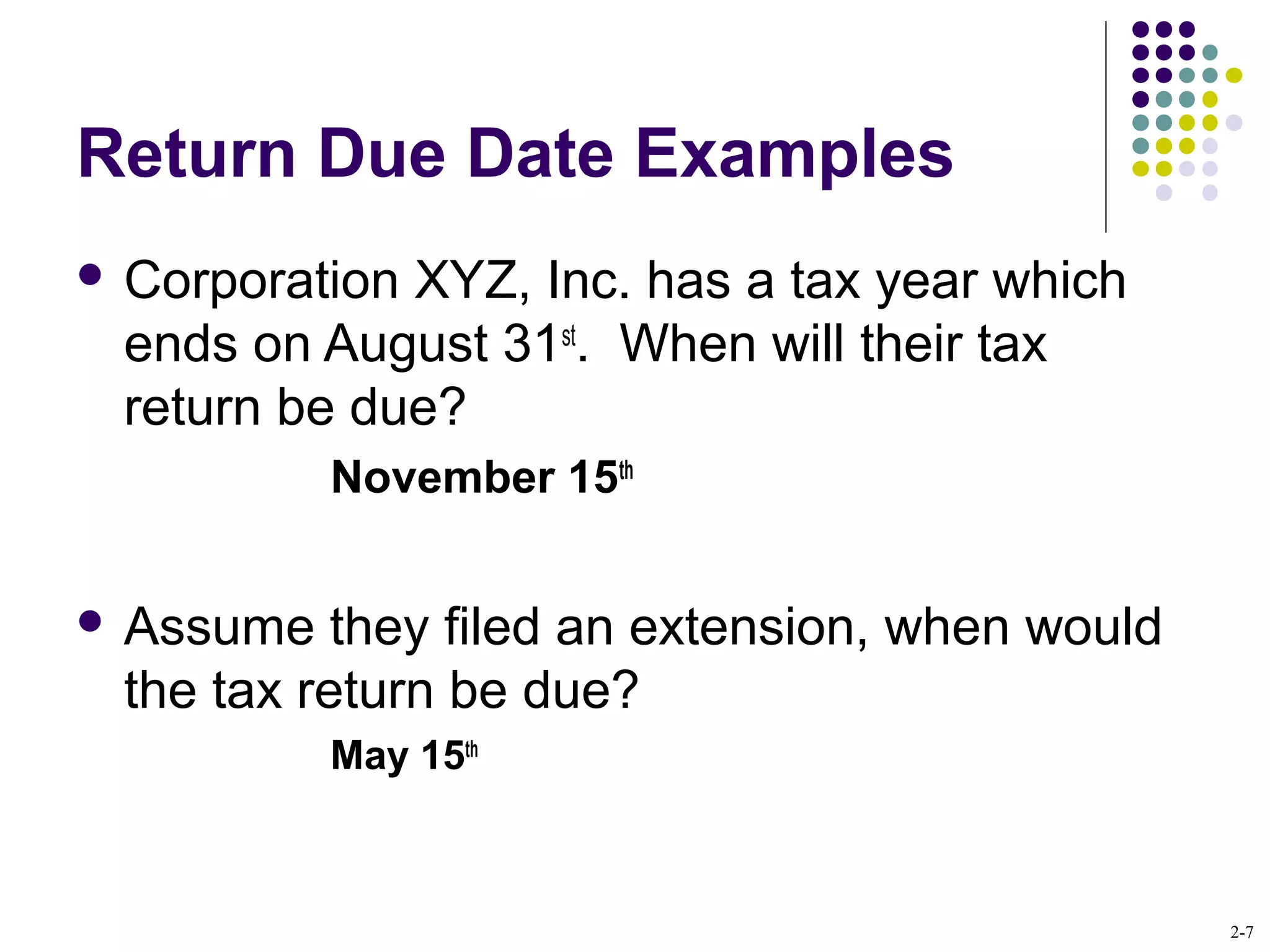

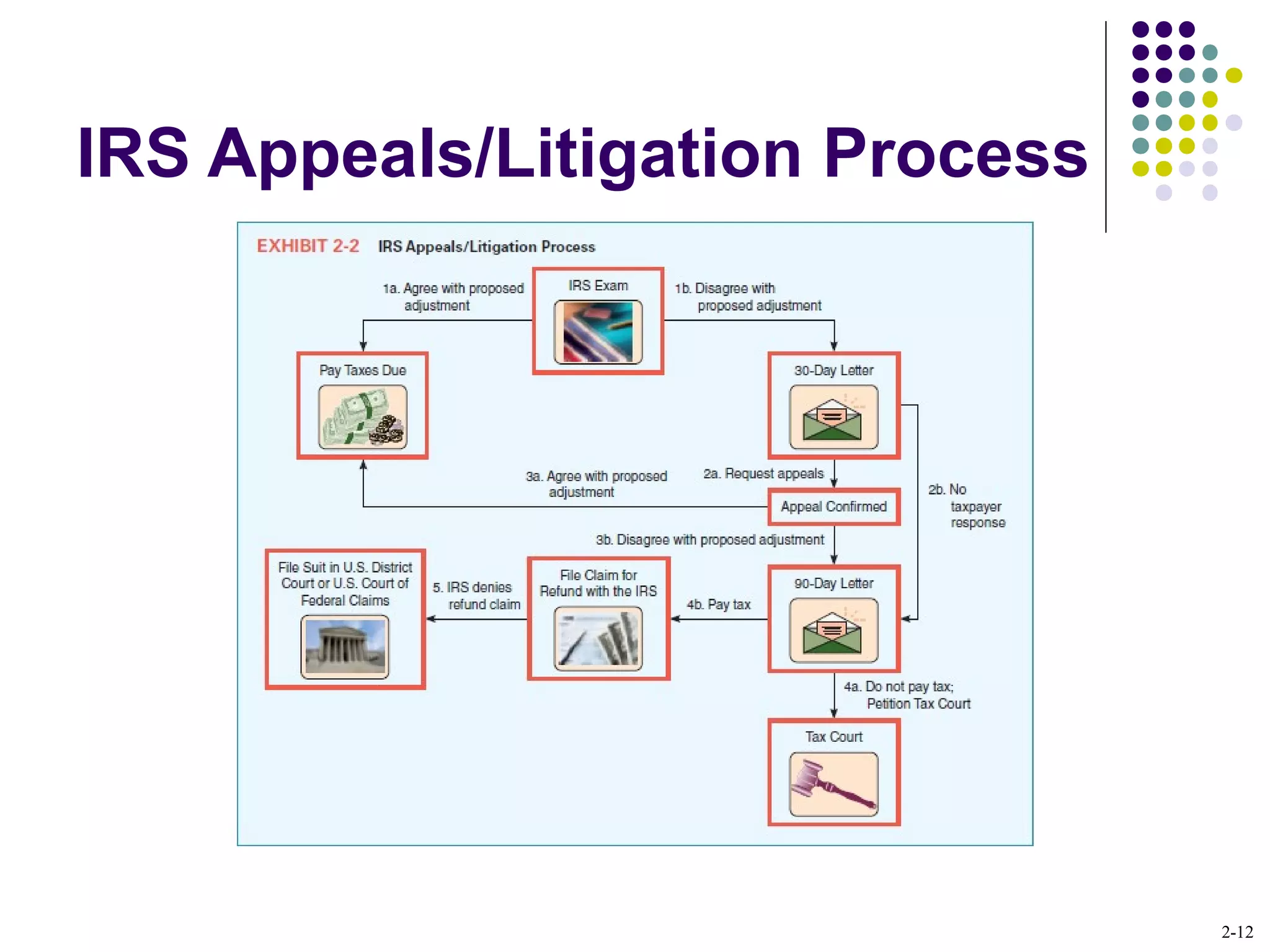

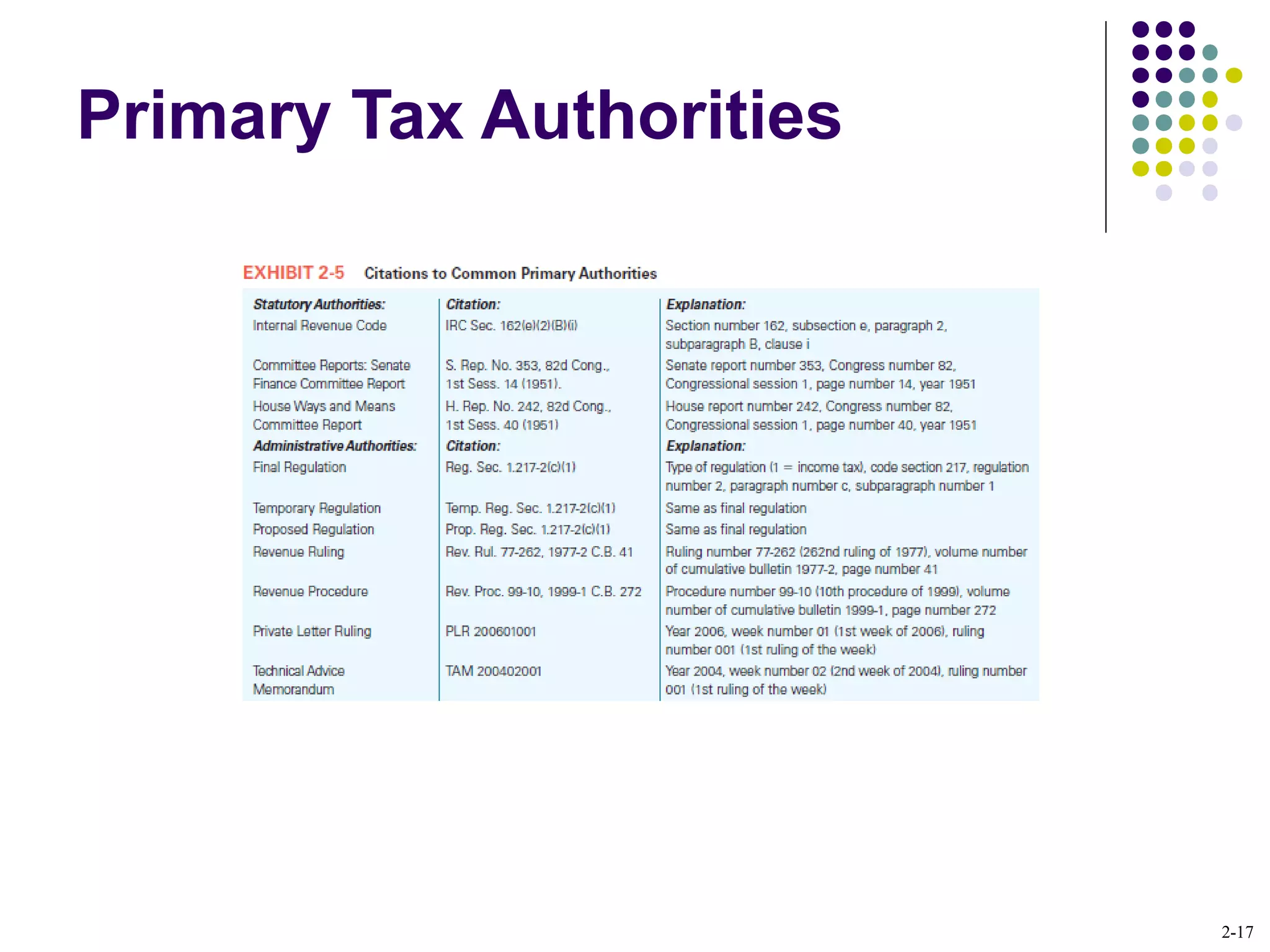

This chapter discusses tax compliance and the IRS audit process. It covers taxpayer filing requirements, statutes of limitations, how returns are selected for audit, and the different types of audits. It also summarizes the primary and secondary sources of tax law, such as statutes, regulations, and court rulings. Additionally, it outlines the tax research process and responsibilities and penalties for taxpayers and tax professionals.