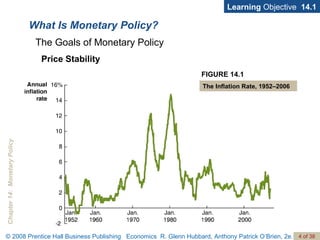

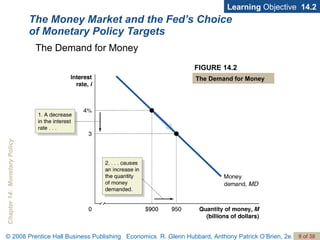

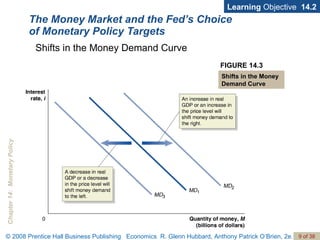

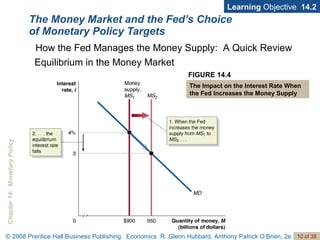

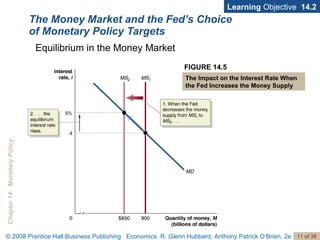

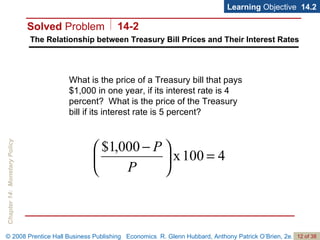

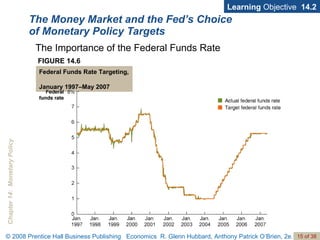

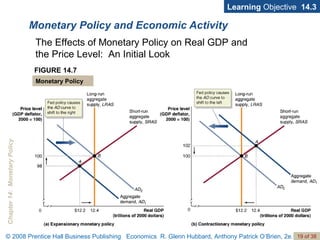

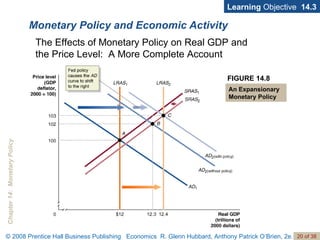

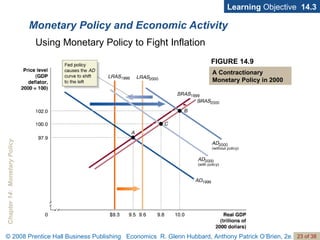

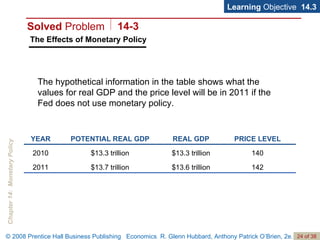

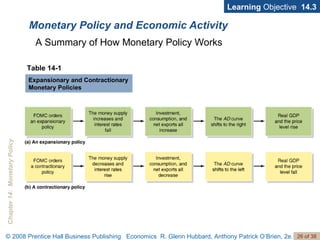

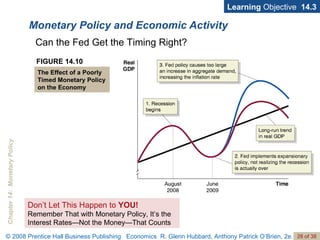

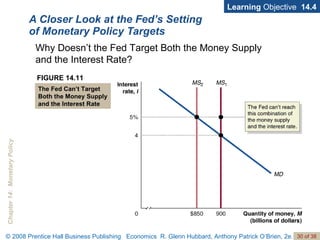

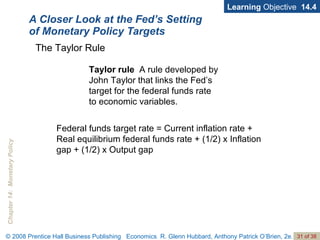

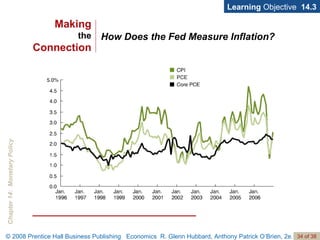

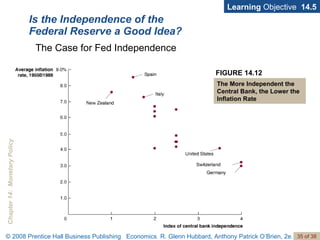

The document discusses monetary policy and the goals of the Federal Reserve. It explains that the Fed pursues four monetary policy goals: price stability, high employment, economic growth, and stability of financial markets. The Fed uses monetary policy tools like adjusting interest rates and the money supply to influence aggregate demand and achieve its goals. The document also examines arguments around whether the Fed should target interest rates or the money supply, and whether the Fed's independence is beneficial.