This document provides an overview of imperfect competition, including monopoly, oligopoly, and monopolistic competition. It discusses the key differences between imperfect and perfect competition. Specifically, it covers:

1) The three types of imperfect competition and how they differ from perfect competition in terms of number of firms, price flexibility, entry/exit, and potential for economic profits.

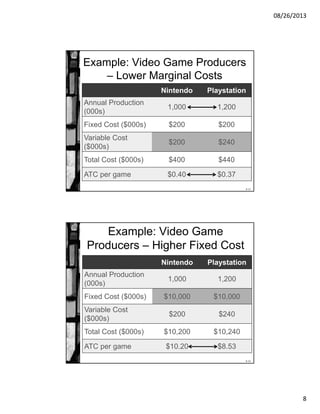

2) The five sources of monopoly power, with a focus on economies of scale as the most enduring source due to decreasing average costs.

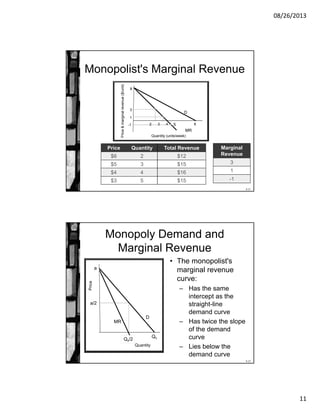

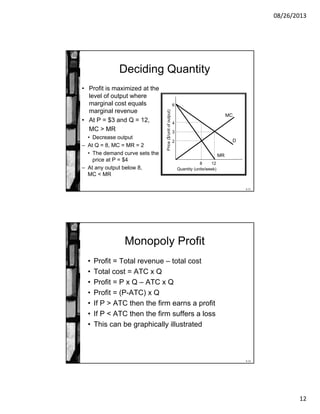

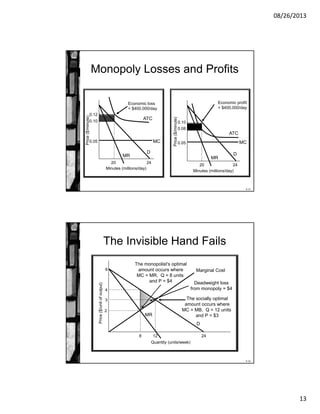

3) How monopolists determine profit-maximizing output by setting marginal revenue equal to marginal cost, which results in a smaller output and higher price than the socially optimal level.

4) Examples are provided