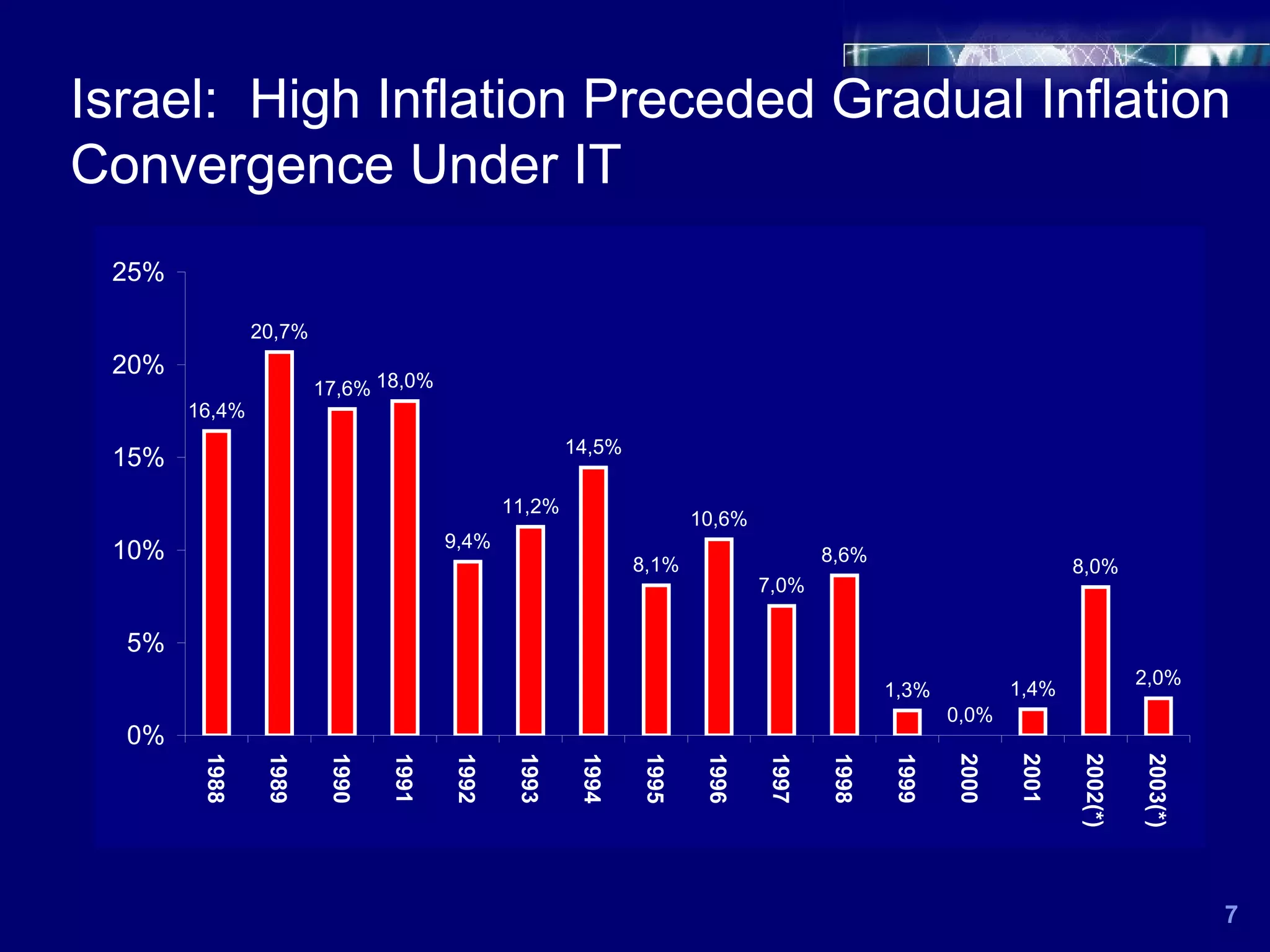

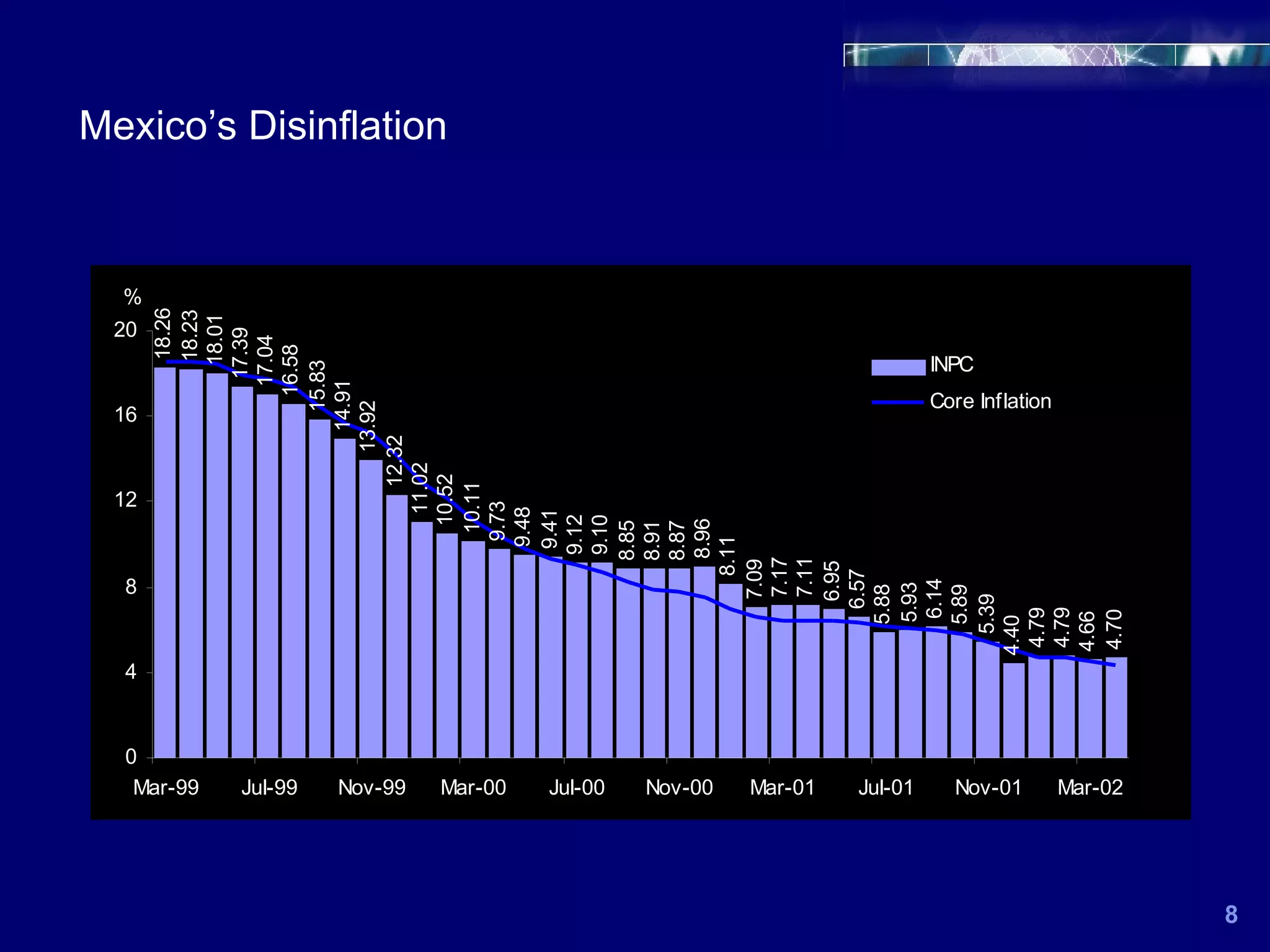

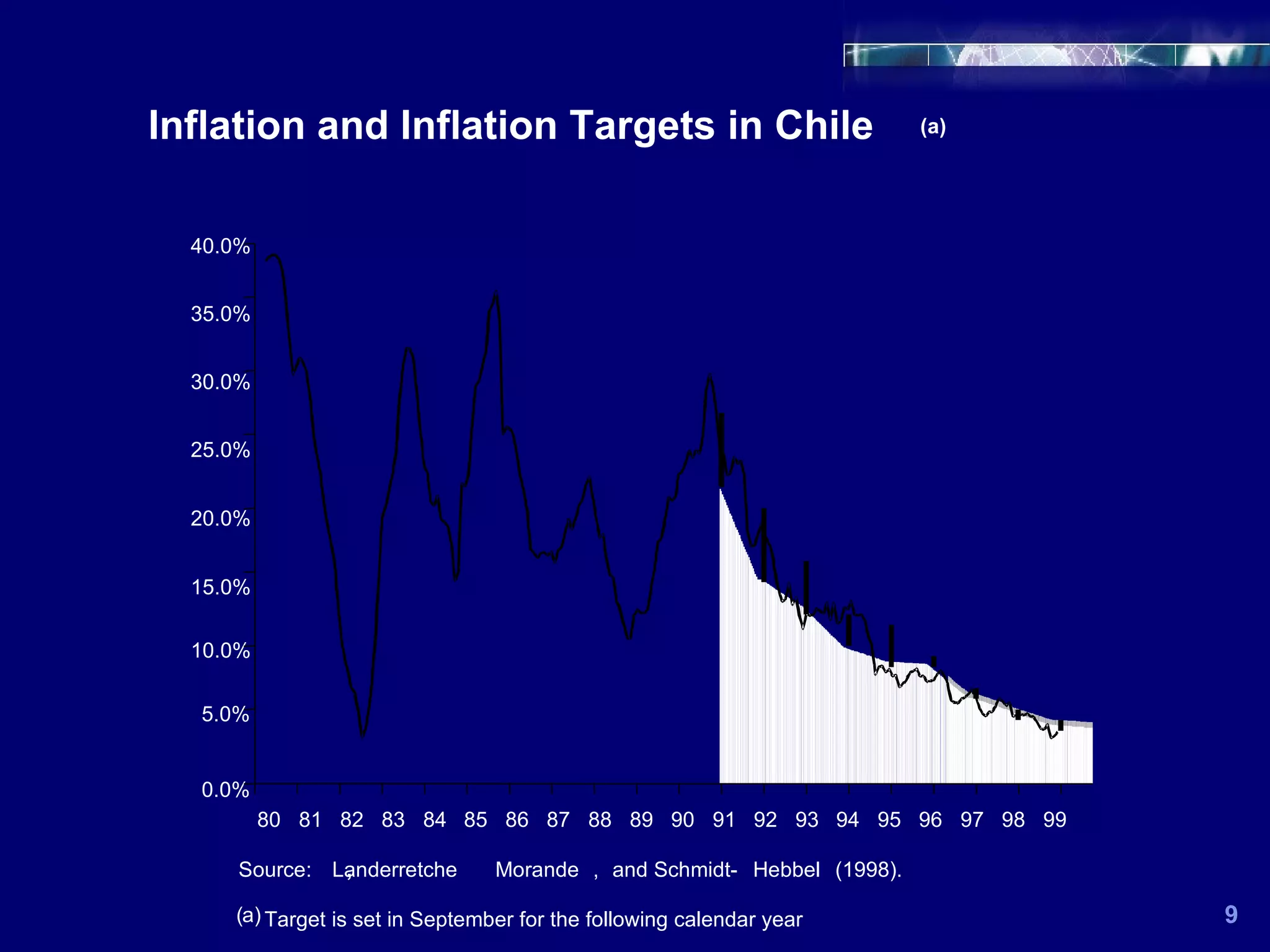

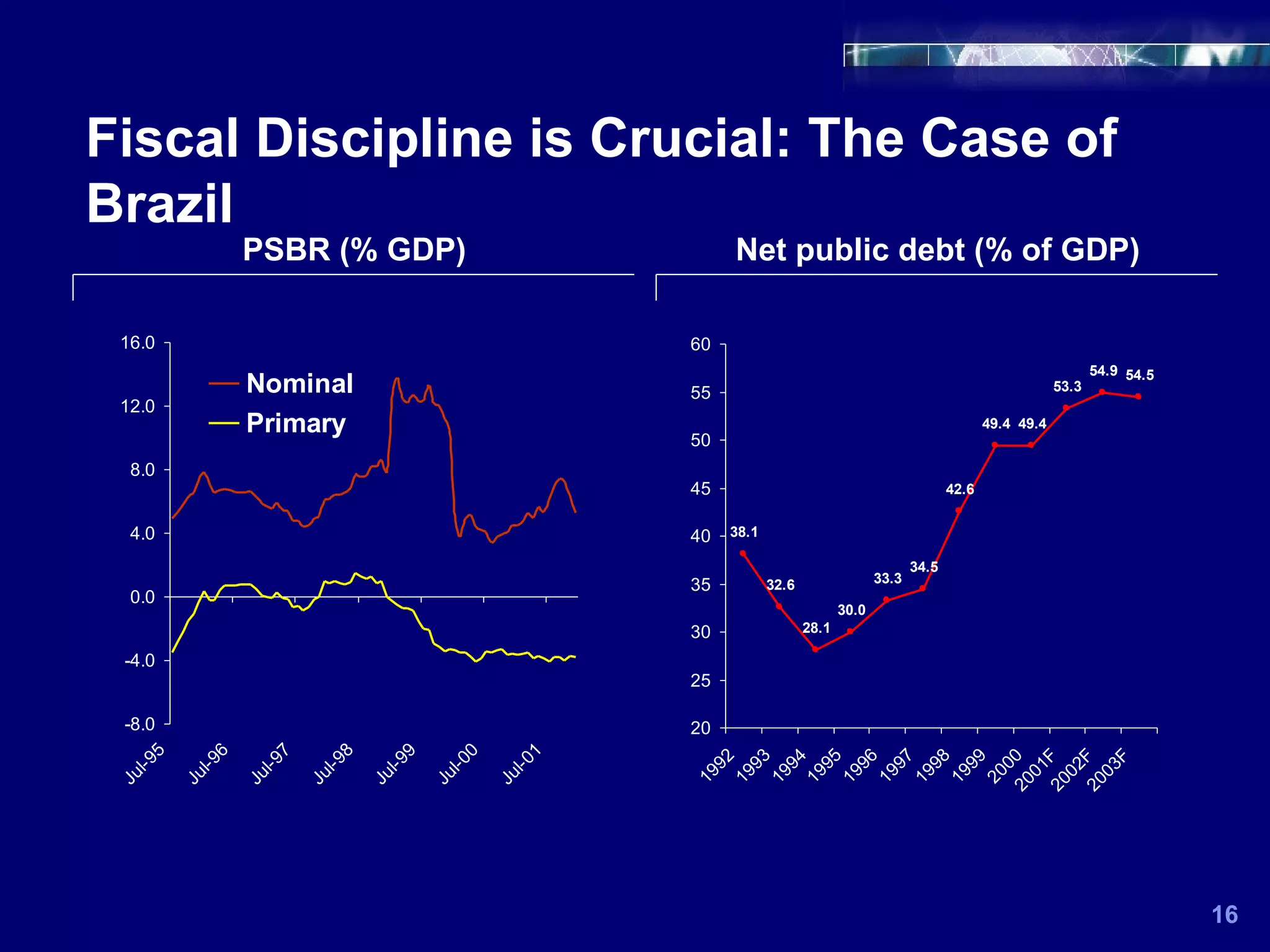

This document discusses the effect of inflation targeting on emerging market economies. It begins by outlining why lower inflation and inflation targeting are important for emerging markets to integrate into the global economy. It then describes how inflation targeting works by having central banks set interest rates to ensure inflation meets multi-year targets. However, emerging market realities like high inflation inertia and inconsistent fiscal policies can pose difficulties for inflation targeting. The document analyzes case studies of inflation targeting in countries like Turkey, Israel, Mexico, and Chile and their experiences bringing inflation down.