This document discusses taxation in the Philippines. It covers several key points:

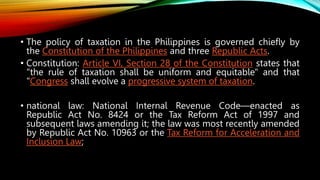

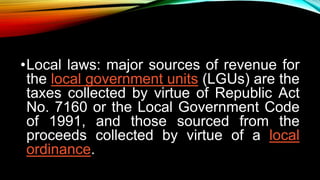

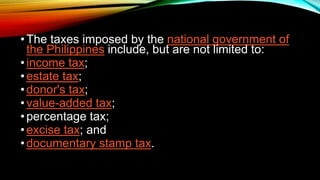

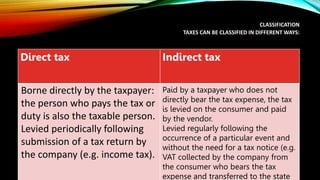

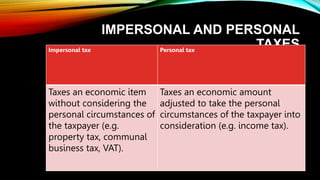

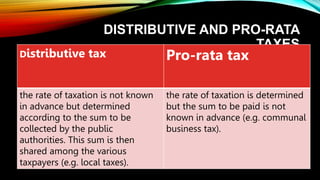

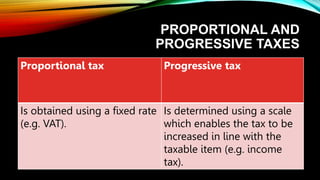

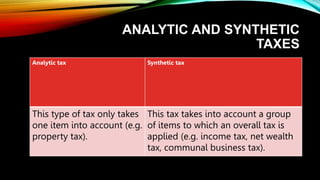

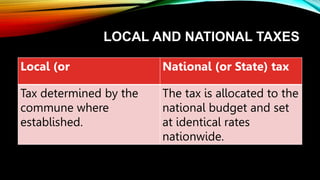

1. The types of taxes imposed by the Philippine government at both the national and local levels, including income tax, VAT, property tax, and others.

2. How taxes are collected in the Philippines, with national taxes handled by the Bureau of Internal Revenue and local taxes by local treasurer's offices.

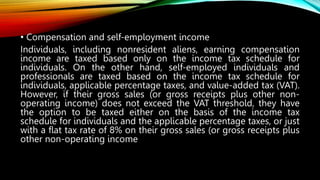

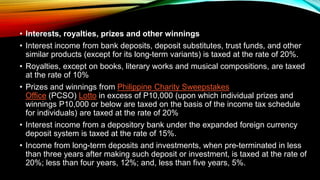

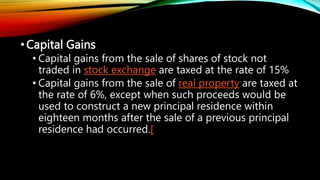

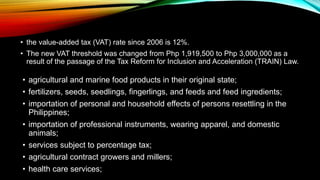

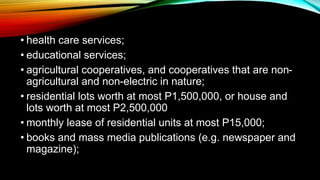

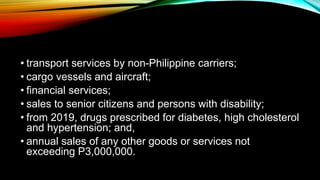

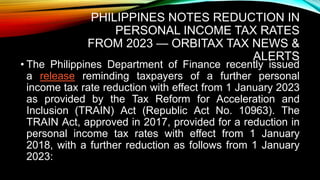

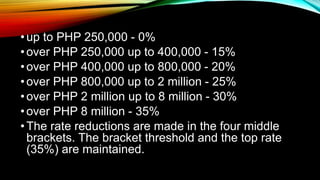

3. Details on personal and corporate income tax rates, capital gains tax, VAT rates, and tax exemptions in the Philippines.

4. An overview of local fiscal administration and its important aspects like budgeting, revenue generation, financial reporting, and resource allocation.