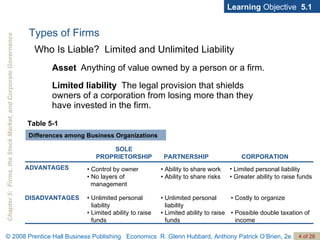

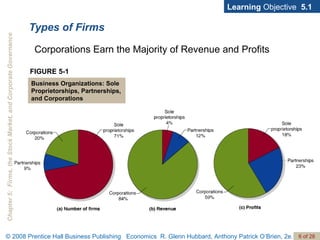

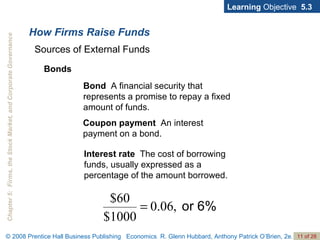

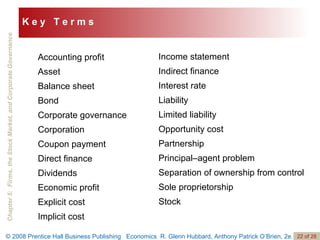

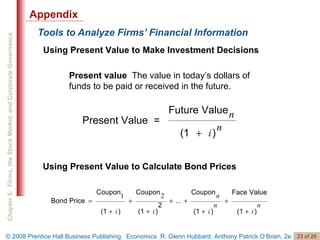

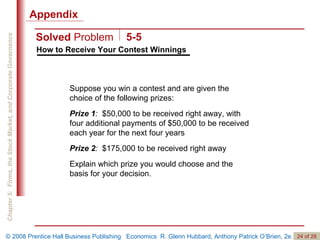

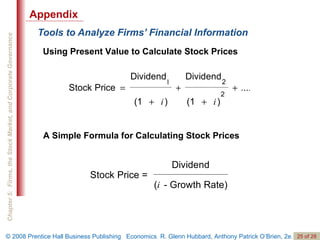

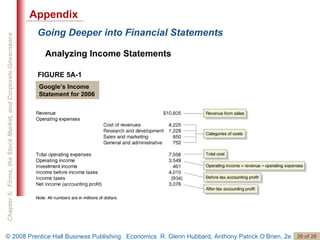

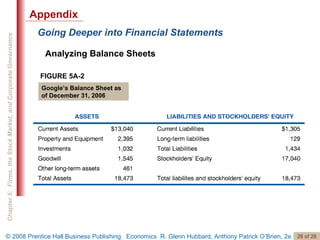

As Google grew larger, it needed more complex management structures and funding sources to support its growth. The document discusses different types of business organizations and how firms obtain funding. It also covers financial statements, corporate governance, and tools to analyze firms' financial information.