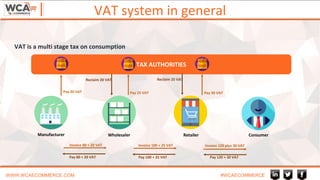

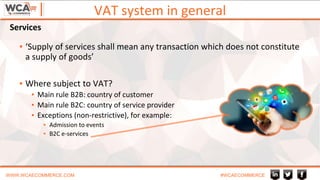

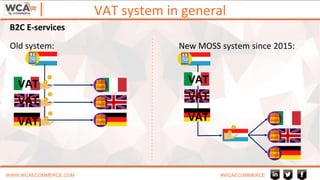

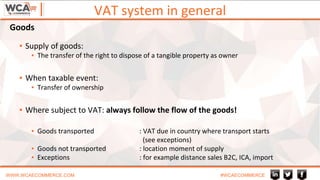

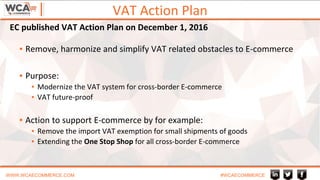

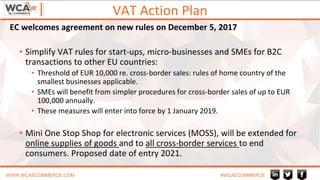

The document summarizes changes to the EU VAT system affecting e-commerce. It discusses the general VAT system, shipping goods into Europe, e-commerce sales, and the EU's VAT Action Plan. The VAT Action Plan aims to simplify and harmonize VAT rules for cross-border e-commerce by 2021, including extending the "one stop shop" system and making marketplaces responsible for collecting VAT on sales by non-EU companies.