fund transfers. The chapter aims to explain this consumer protection regulatory environment.