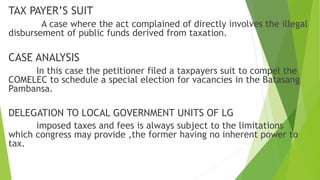

The document classifies and describes different types of taxes in the Philippine system. It discusses taxes based on subject (personal, property, excise), purpose (general/revenue, special/regulatory), who bears the burden (direct, indirect), scope (national, local), determination of amount (specific, ad valorem), gradation or rate (proportional, progressive, regressive), and the processes involved in taxation (levying, collection). It also outlines matters within the competence of the legislative body regarding taxation and discusses taxpayer suits.