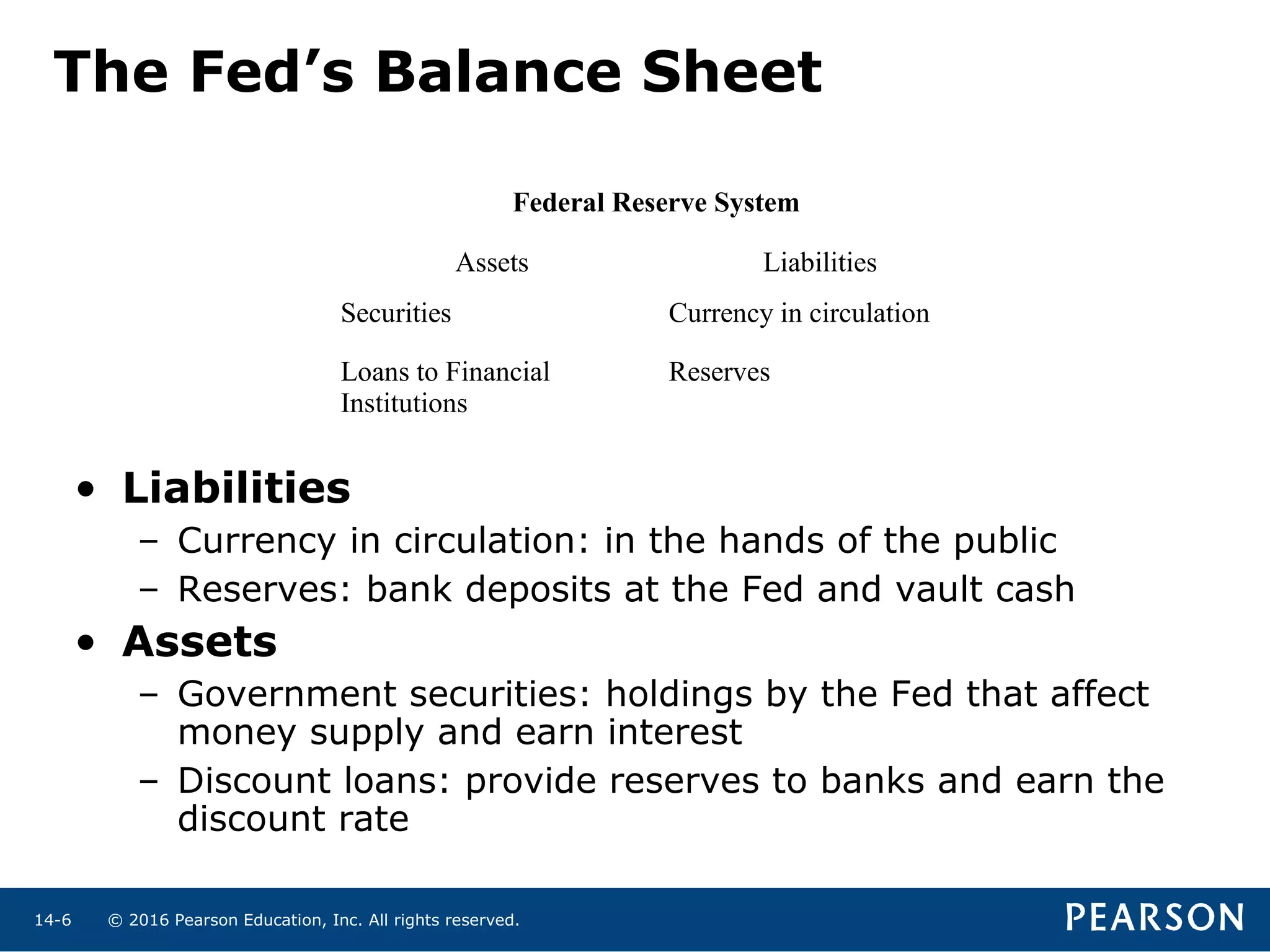

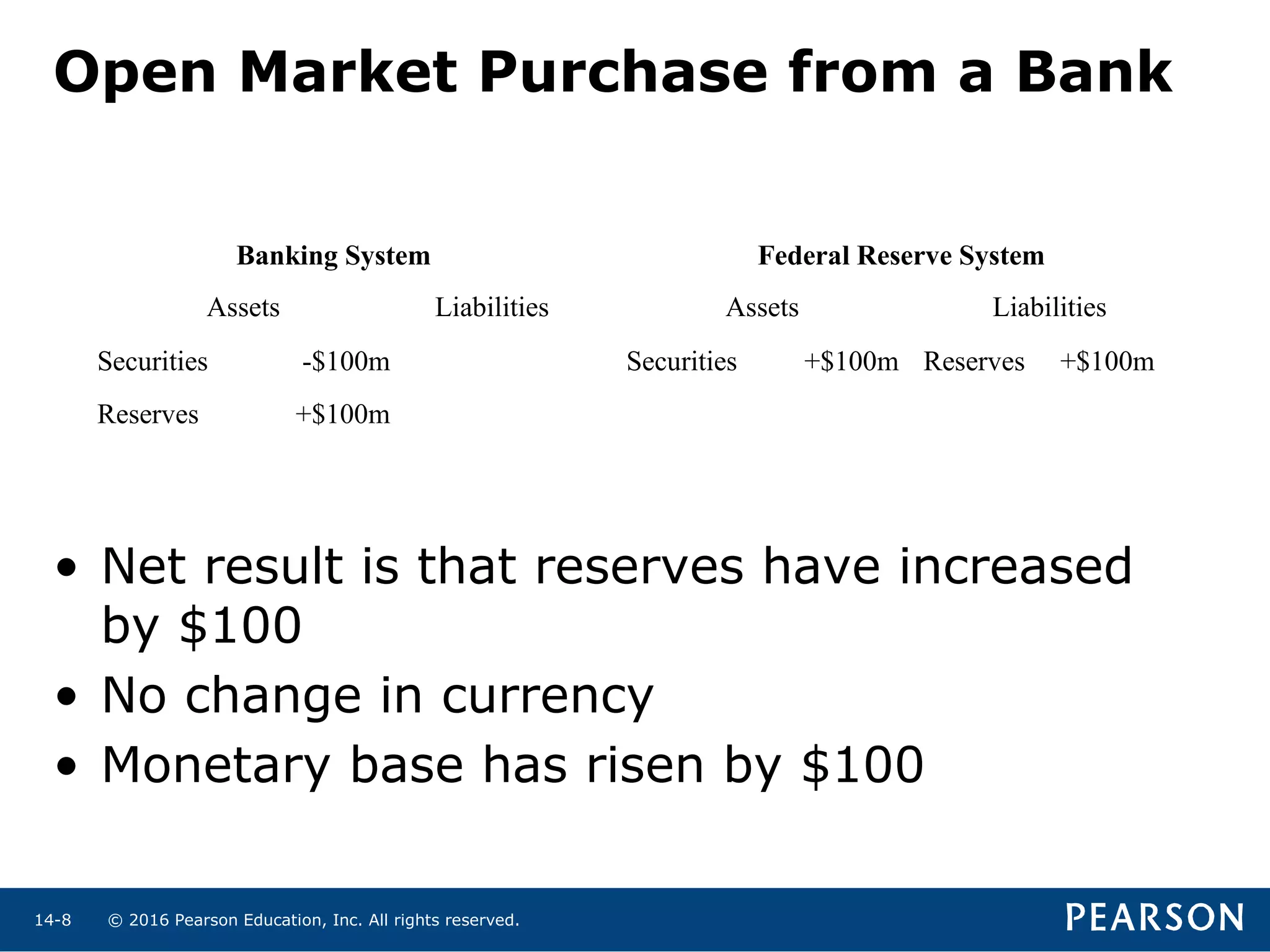

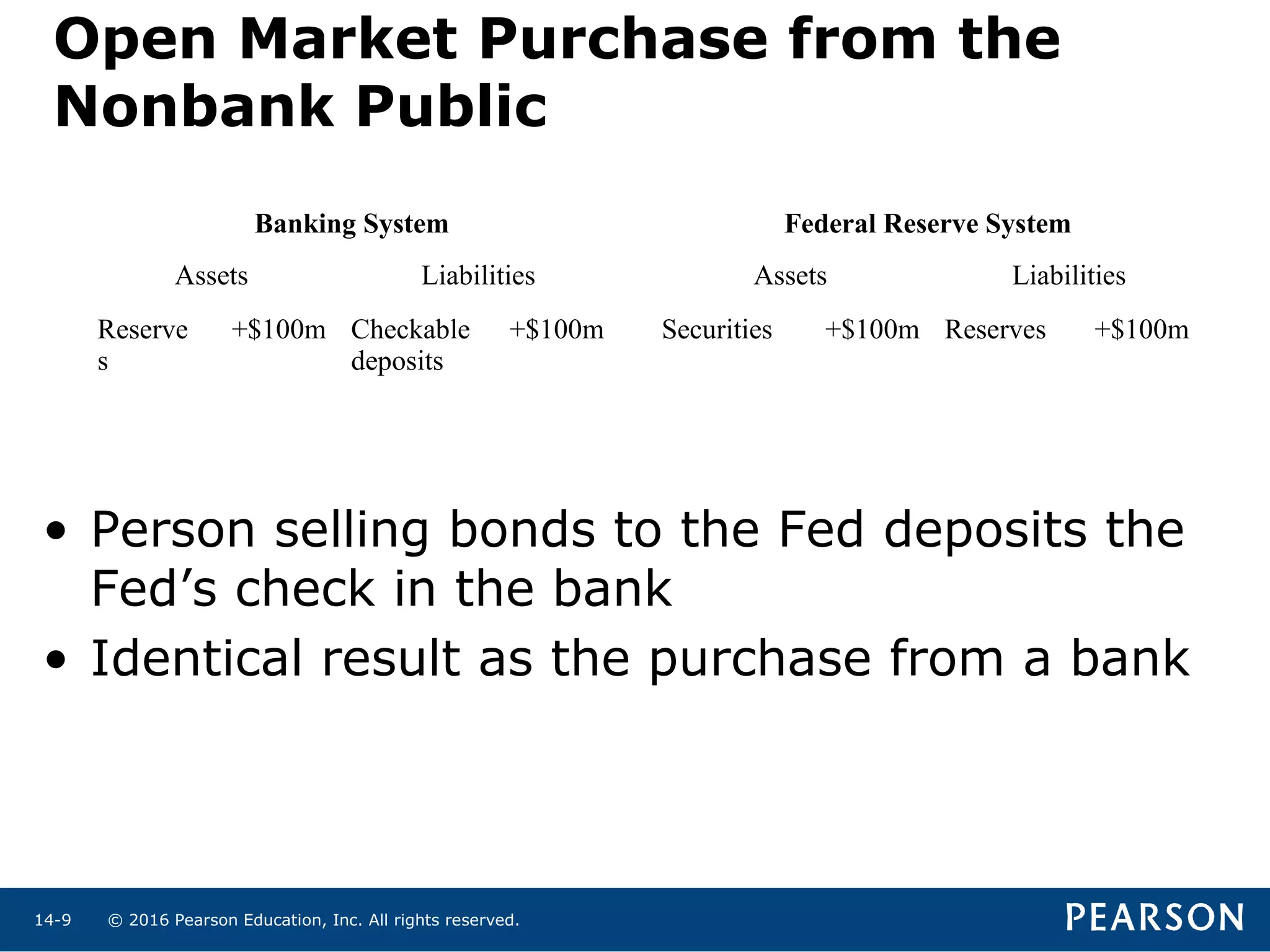

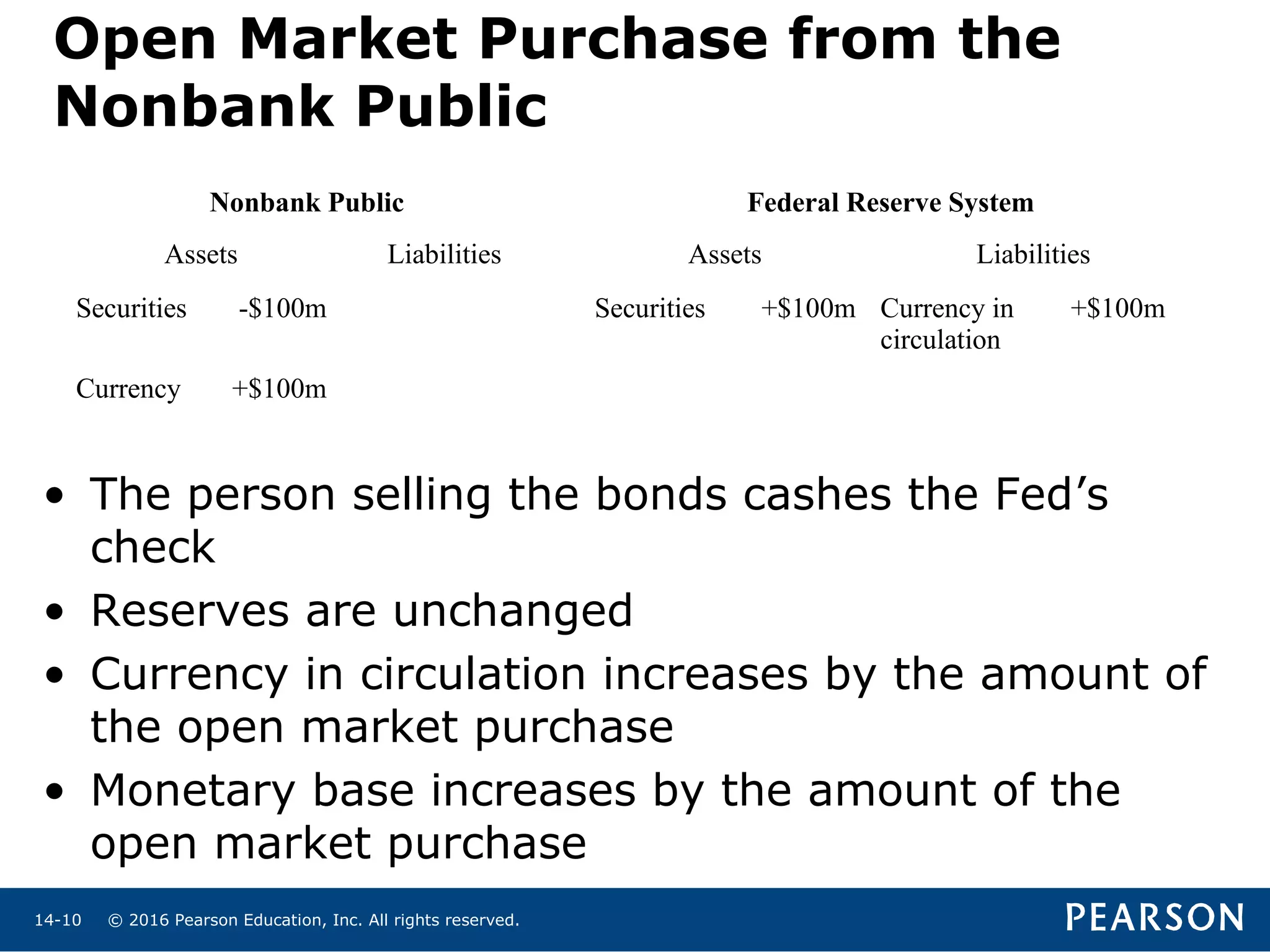

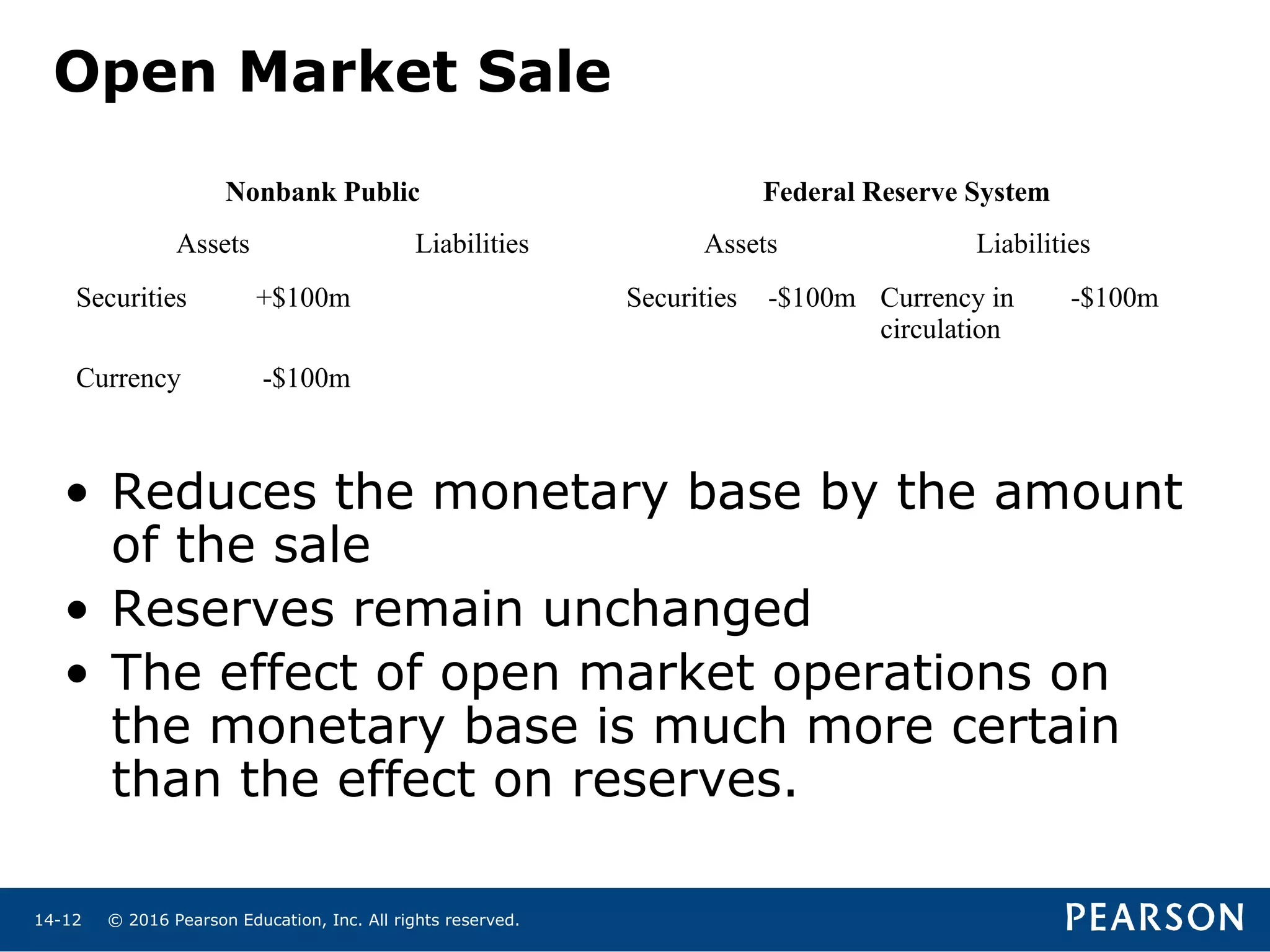

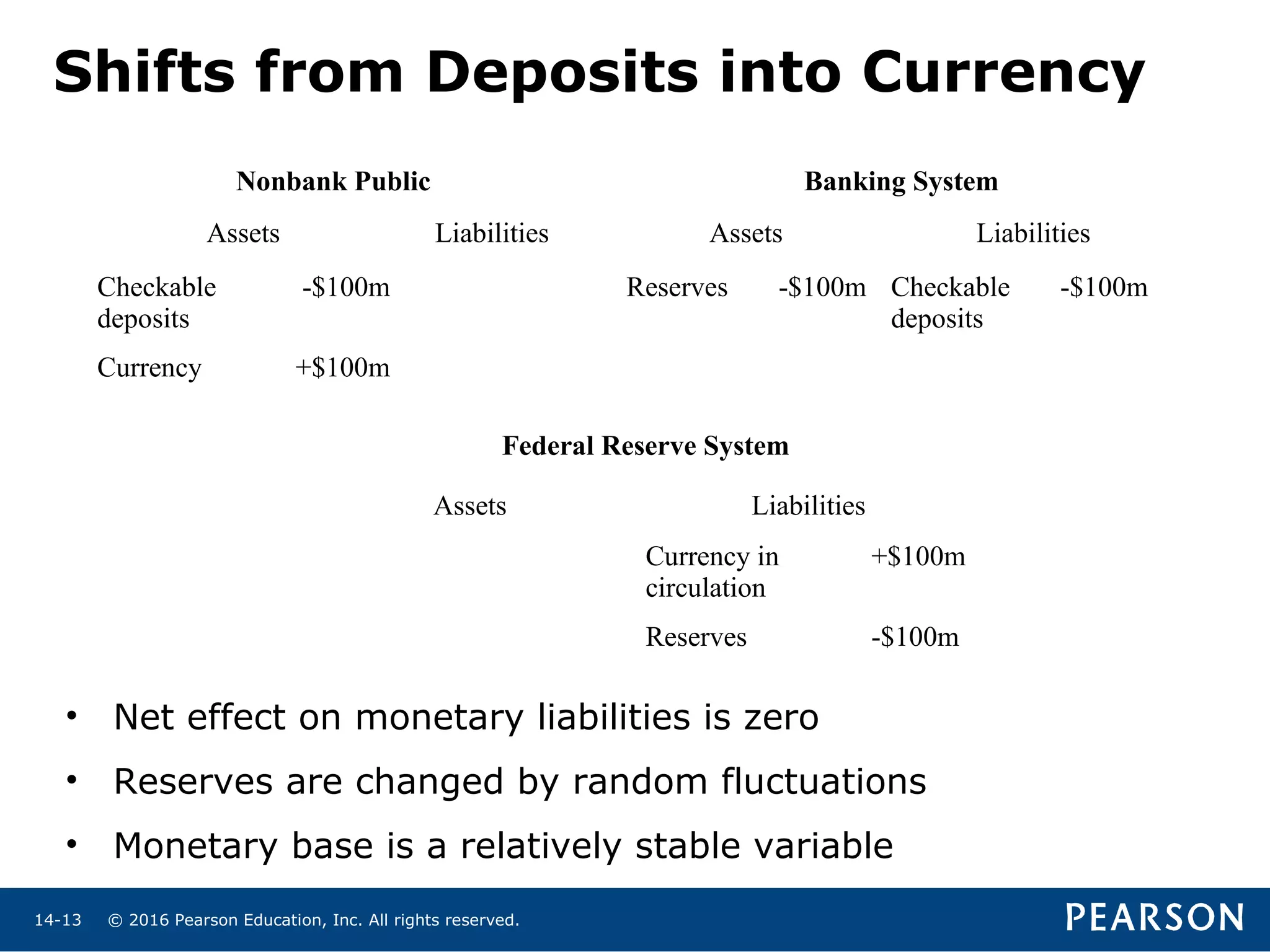

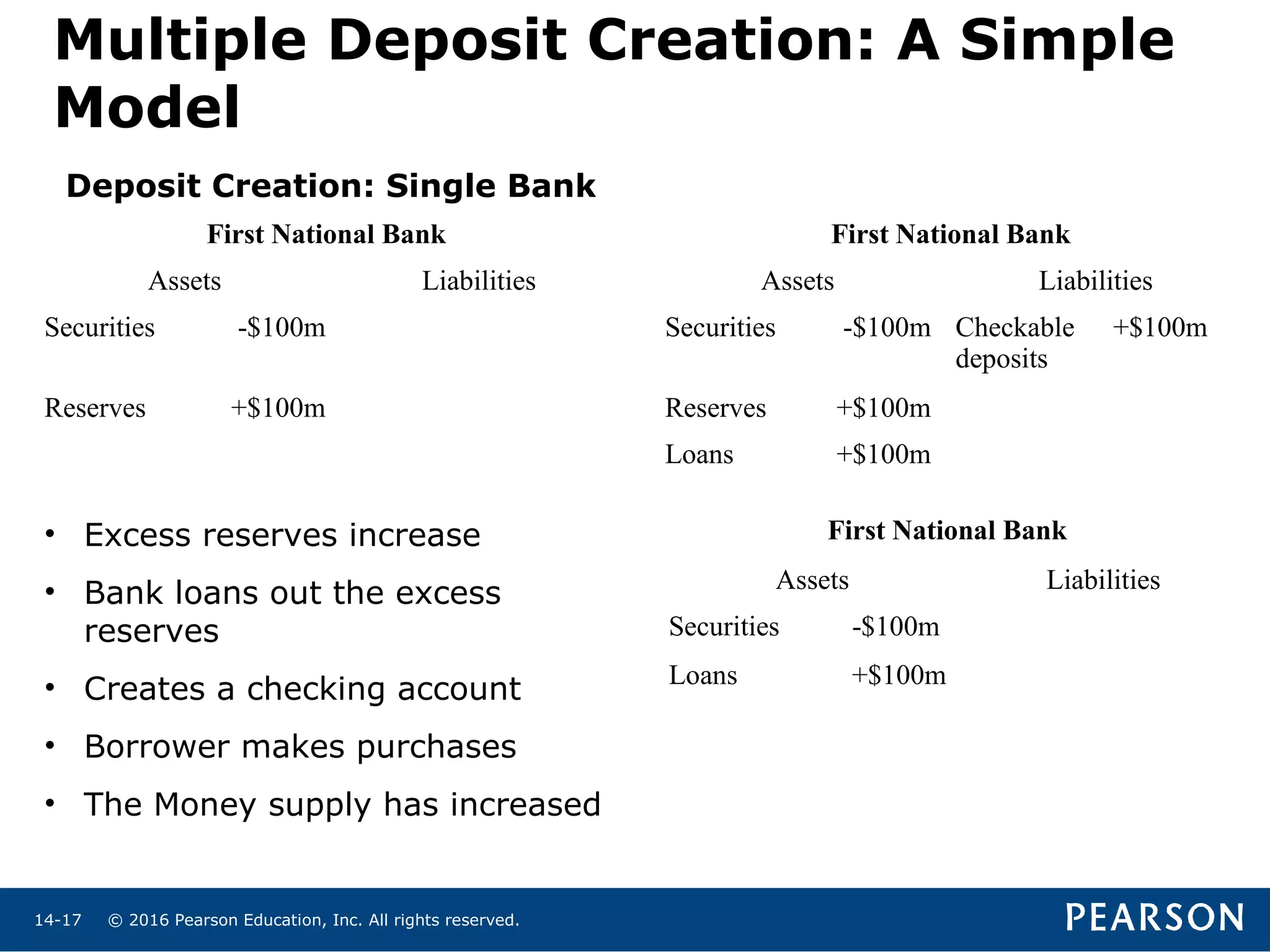

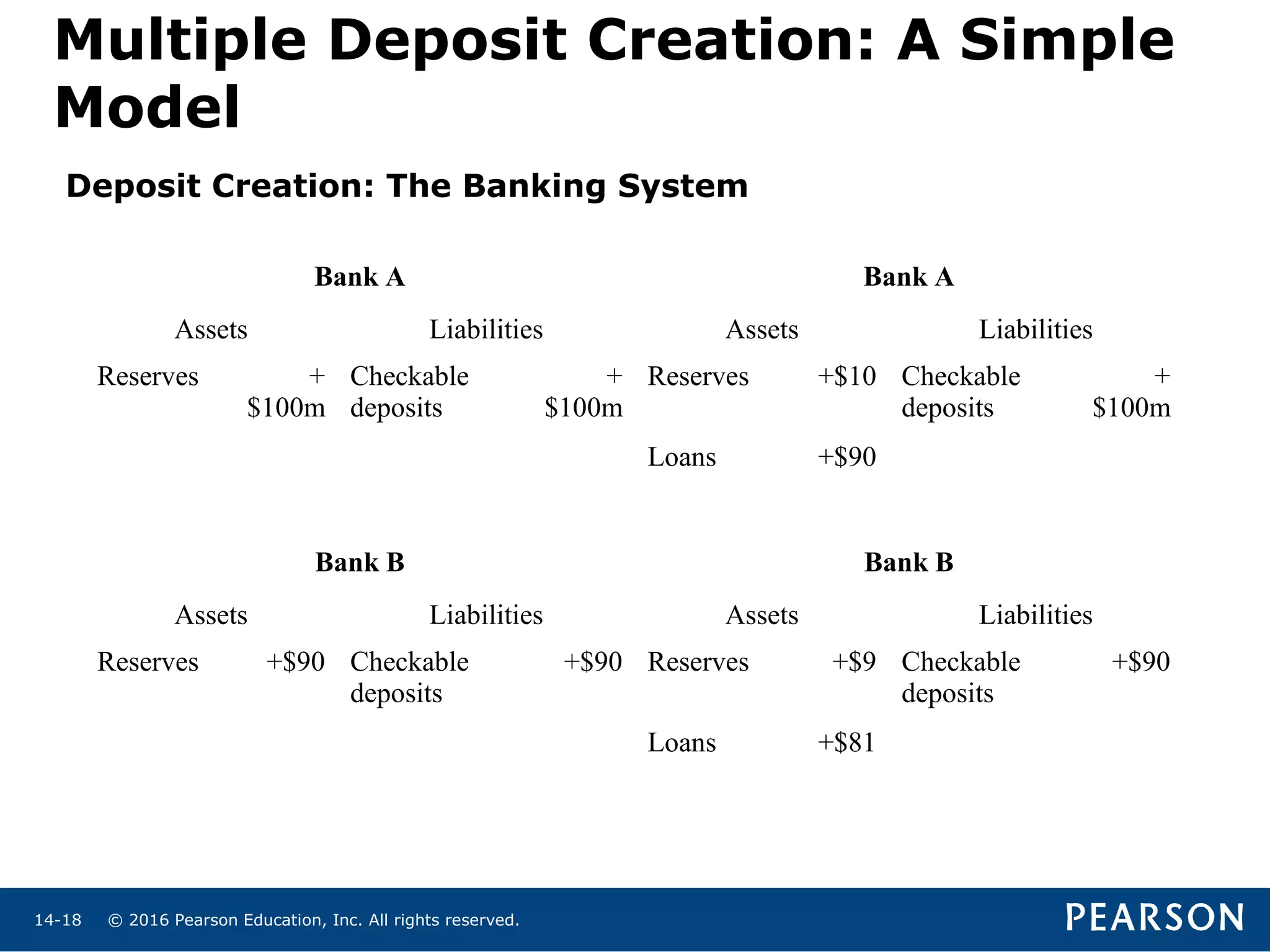

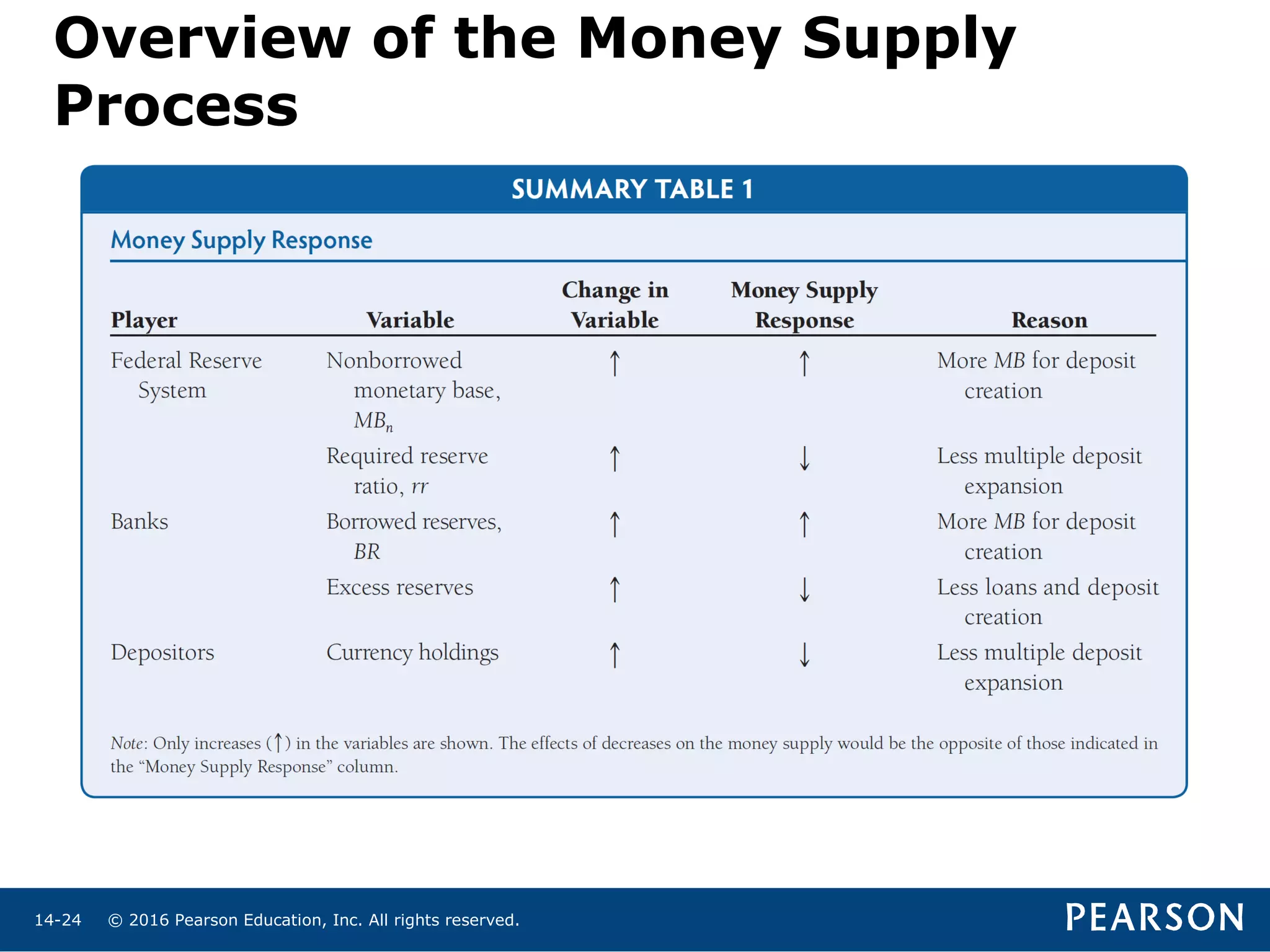

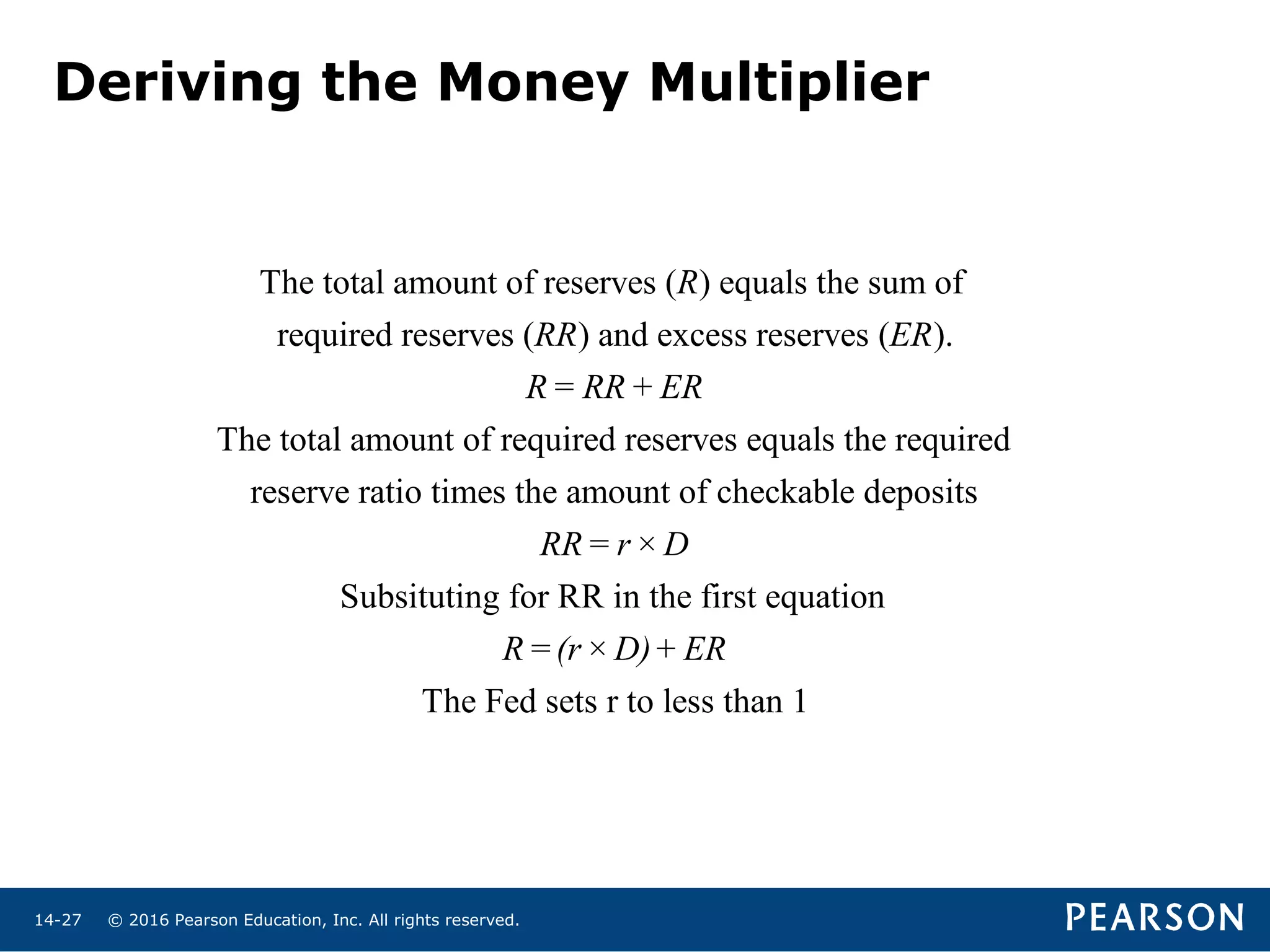

The document provides an overview of the money supply process involving three key players: the central bank (Federal Reserve), commercial banks, and depositors. It discusses how the Federal Reserve uses open market operations and changes in reserve requirements to influence the monetary base and money supply. It also introduces the money multiplier concept to illustrate how the money supply is multiplied from the original monetary base through the deposit creation process in the banking system.