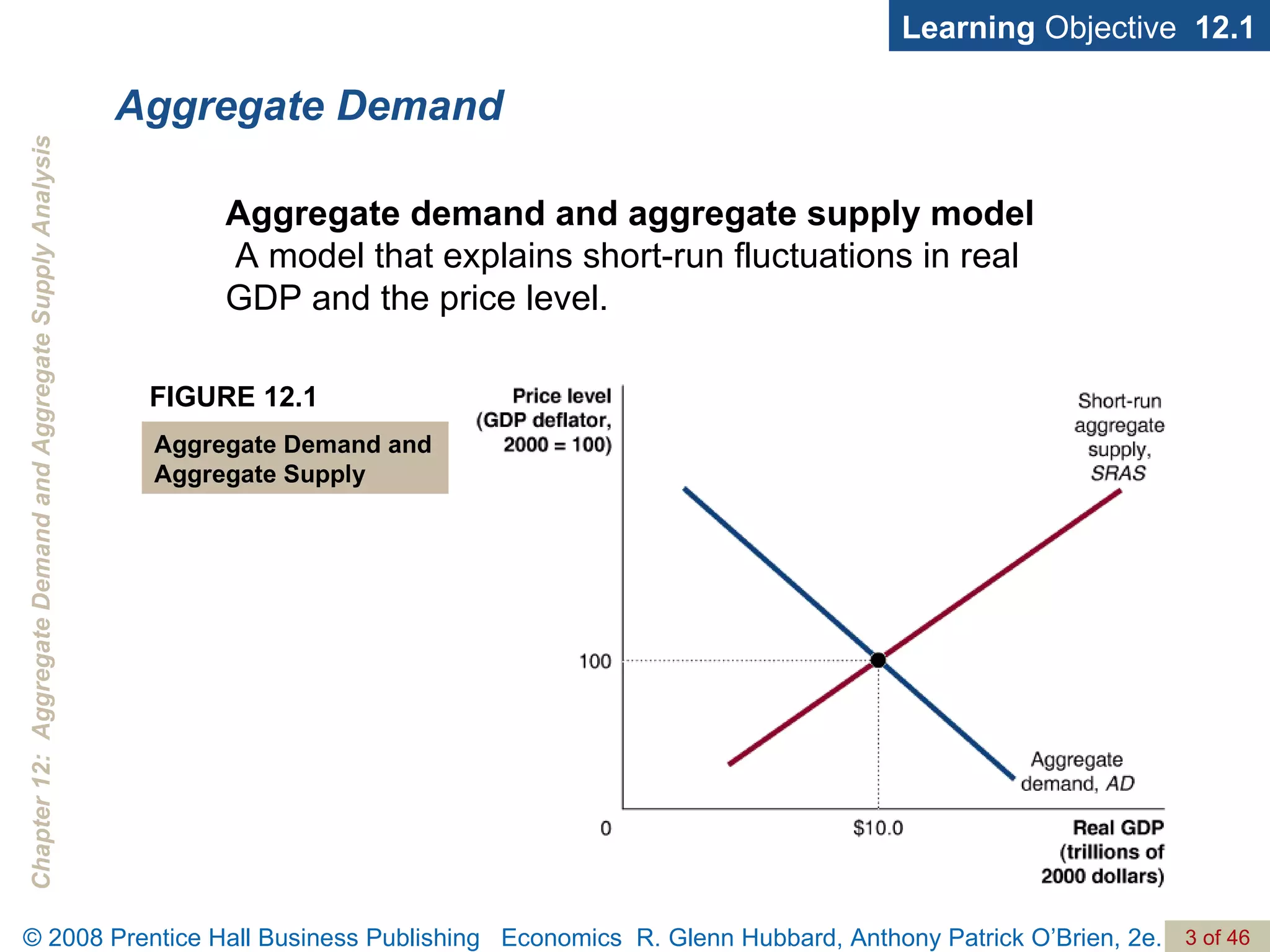

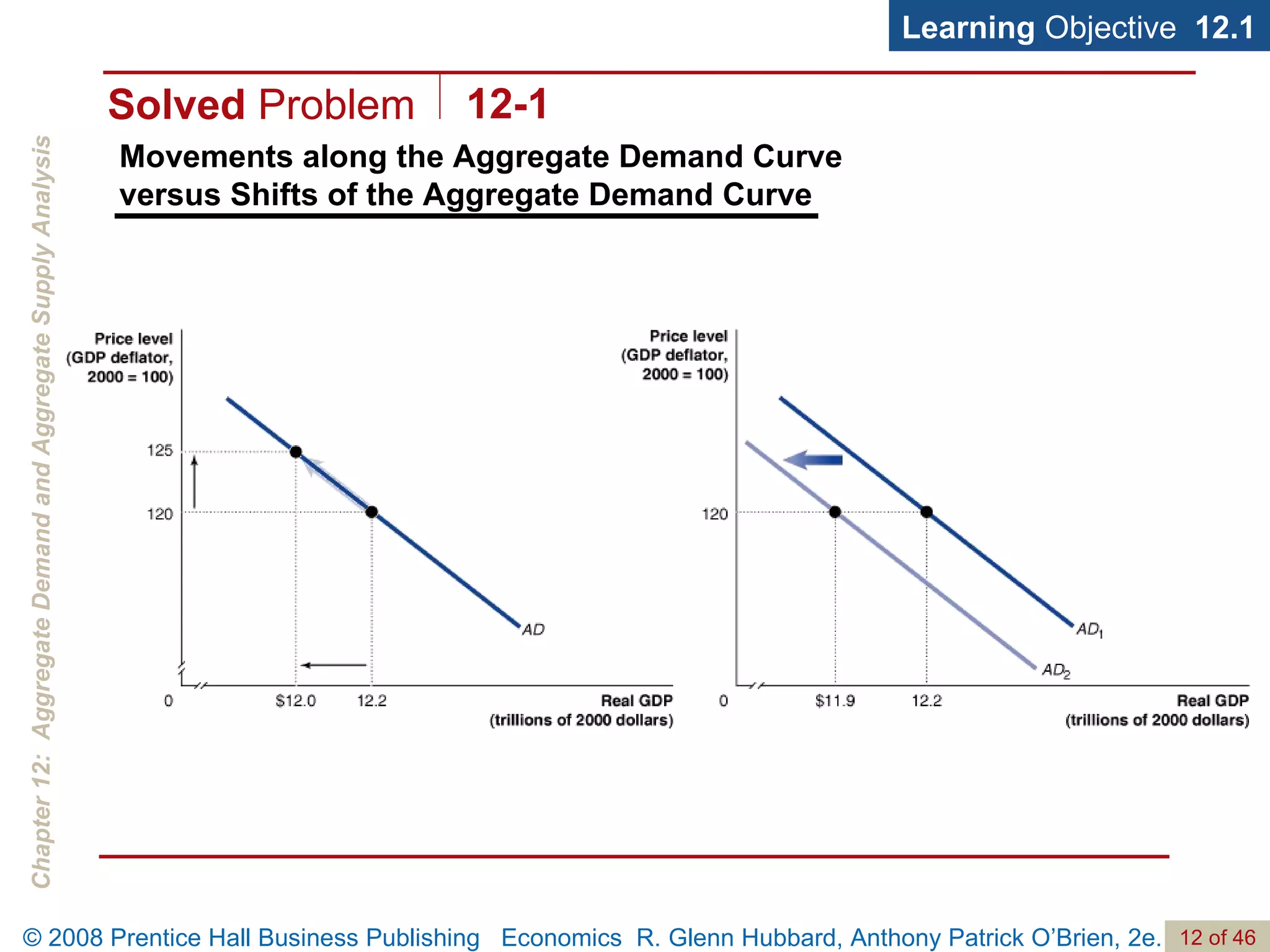

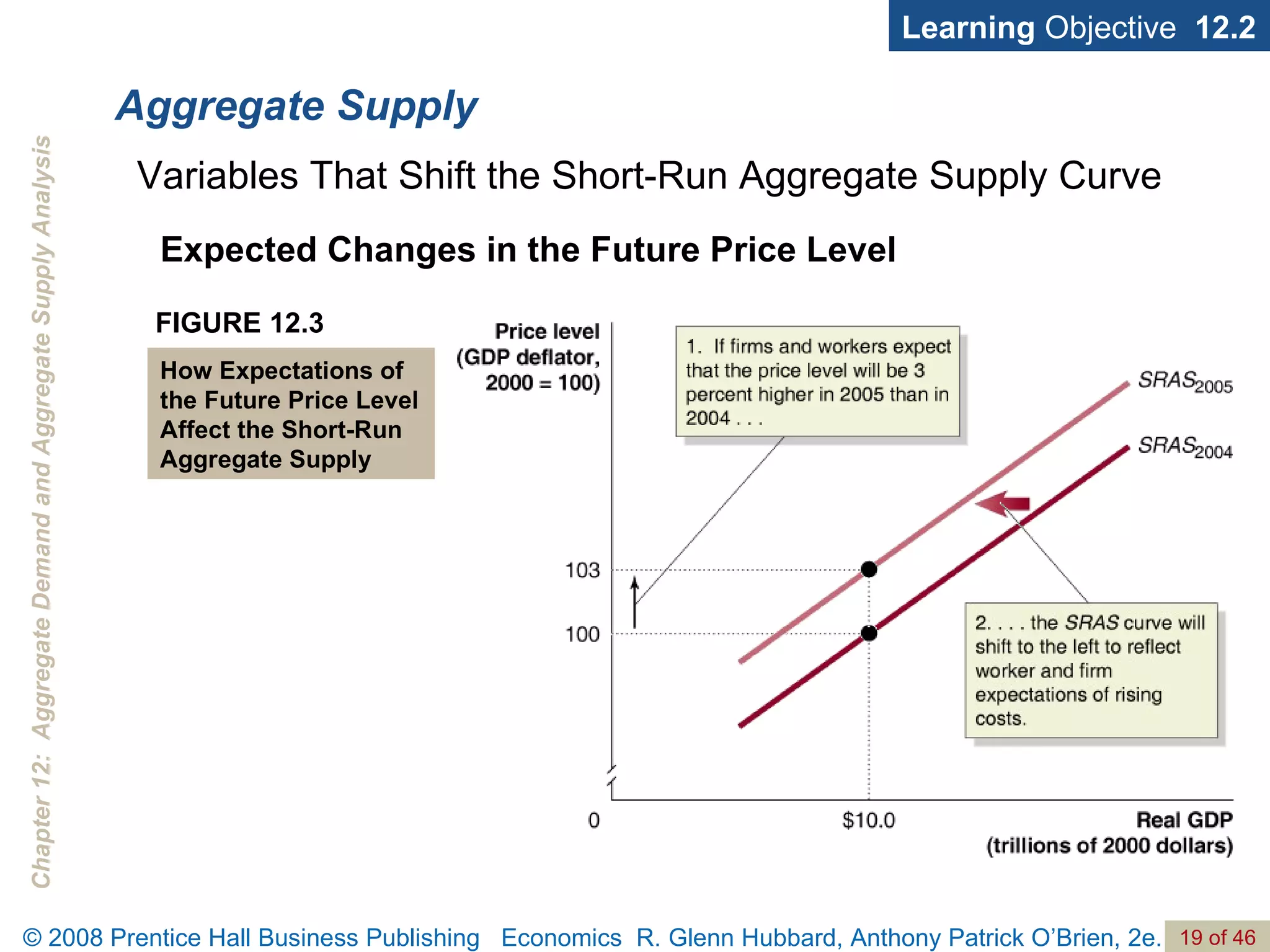

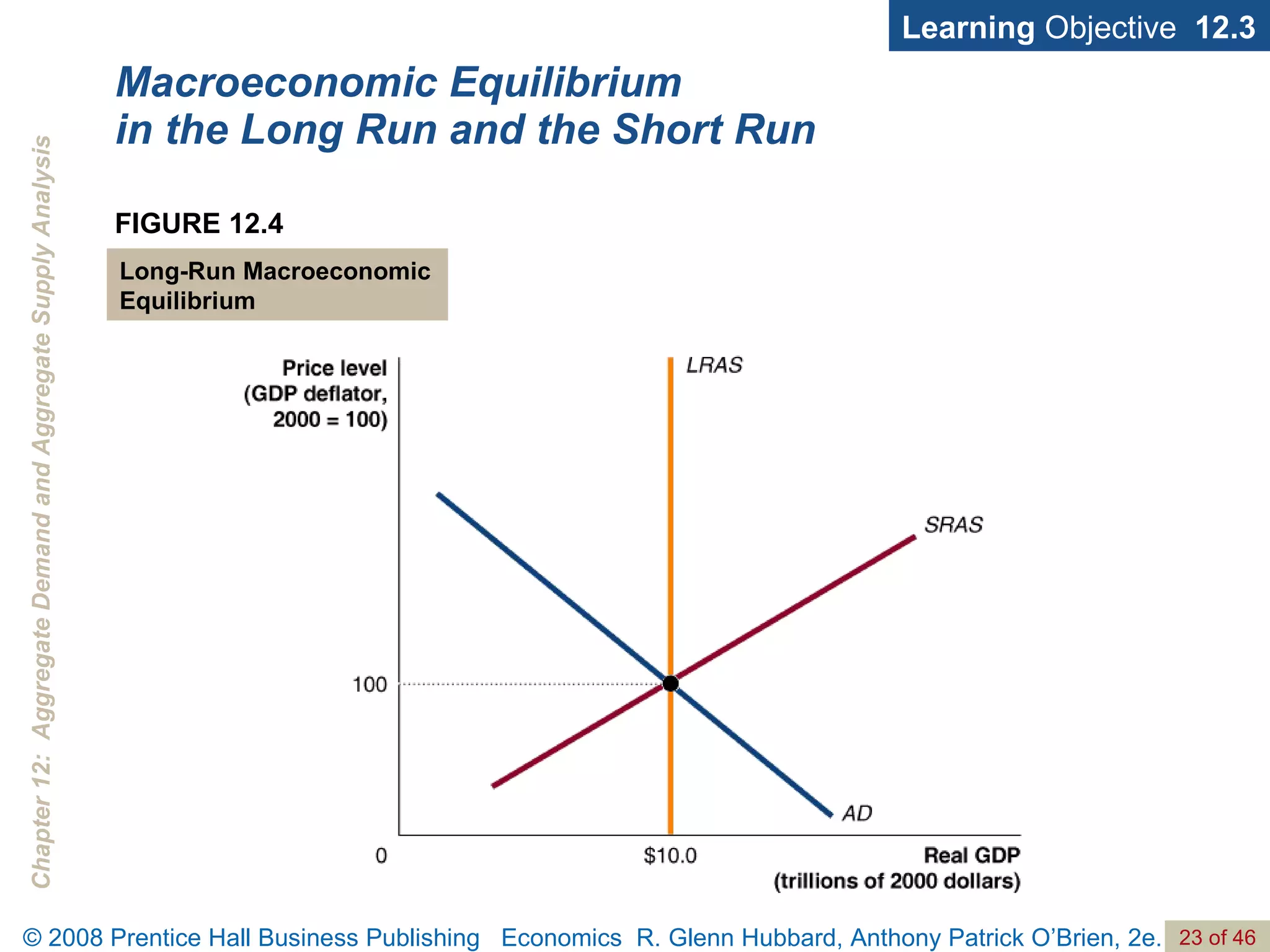

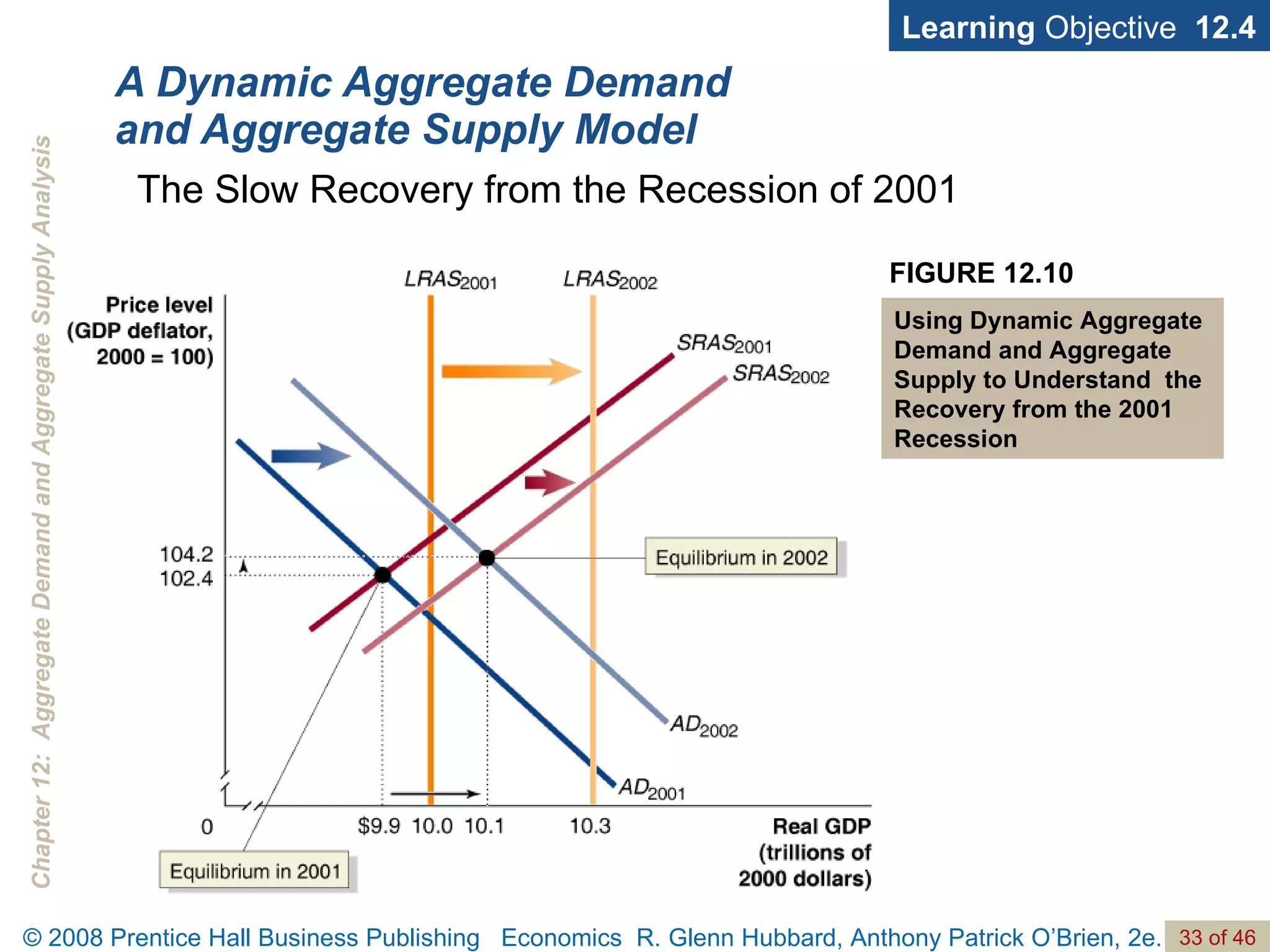

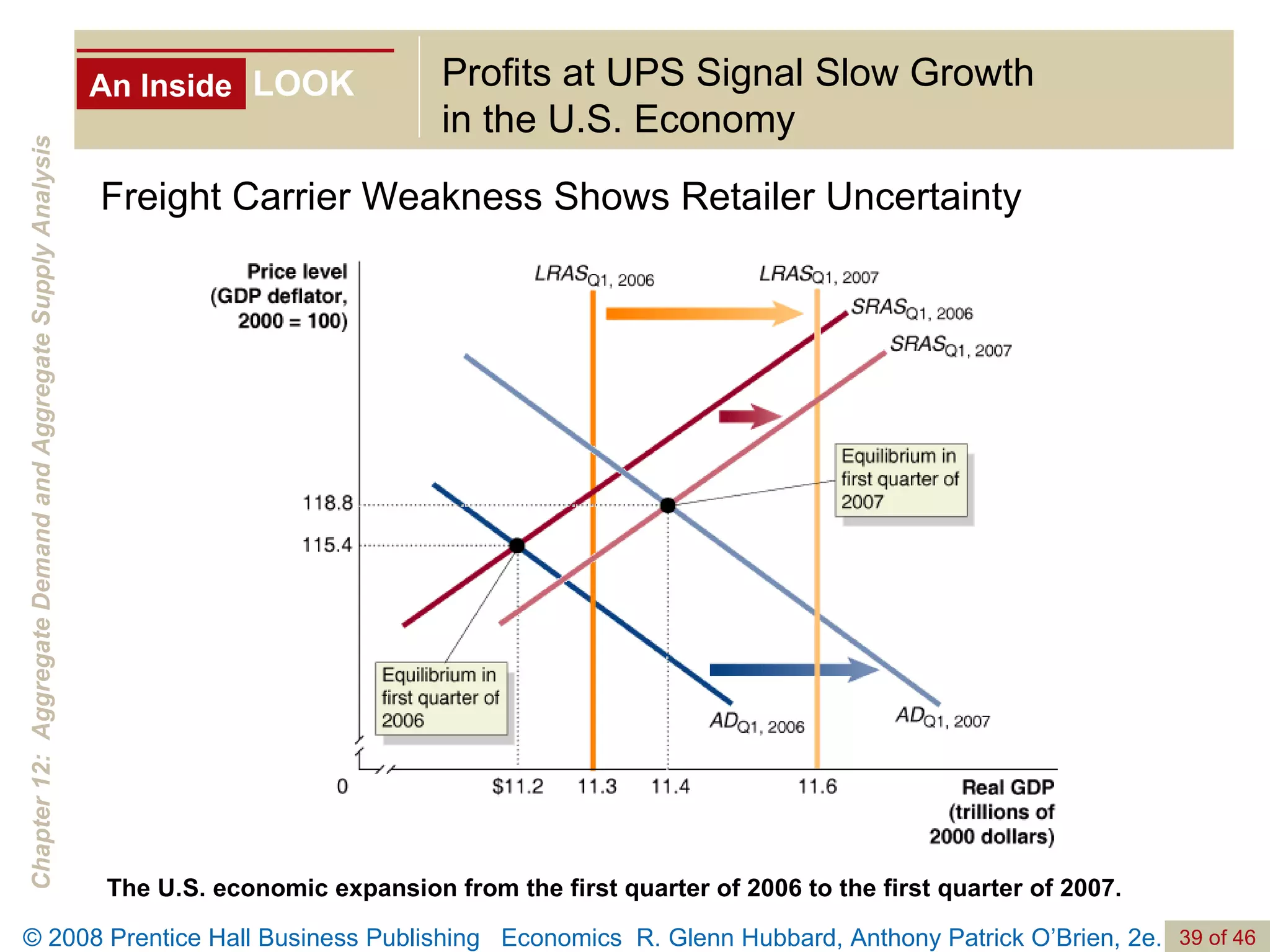

The document discusses how FedEx and other firms are affected by the business cycle. It provides an overview of aggregate demand and aggregate supply models, explaining how recessions and expansions impact real GDP, employment, and prices in both the short-run and long-run. Key topics covered include the determinants of aggregate demand and supply, as well as the variables that can cause shifts or movements along the aggregate demand and supply curves.