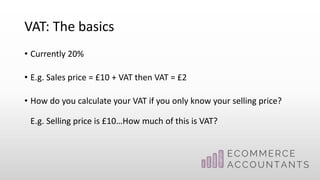

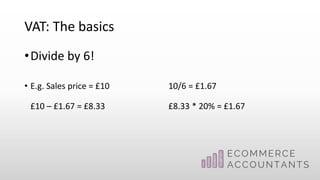

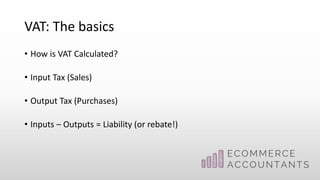

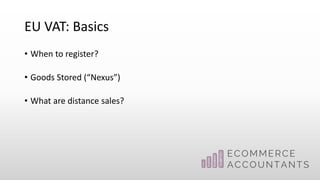

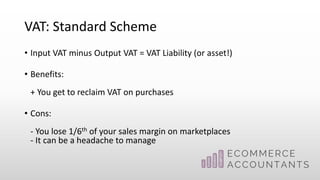

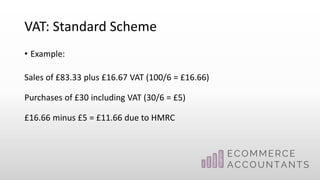

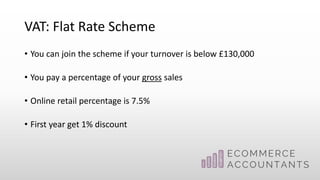

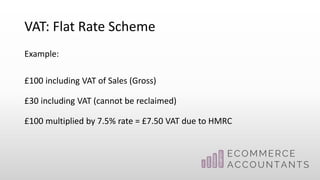

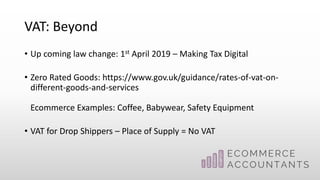

This document provides an overview of VAT (Value Added Tax) for ecommerce and online businesses. It discusses the basics of VAT including how it is calculated at 20% of sales price and divided by 6. It also covers different VAT schemes businesses can register for, including the Standard Scheme, Flat Rate Scheme, and Annual Scheme. The document notes upcoming changes to VAT law taking effect in April 2019, and provides examples of zero rated goods and how VAT applies to drop shippers based on place of supply. The presentation aims to explain the key concepts ecommerce businesses need to know about VAT.