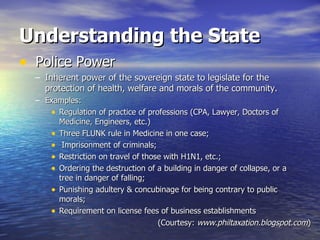

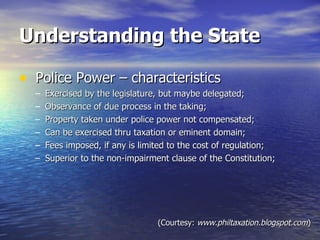

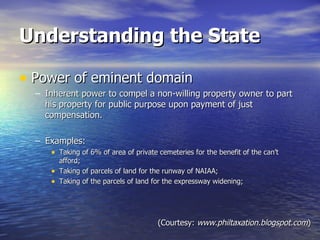

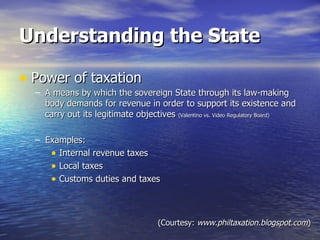

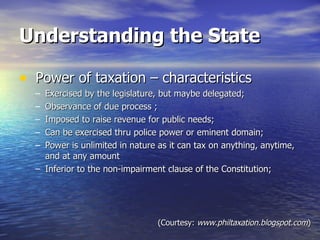

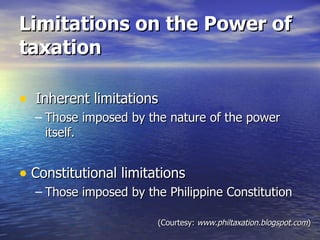

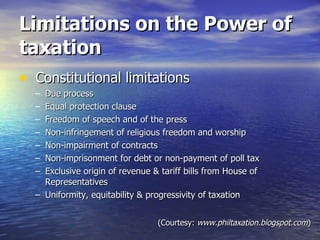

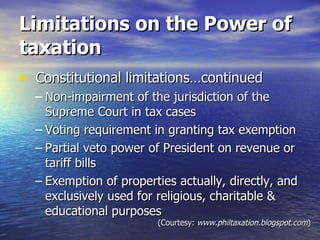

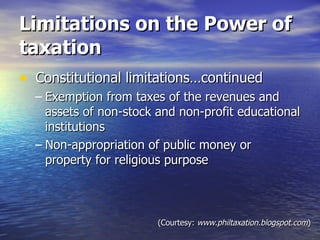

The document discusses the key concepts and principles of taxation as an inherent power of the state. It defines taxation as a means for the sovereign state to demand revenue through its legislature to fund public needs and purposes. The document outlines the characteristics and limitations of the taxation power, comparing it to other state powers like police power and eminent domain. It notes taxation power is unlimited but must be exercised for a public purpose and within constitutional restrictions.