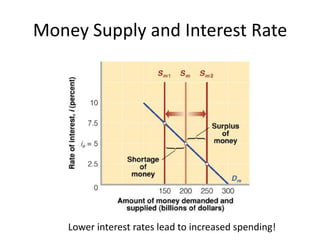

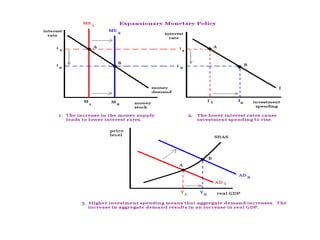

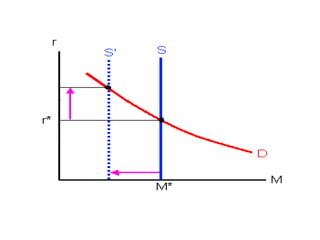

The Federal Reserve uses monetary policy to influence interest rates and the money supply in order to achieve its policy goals of price stability, maximum employment, and moderate long-term growth. It targets the federal funds rate through open market operations and adjusts the money supply through bond purchases and sales. Raising interest rates and reducing the money supply are used to fight inflation, while lowering rates and increasing the supply are used to stimulate the economy during recessions. The Fed aims to keep recessions short and mild through timely countercyclical monetary policy actions.