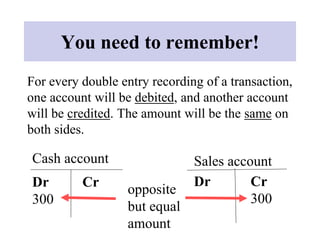

The document discusses the basics of double entry bookkeeping. It explains that every transaction involves two accounts - one will be debited and one will be credited for the same amount. The key points covered include:

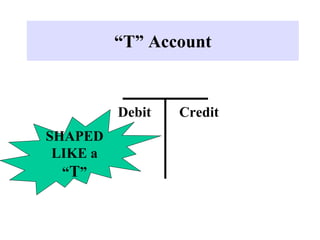

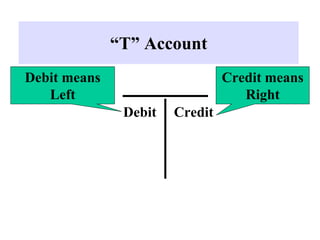

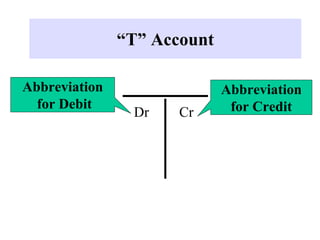

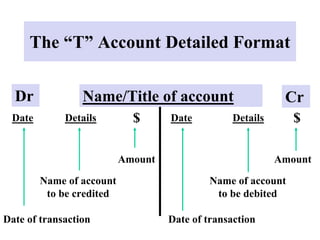

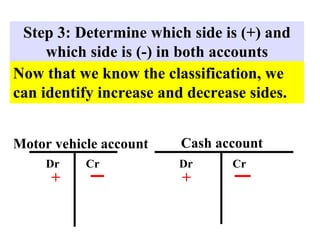

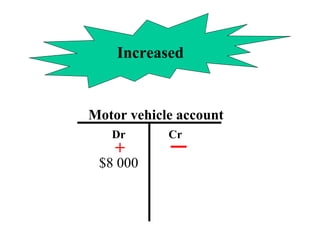

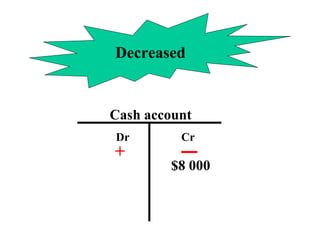

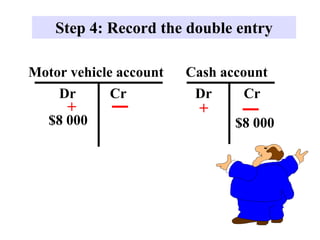

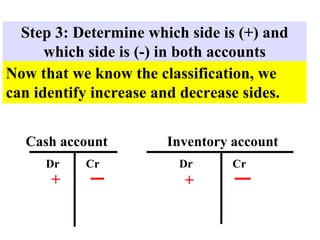

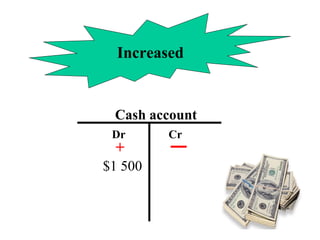

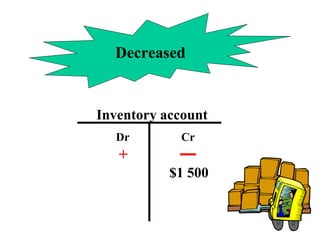

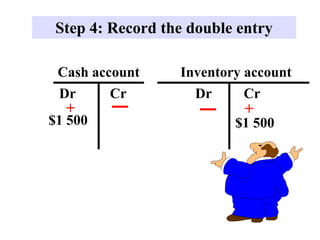

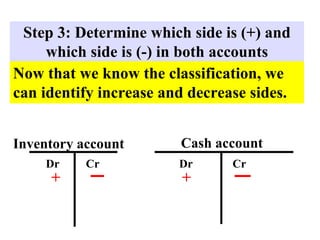

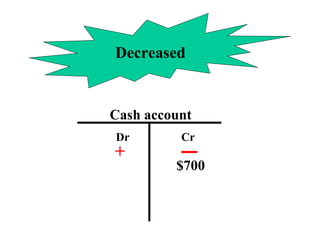

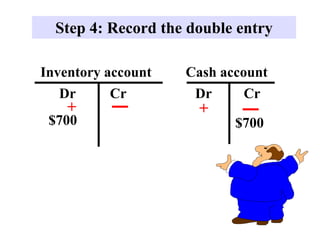

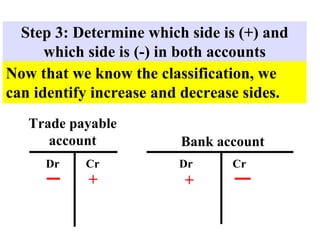

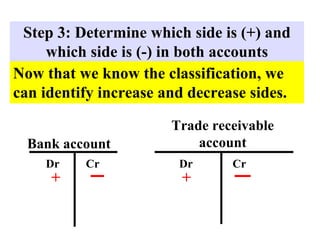

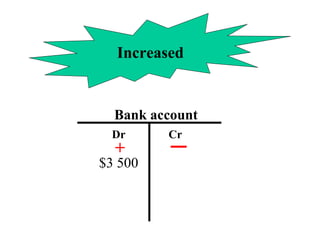

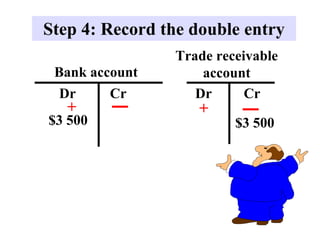

- What a T-account is and how it is used to record debits and credits

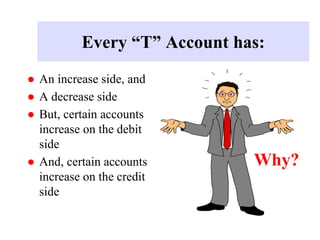

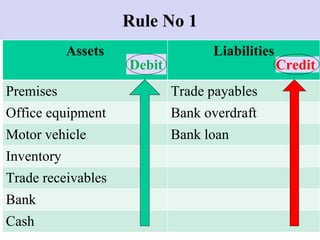

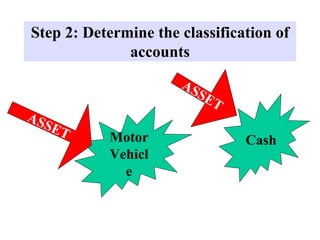

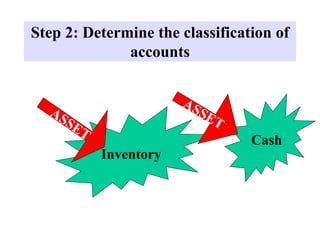

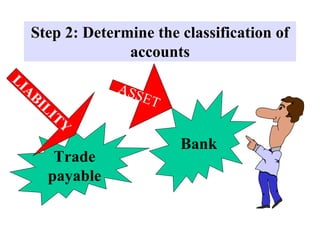

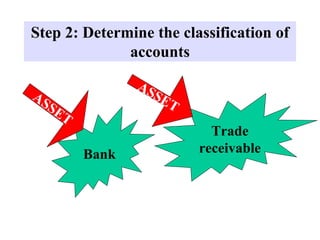

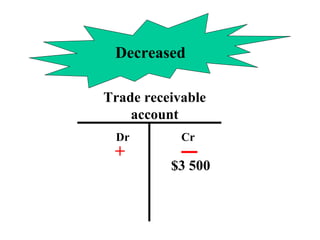

- Common asset, liability, and expense accounts that increase or decrease on different sides

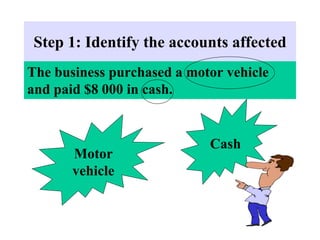

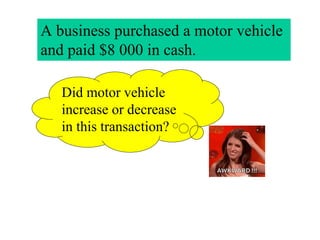

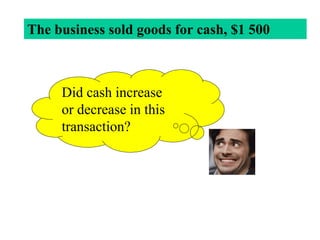

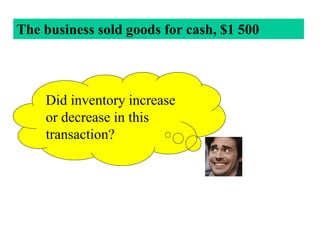

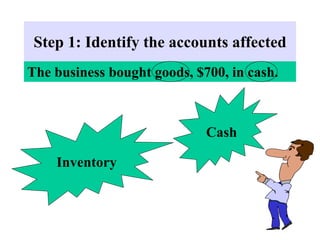

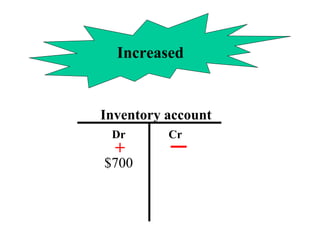

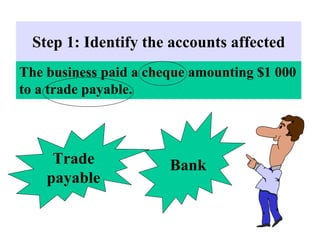

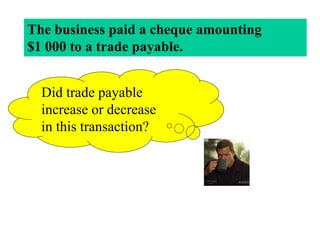

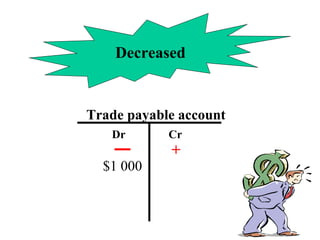

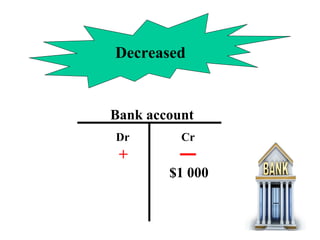

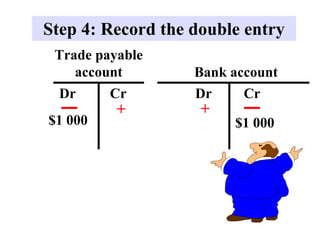

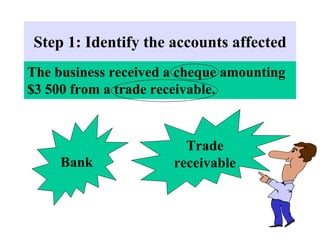

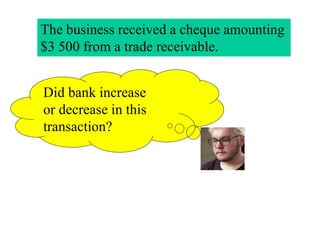

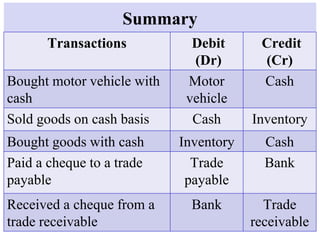

- Examples of double entries for transactions like purchasing an asset with cash, selling goods for cash, buying goods with cash, paying a supplier, and receiving payment from a customer

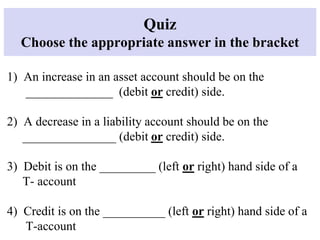

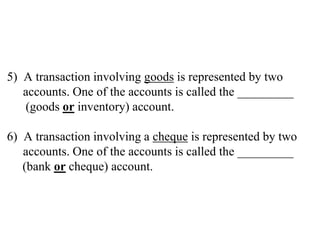

- A short quiz to test the understanding of debit, credit, and double entries