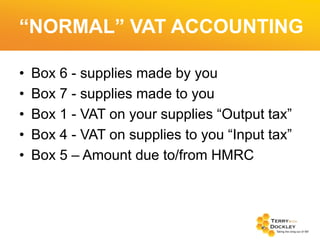

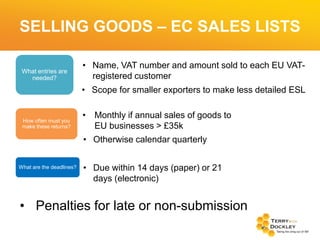

The document outlines a VAT seminar for accountants held on January 22, 2014, covering topics such as partial exemption, VAT accounting for trade with Europe, and detailed examples of taxable and exempt supplies. It provides specific guidance on VAT recovery for various scenarios, including mileage, subsistence, and entertainment expenses, as well as the associated reporting requirements for EU transactions. The content emphasizes the importance of professional advice for VAT-related actions and outlines compliance measures for goods and services transactions in the EU.