This document discusses taxation on donations or gifts in the Philippines. It covers various topics:

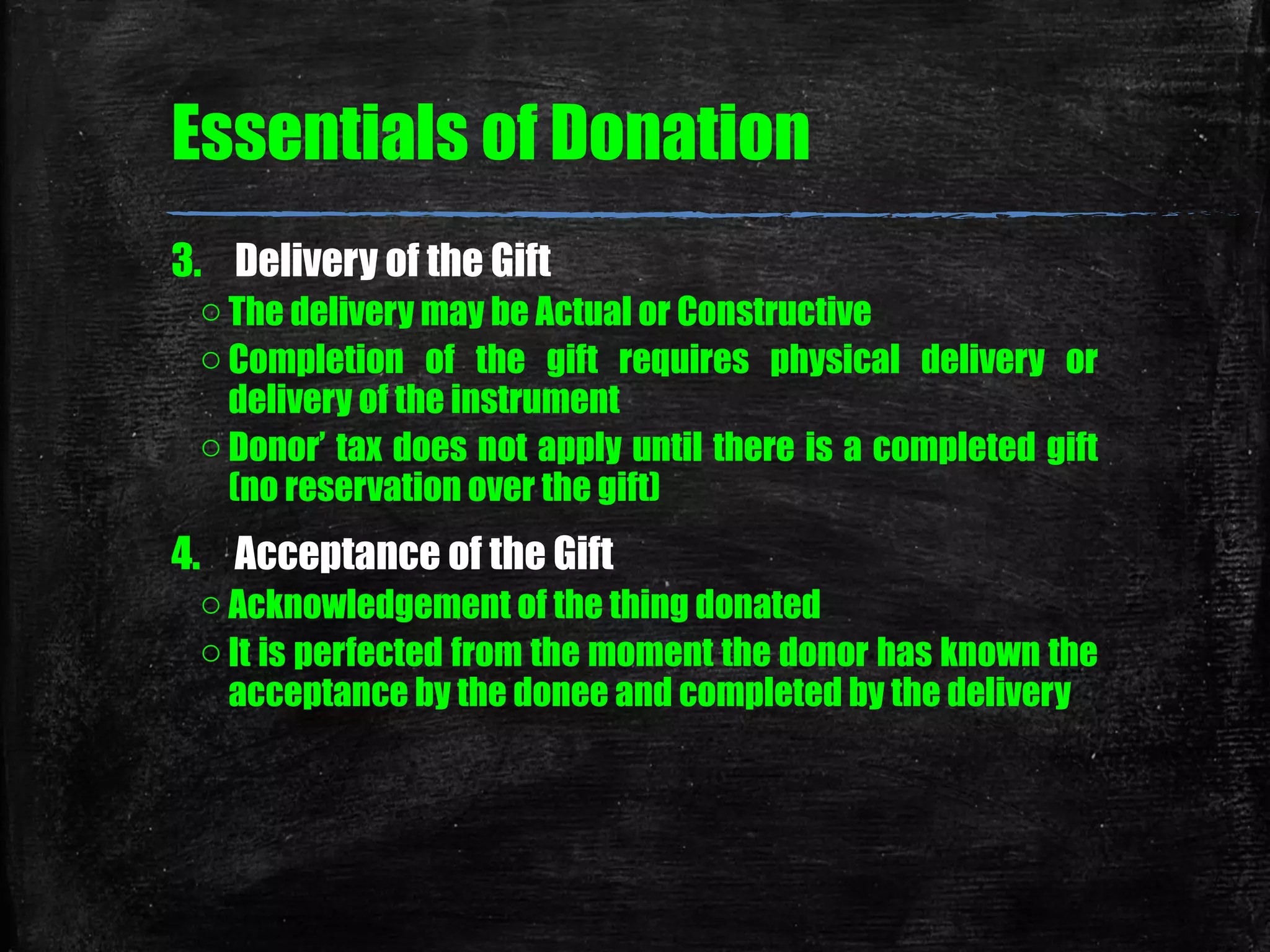

1) Definitions of donations and the essential elements of a valid donation including donor capacity, donative intent, delivery, and acceptance of the gift.

2) Classification of donors as citizens/residents or nonresidents and what donations are taxable depending on this classification. Gross gifts include all property donated regardless of location for citizens/residents but only include property within the Philippines for nonresidents.

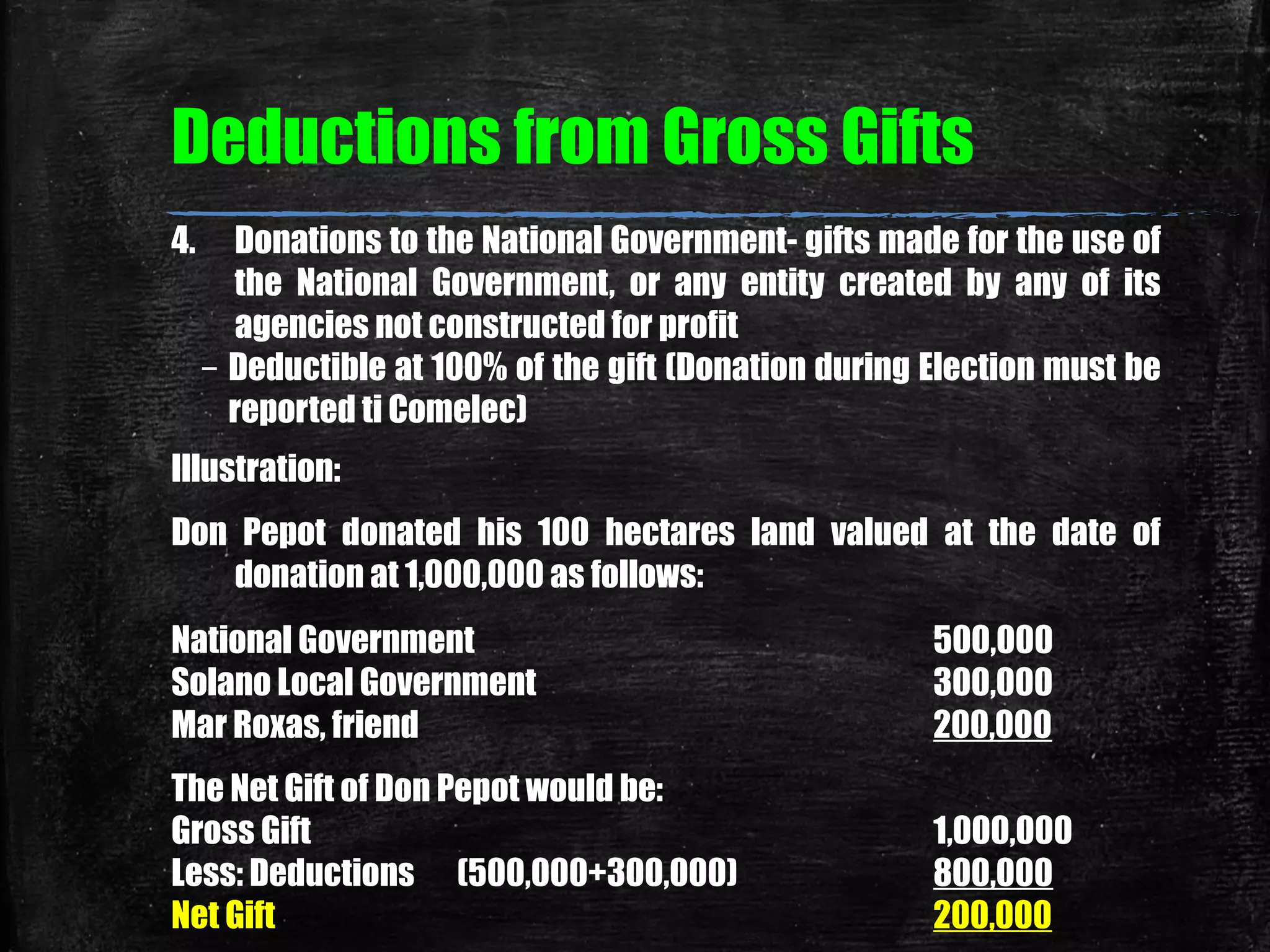

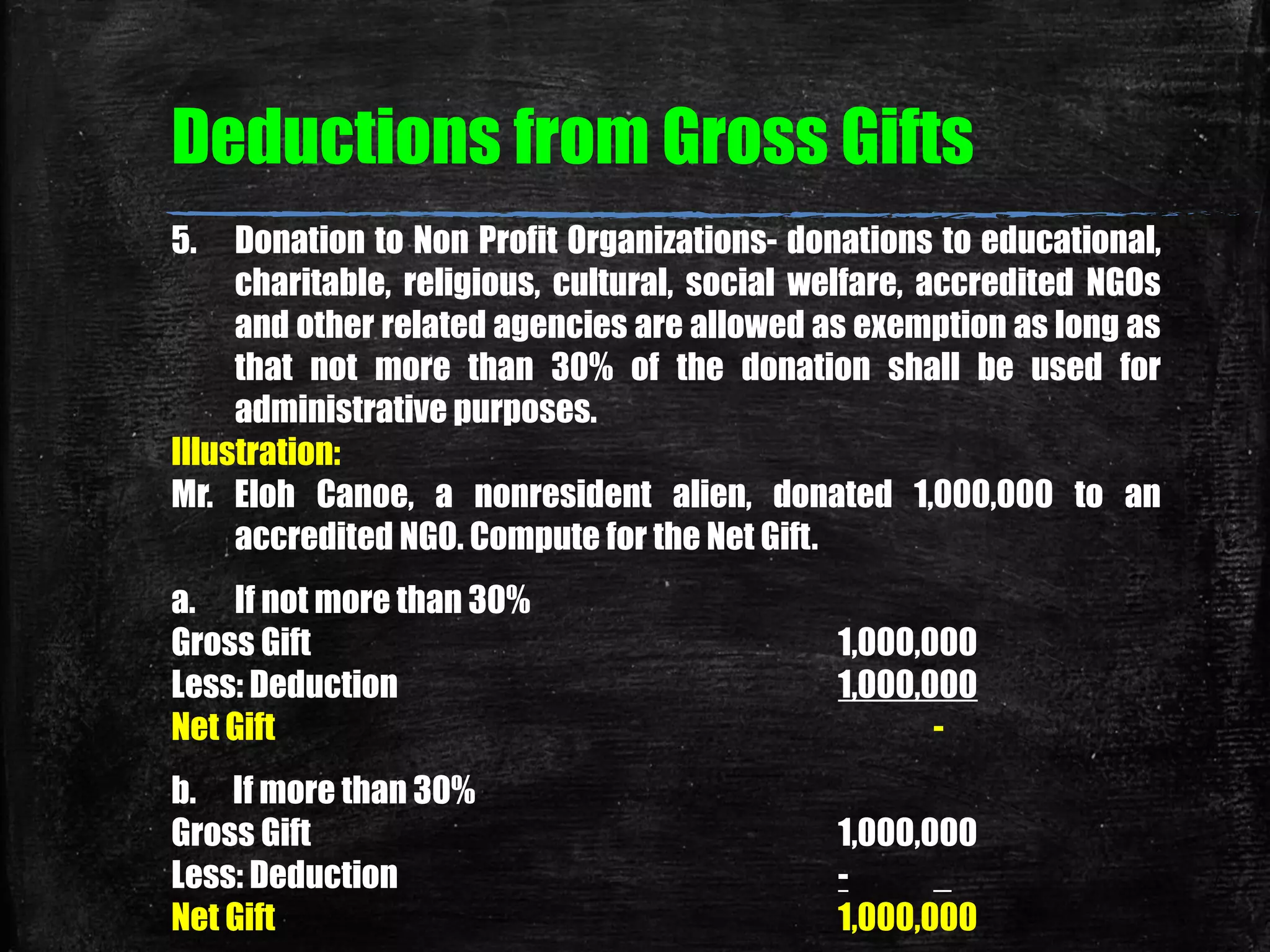

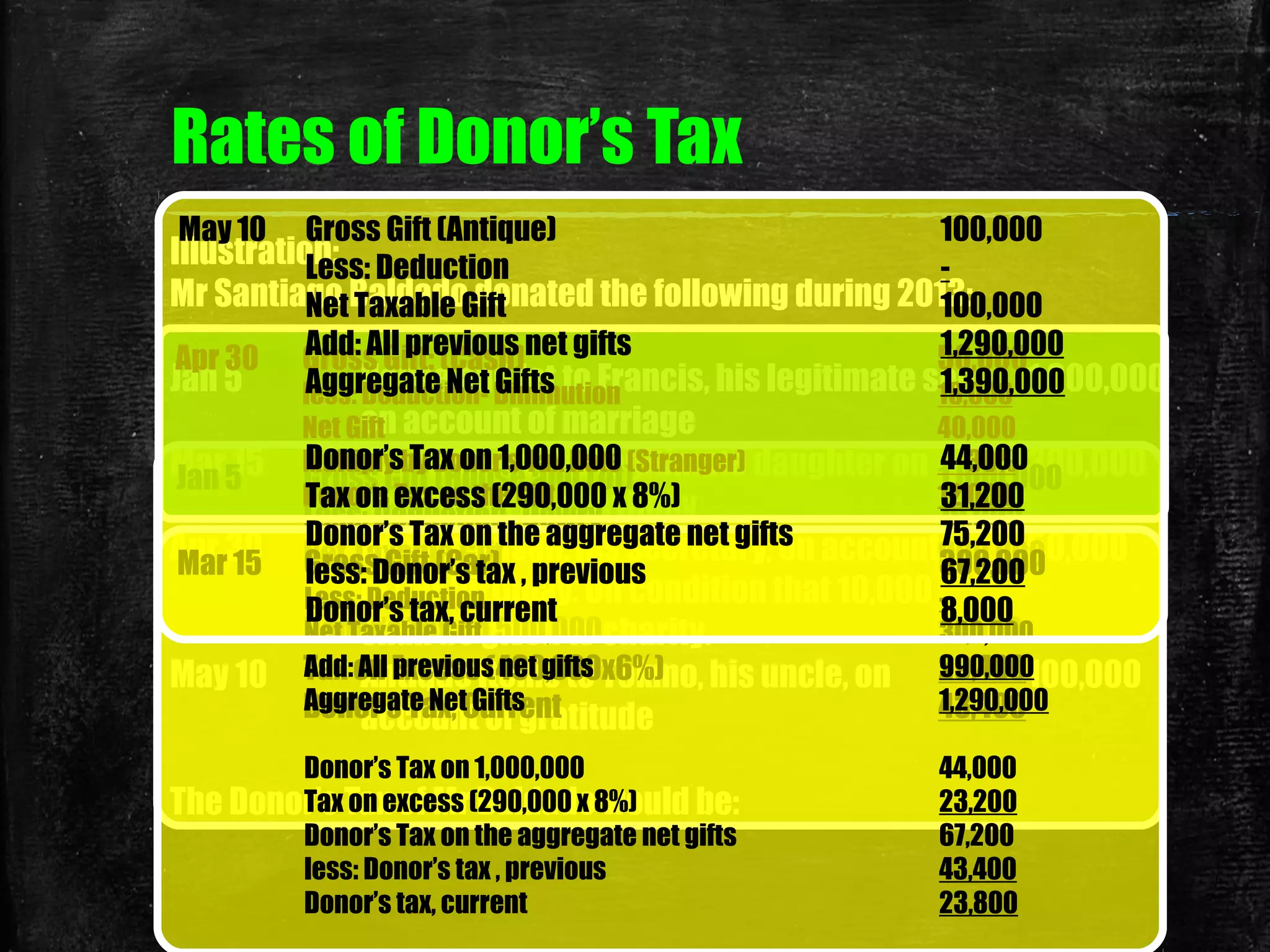

3) Allowable deductions from gross gifts including dowries, encumbrances assumed by the donee, donations to government/non-profits, and the standard 100,000 peso exemption for yearly donations to