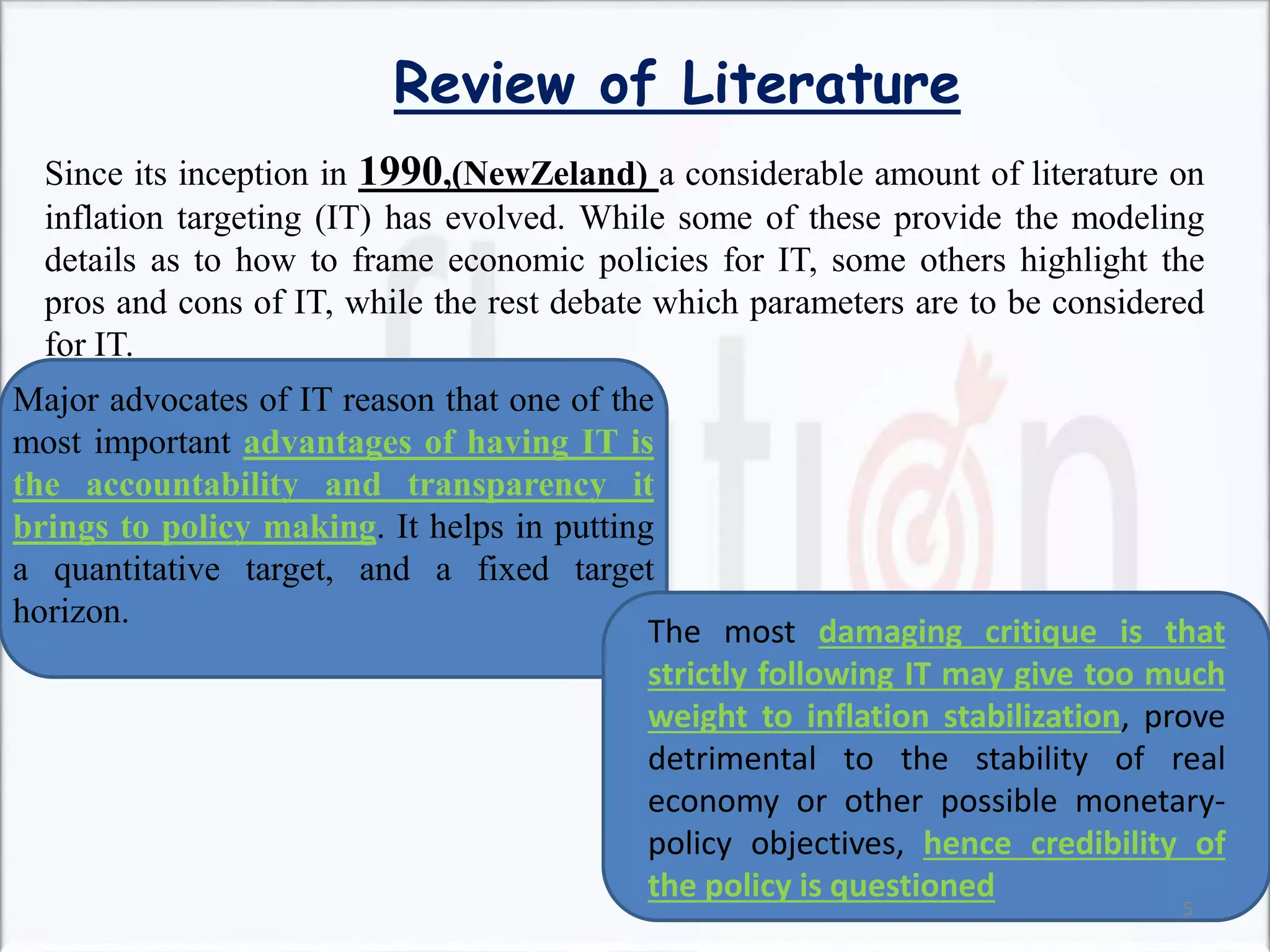

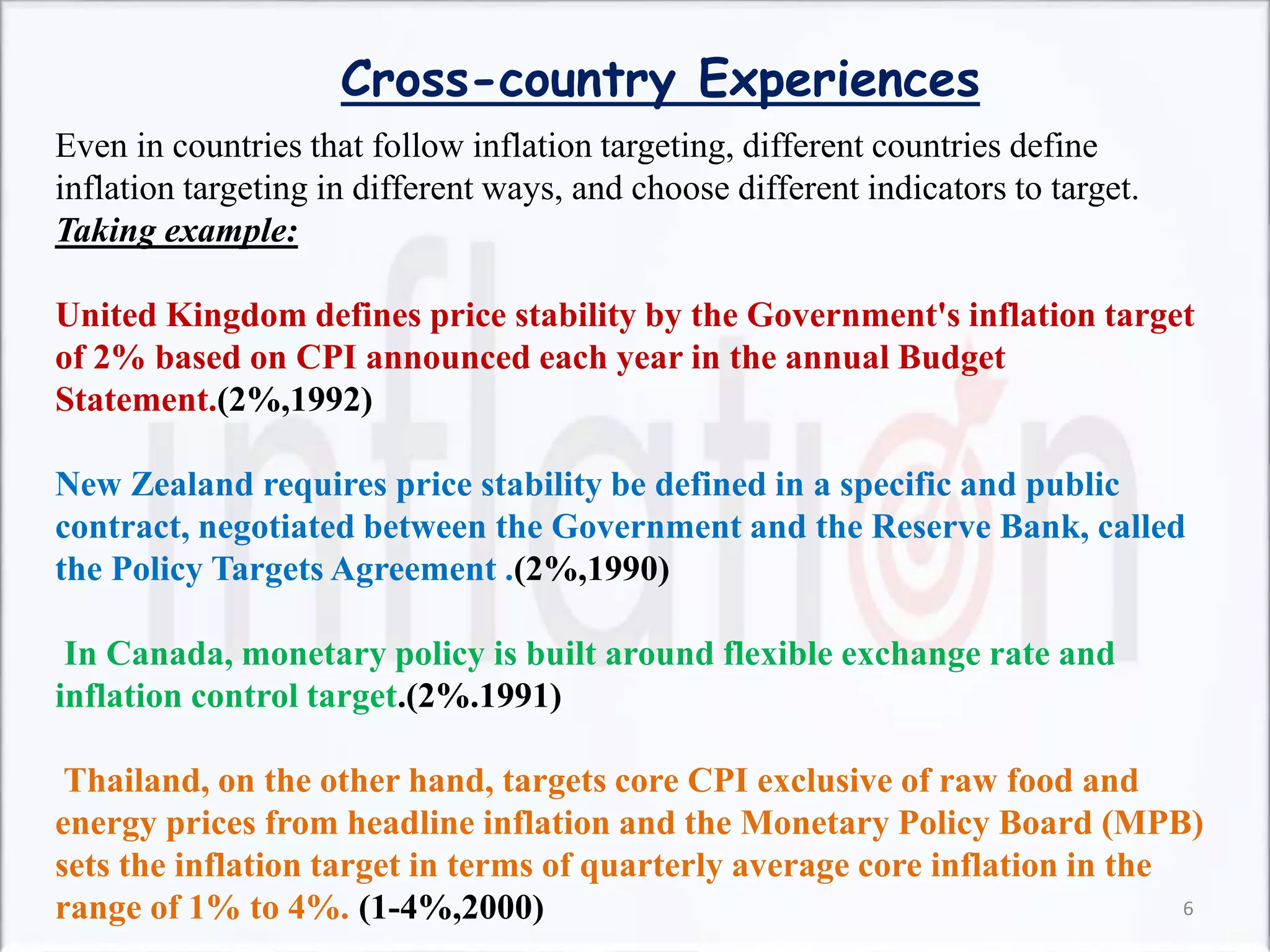

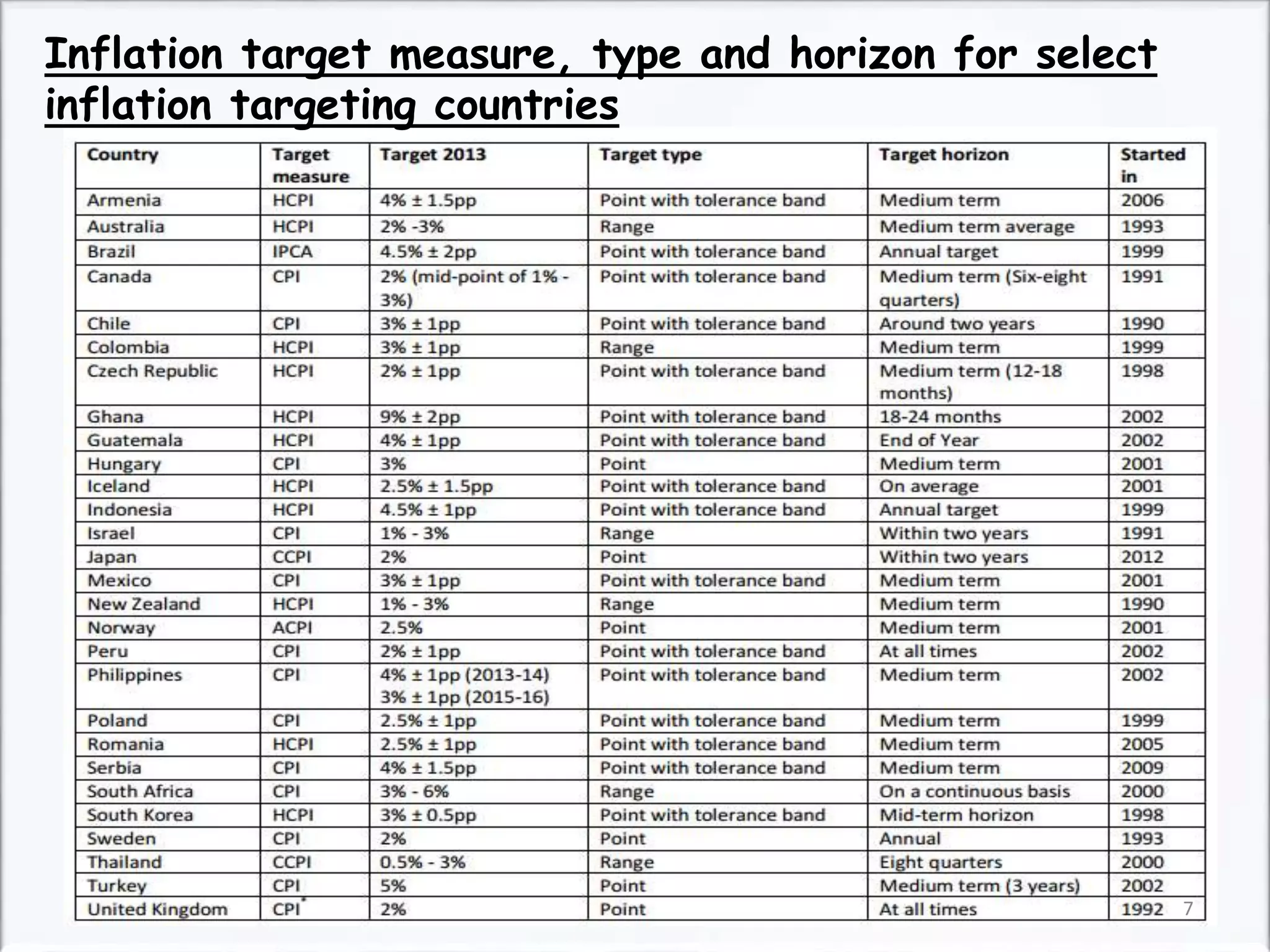

1) The document discusses topics related to inflation targeting including what it is, why it is controversial, cross-country experiences, how to implement it, and recommendations for India.

2) Inflation targeting is a monetary policy strategy used by central banks to maintain inflation at a specific target level or range through interest rate changes and other monetary actions. It aims to improve transparency but may prioritize inflation over other goals like growth.

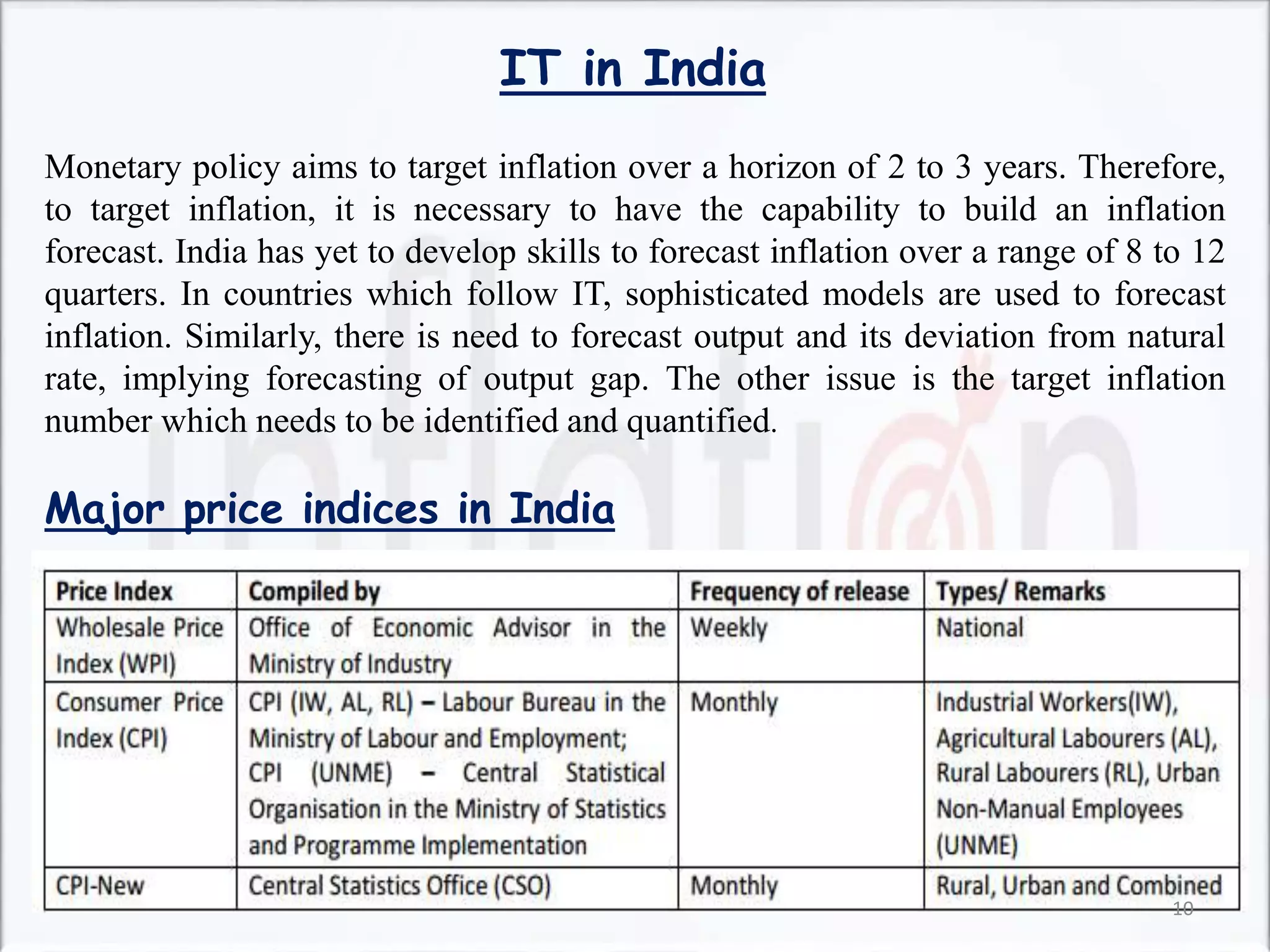

3) Implementing inflation targeting requires conditions like central bank independence, developed financial markets, and a flexible exchange rate - conditions many emerging economies like India currently lack.