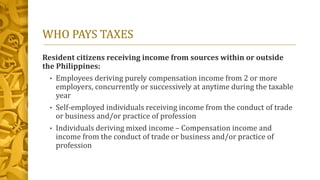

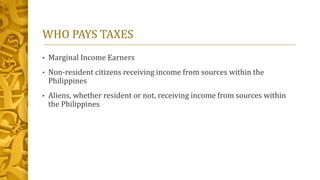

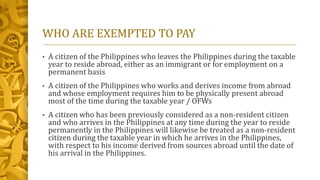

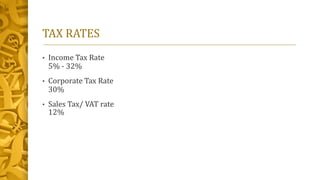

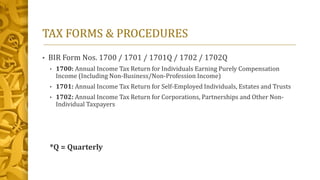

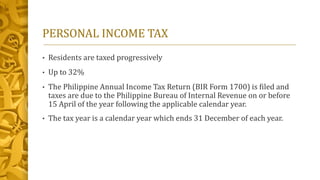

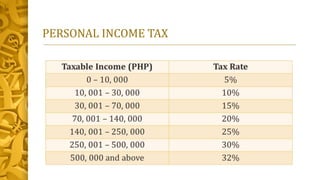

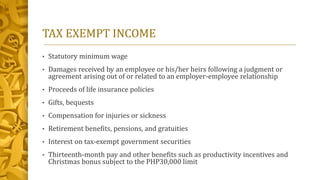

Philippines has an income tax system that taxes residents and citizens on income earned within or outside the country, as well as taxes non-residents on income from Philippine sources. Tax rates range from 5% to 32% for individuals and 30% for corporations. Common tax forms include BIR Form 1700 for individual compensation income and BIR Form 1701 for self-employed individuals. Some exemptions include statutory minimum wage, damages from employer lawsuits, life insurance payouts, and some retirement benefits.