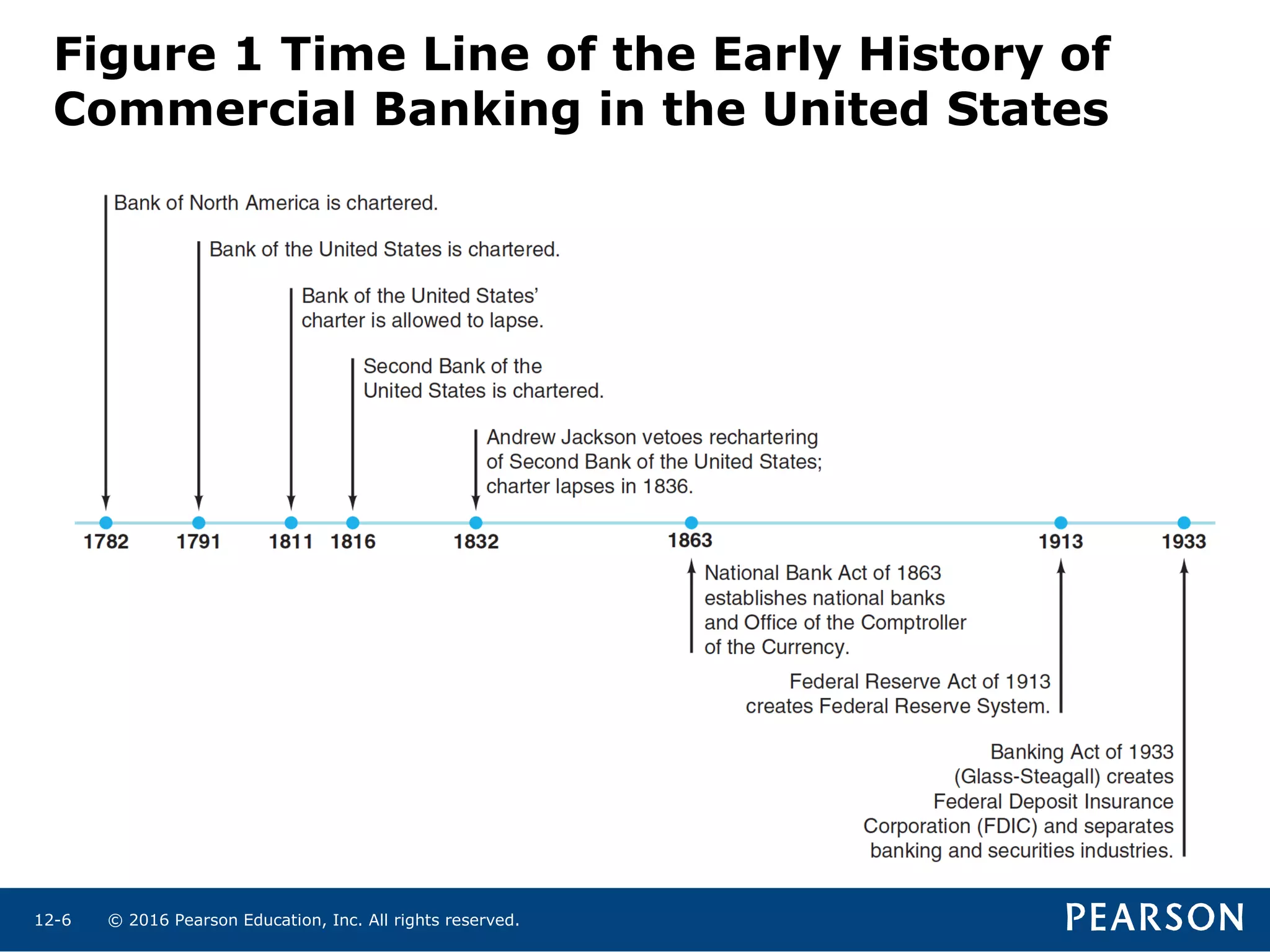

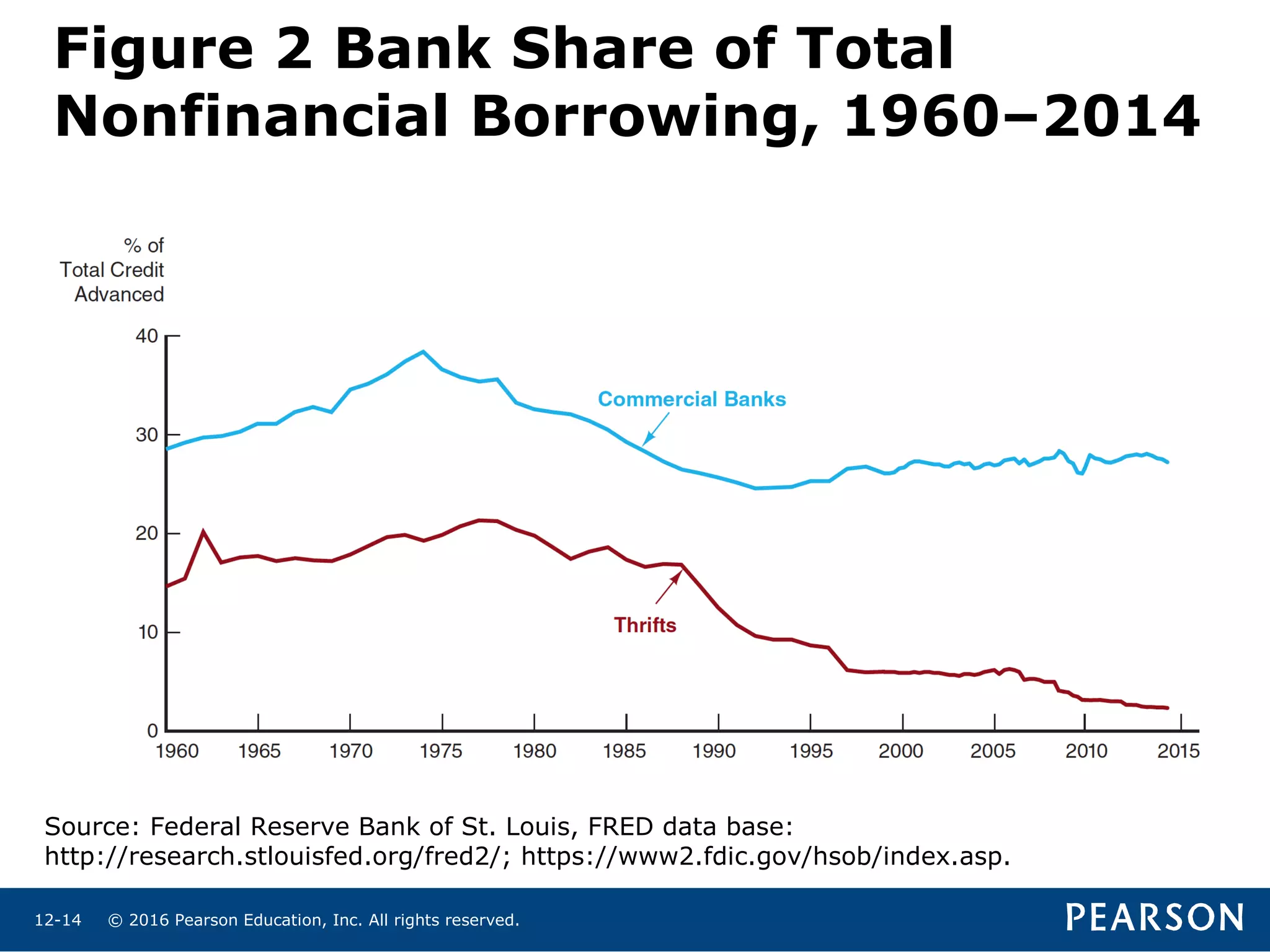

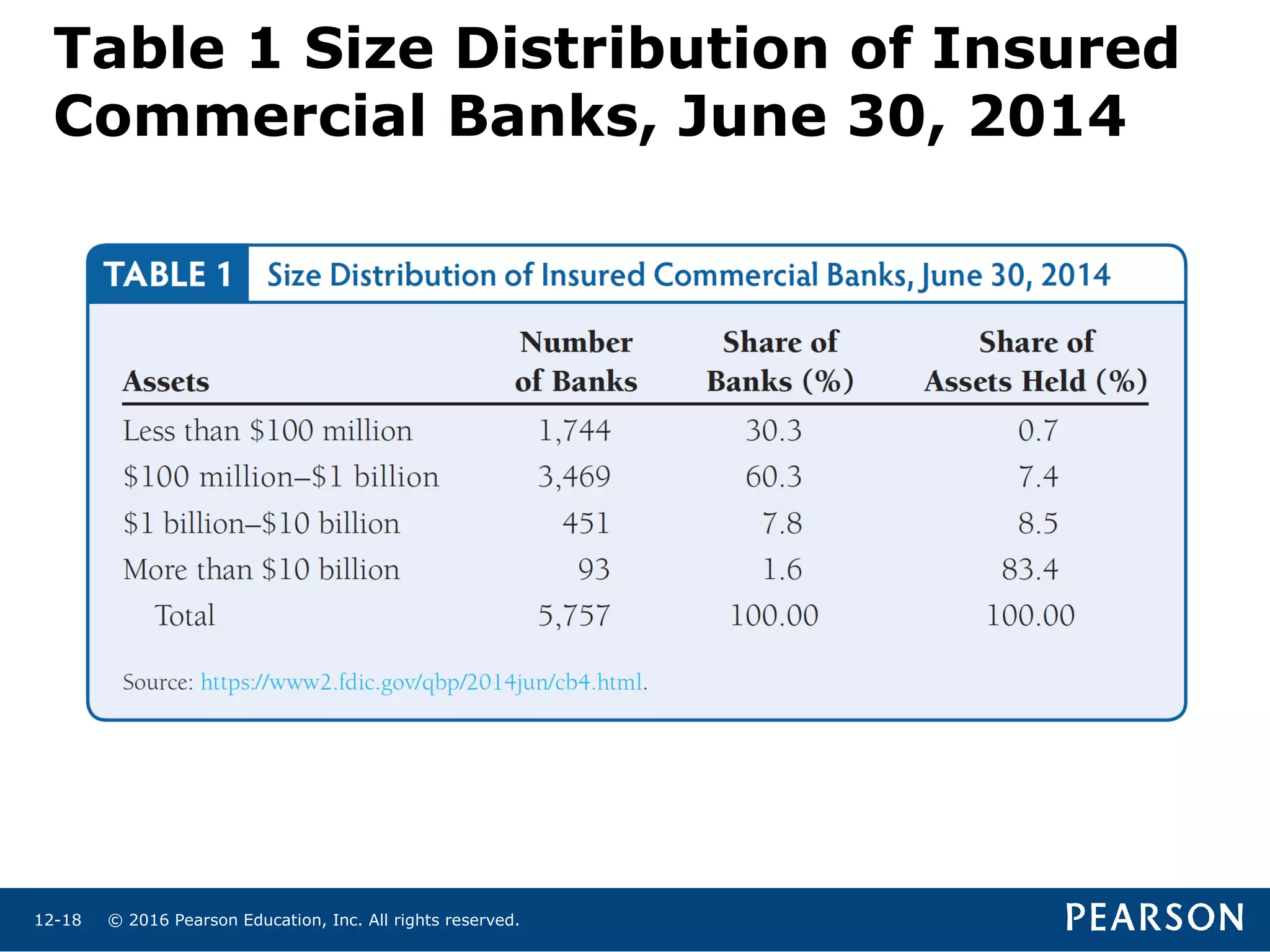

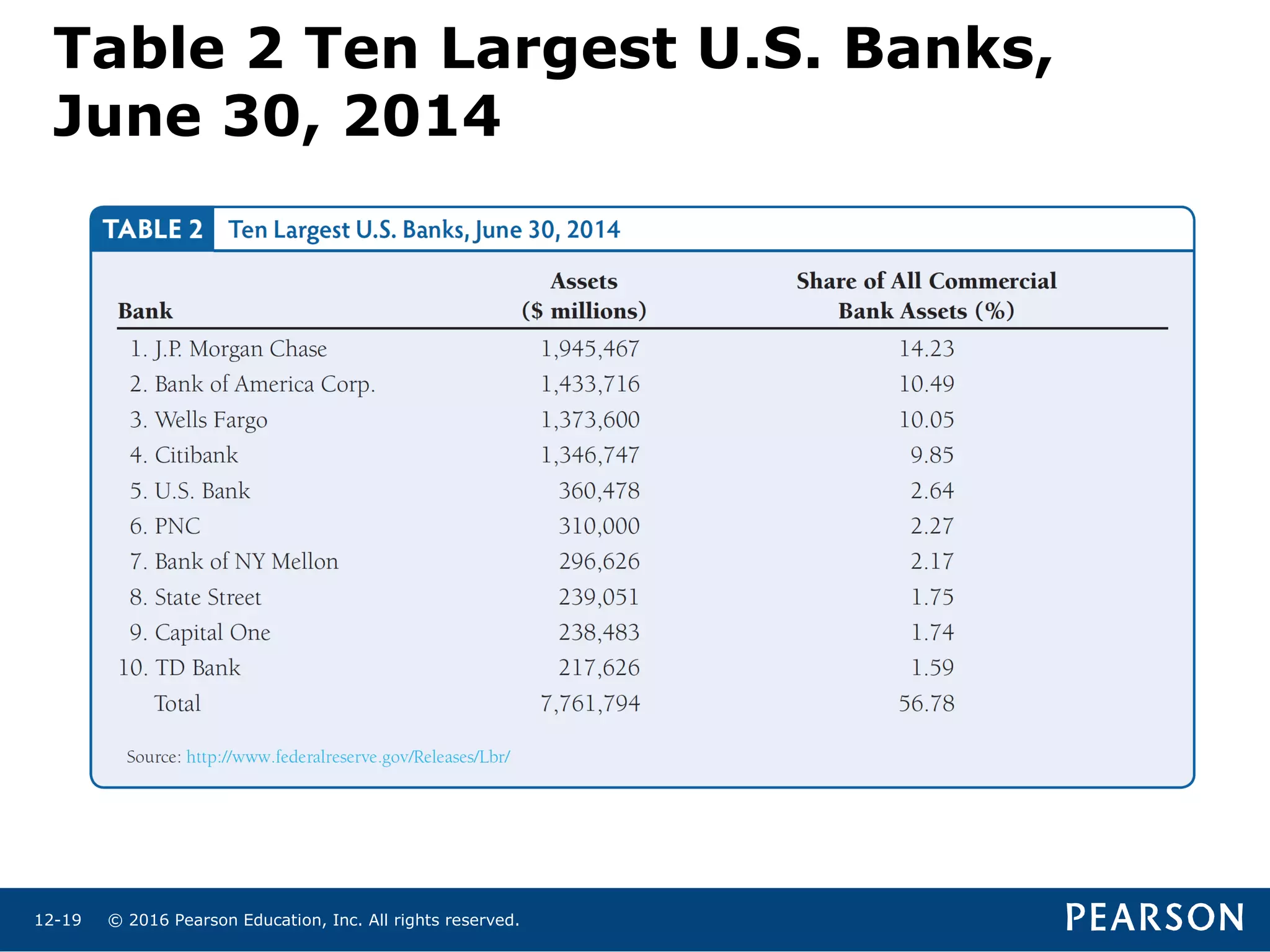

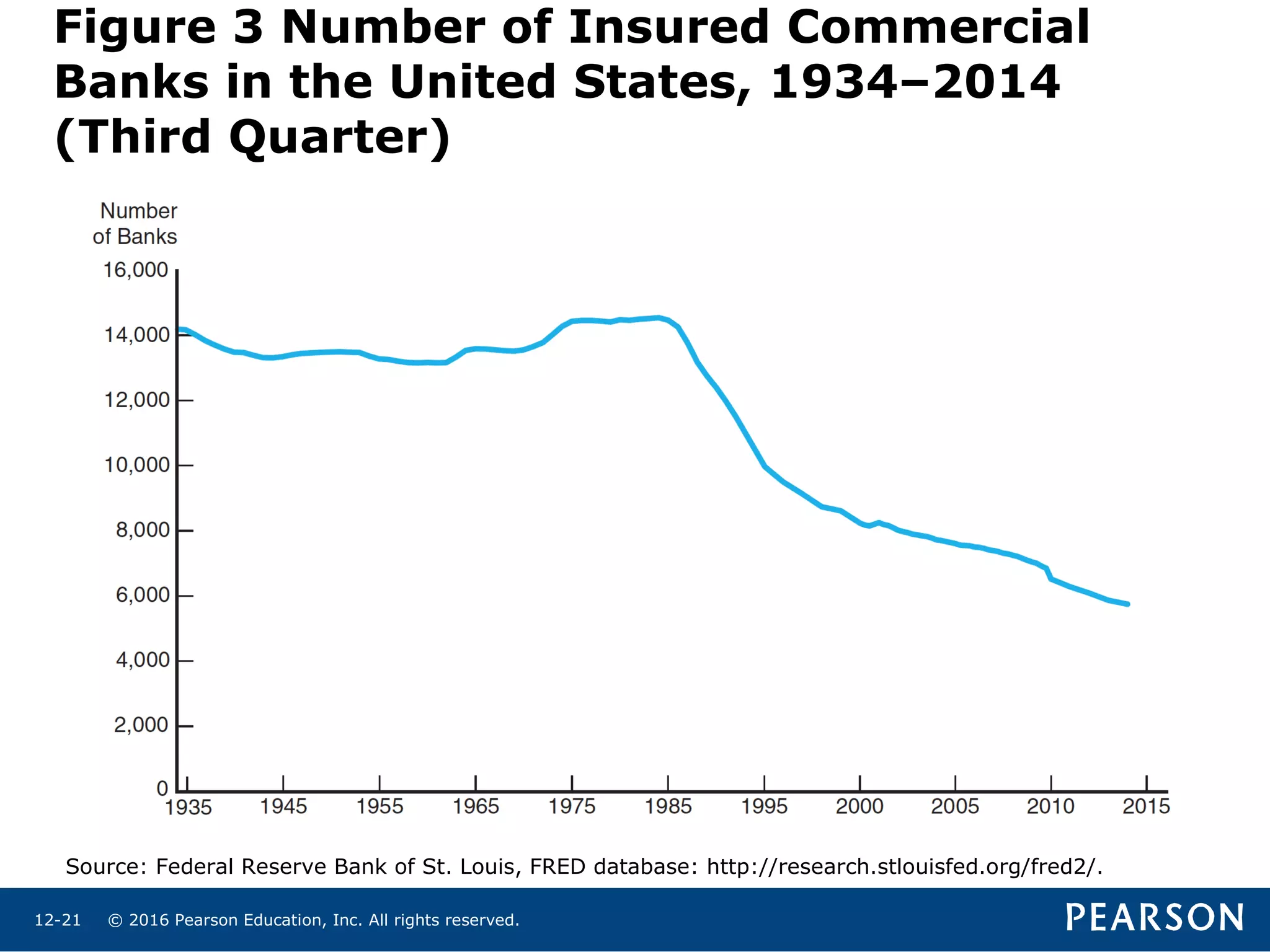

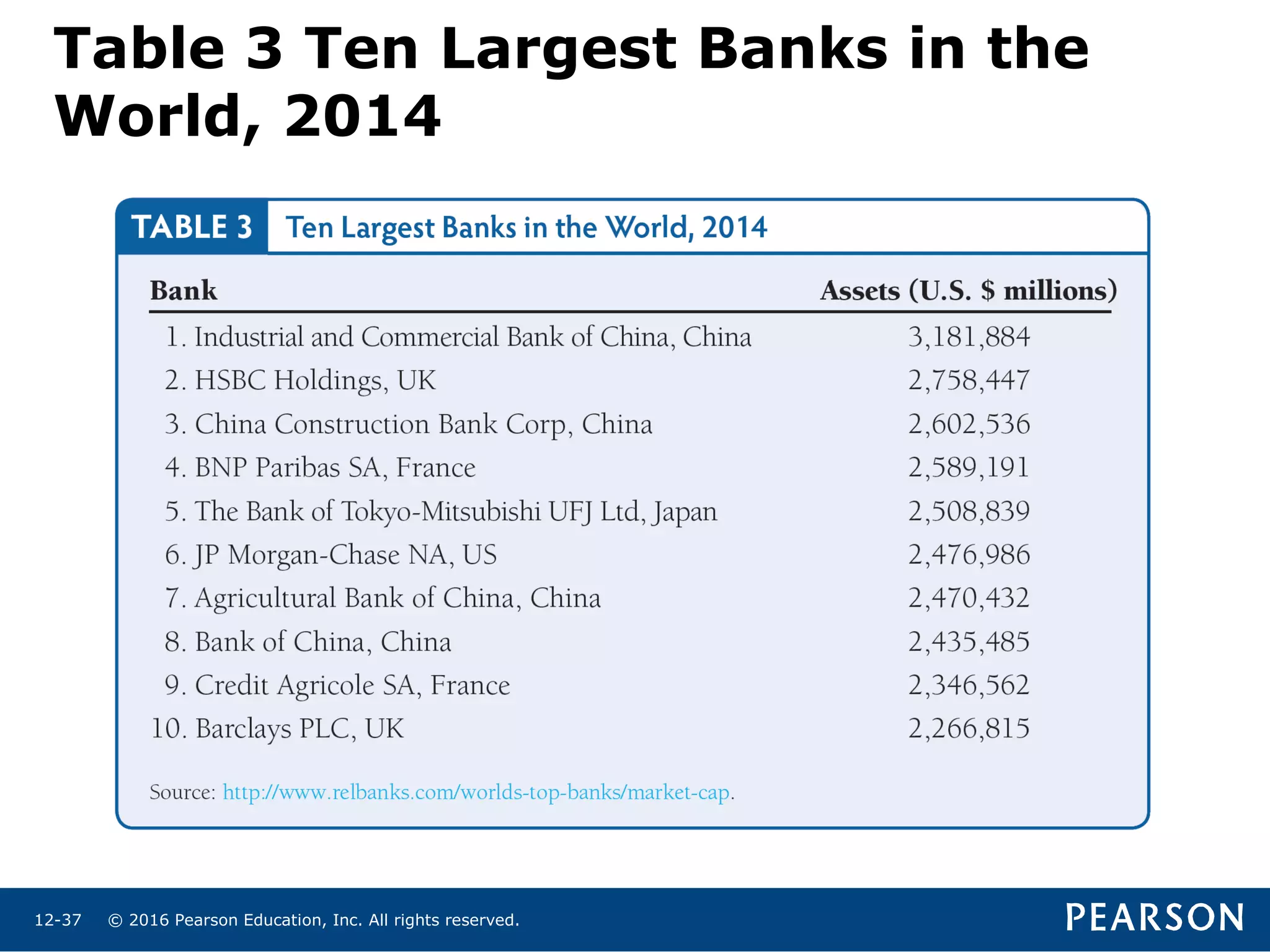

This chapter examines the historical development and current structure of the banking industry in the United States. It discusses the growth of financial innovation leading to the shadow banking system and the decline of traditional banking. The chapter also covers consolidation in the commercial banking sector driven by deregulation and technology, as well as the roles of various types of banks and their regulation.