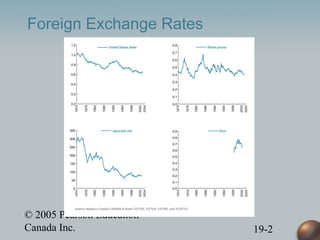

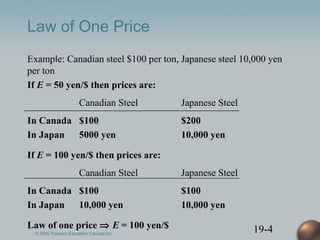

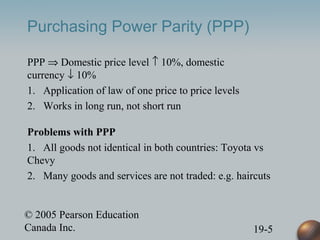

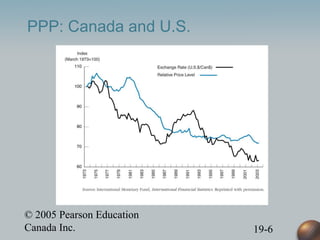

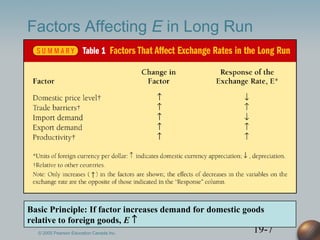

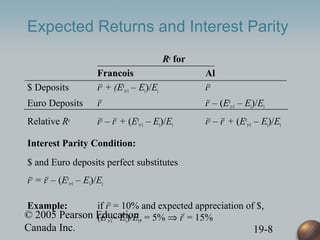

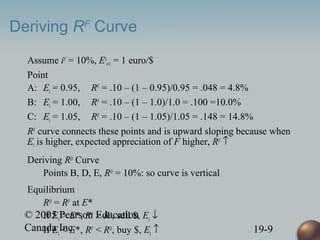

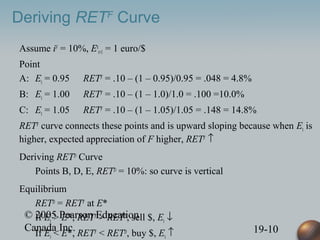

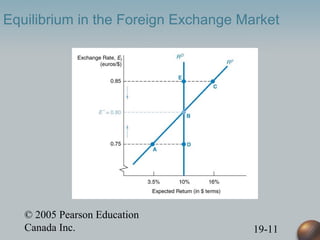

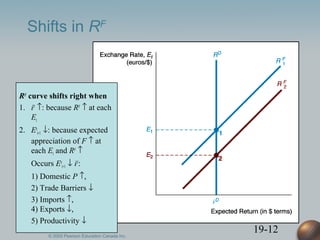

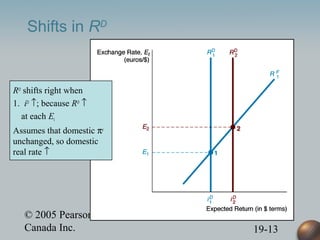

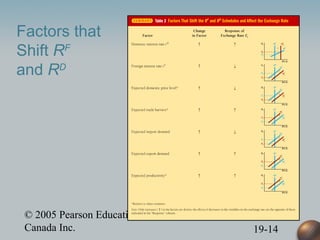

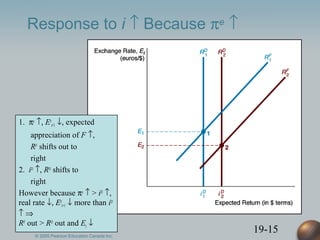

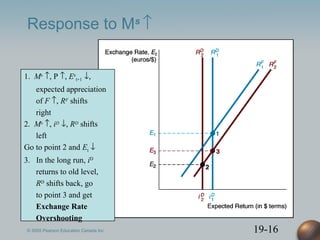

This document provides an overview of key concepts related to foreign exchange rates and the foreign exchange market. It defines spot and forward exchange rates, currency appreciation and depreciation, and discusses how these impact domestic businesses and consumers. The law of one price and purchasing power parity (PPP) are explained. Factors that can affect exchange rates in the long run are also outlined, including how expected returns, interest rate parity, and shifts in the RF and RD curves impact the equilibrium exchange rate. The document examines sources of exchange rate volatility such as fluctuations in expectations of future exchange rates and the potential for exchange rate overshooting.