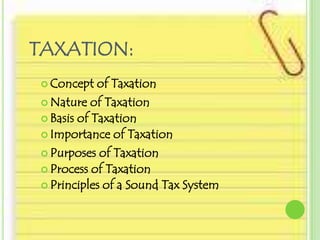

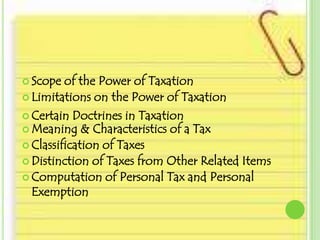

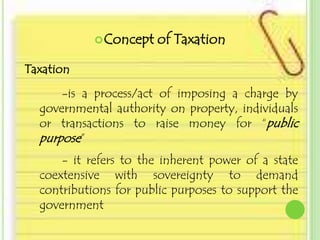

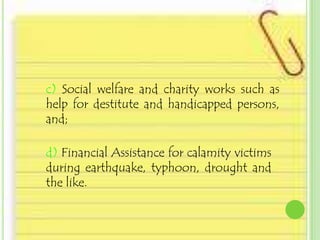

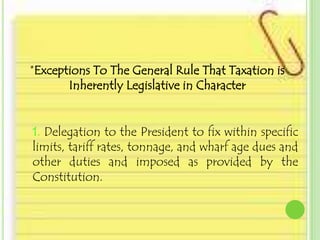

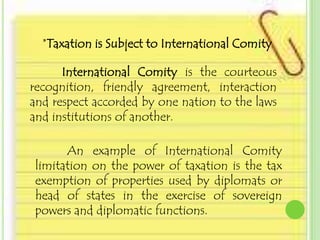

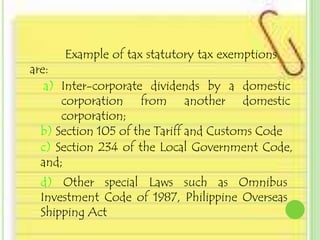

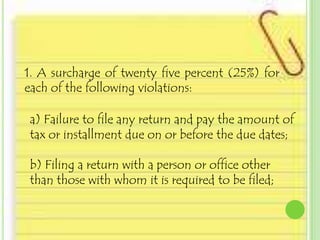

The document provides a comprehensive overview of taxation, defining it as the governmental act of imposing charges on individuals and properties to fund public purposes. It discusses the principles, processes, and limitations of taxation, the importance of adhering to established laws, and various doctrines such as the prospectivity of tax laws and escape from taxation. The document also outlines the classification of taxes, tax exemptions, and the reach and limitations of tax power, emphasizing the need for equitable and just taxation practices.