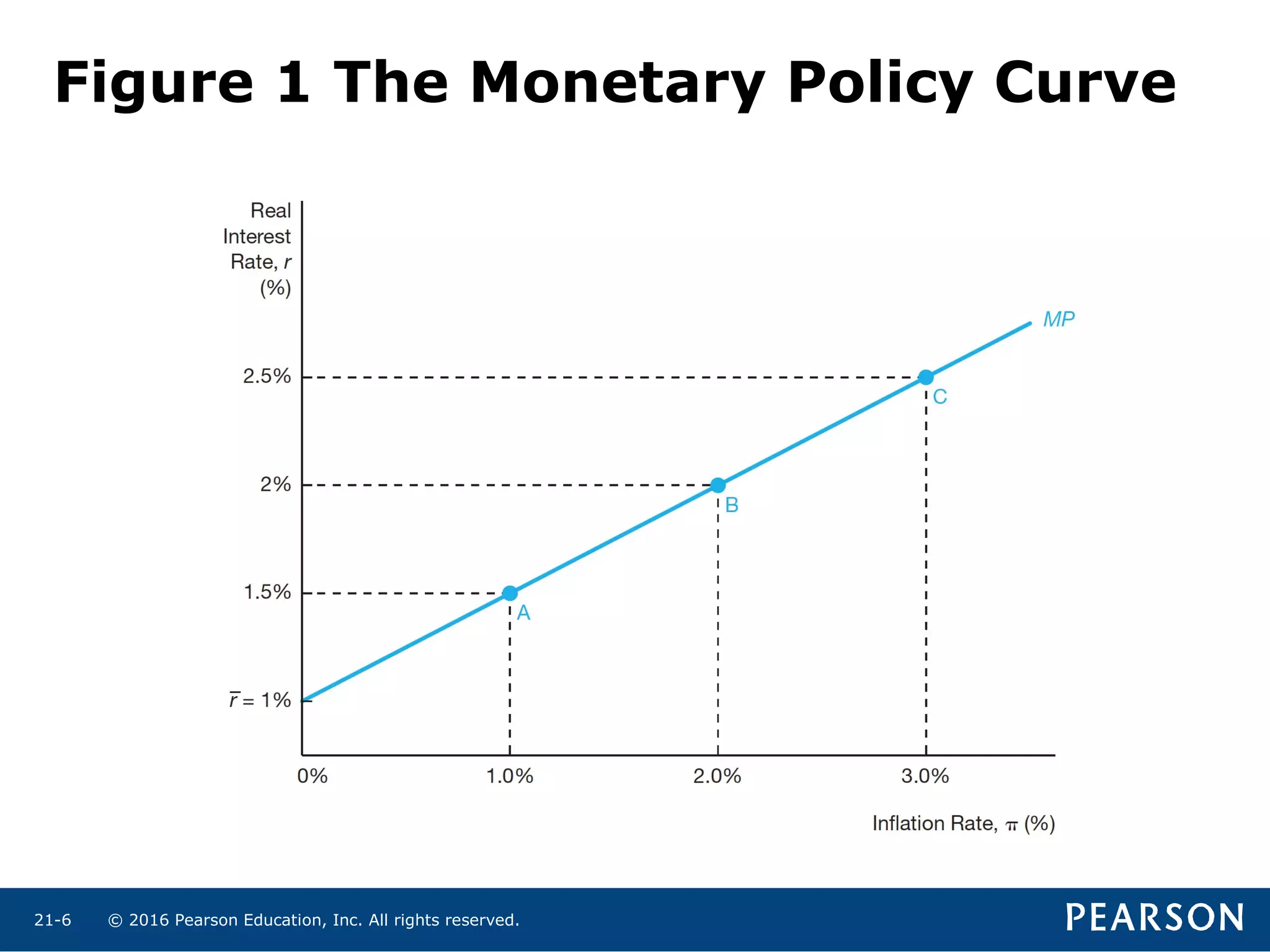

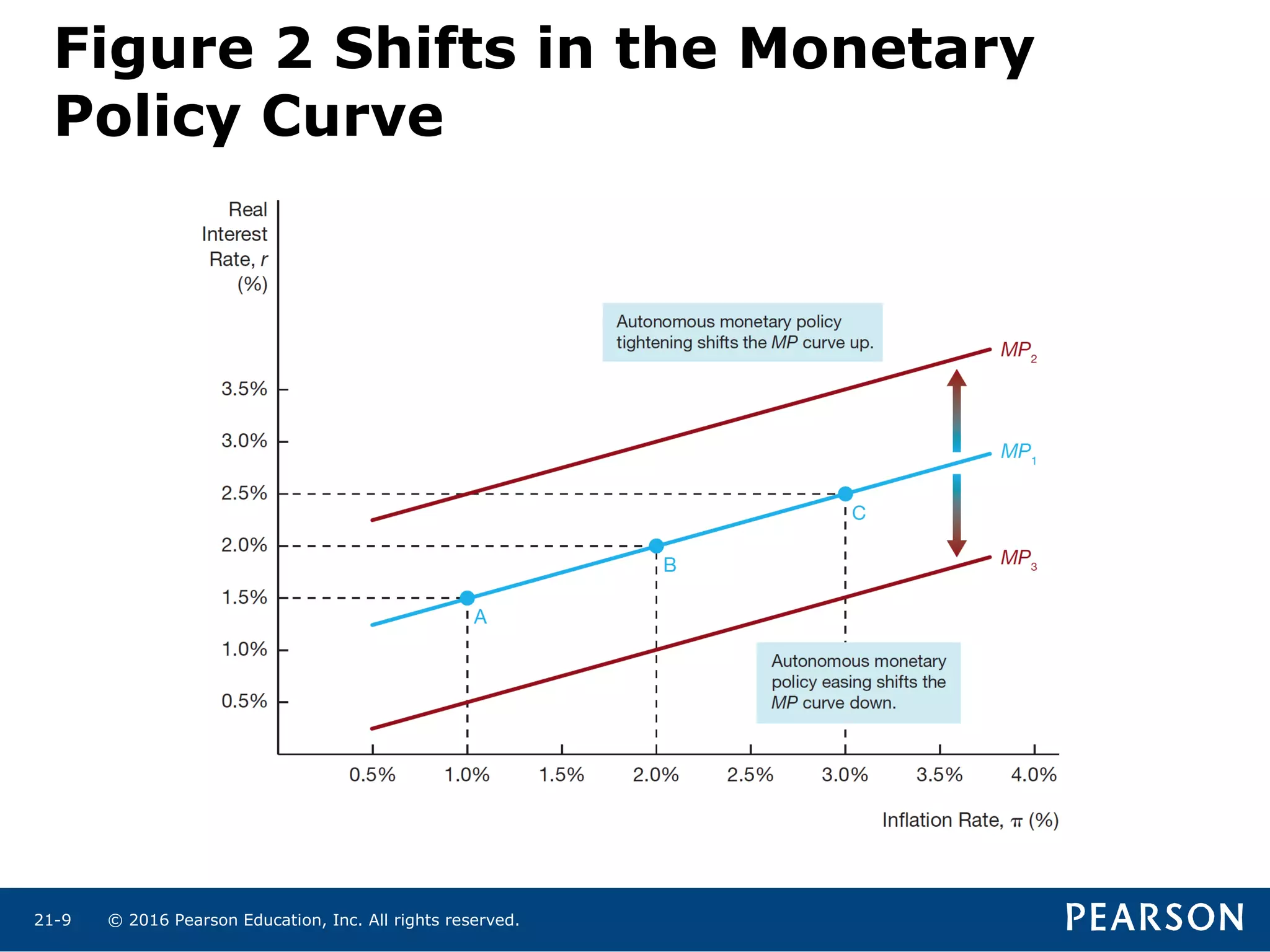

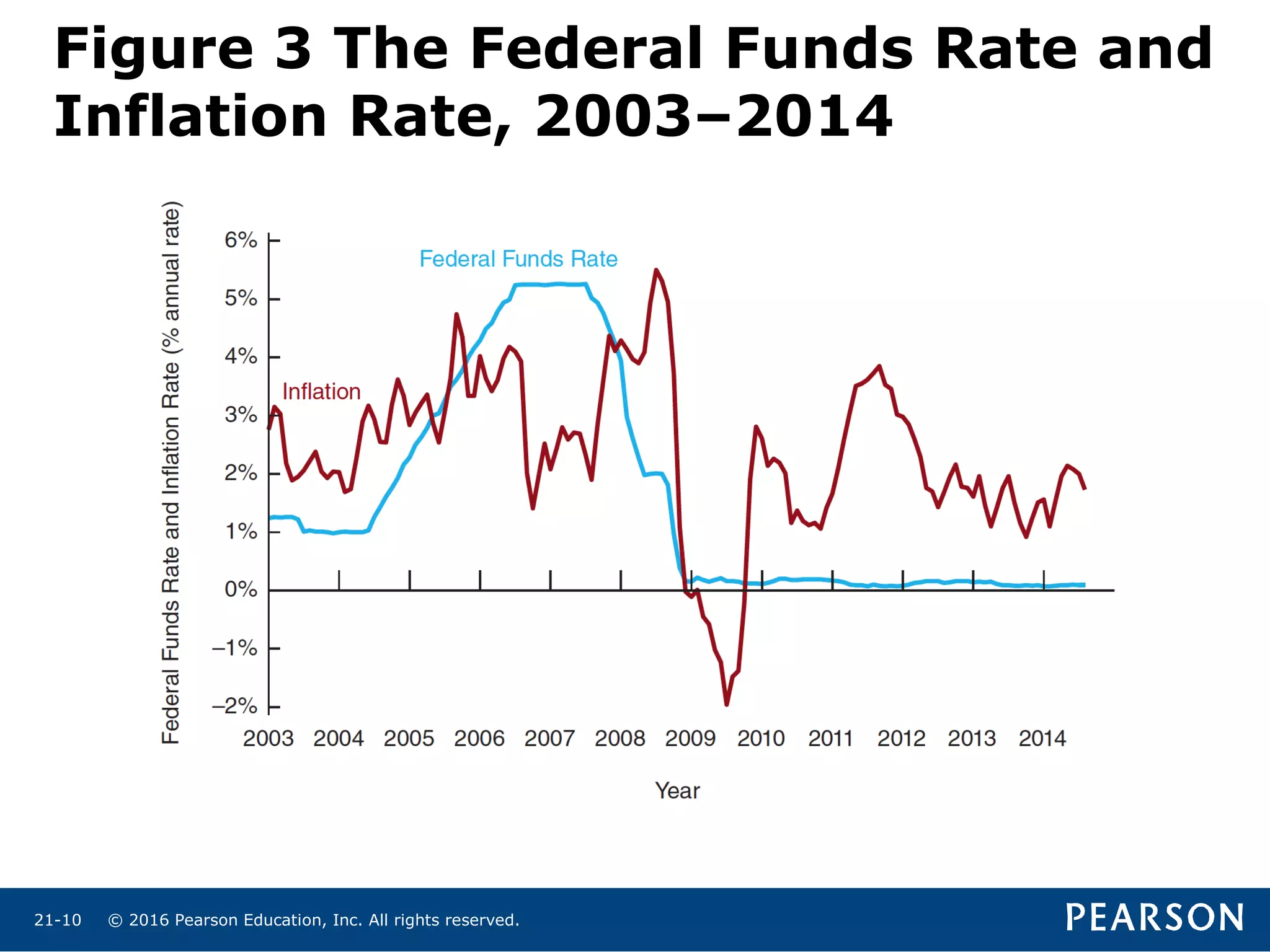

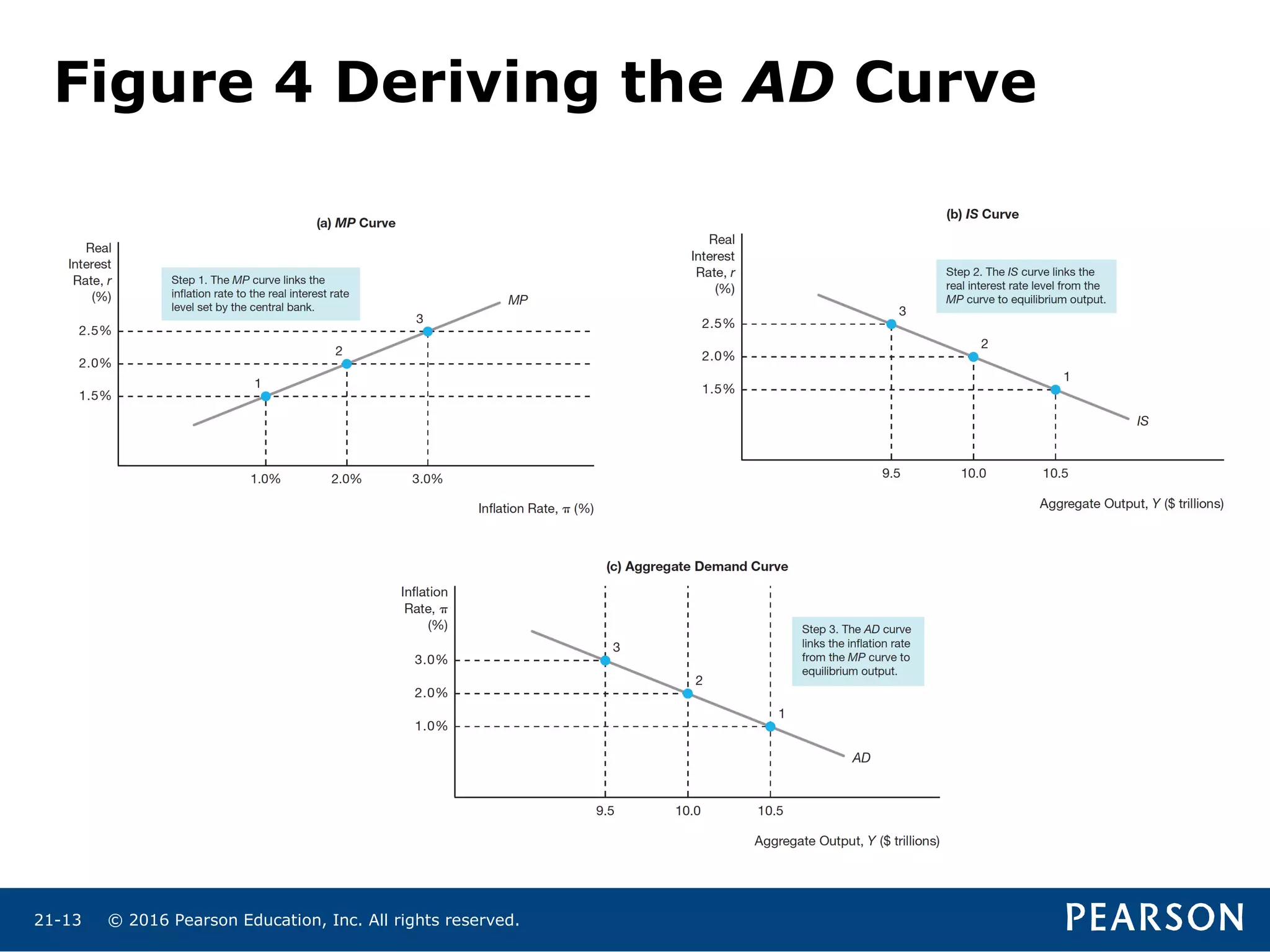

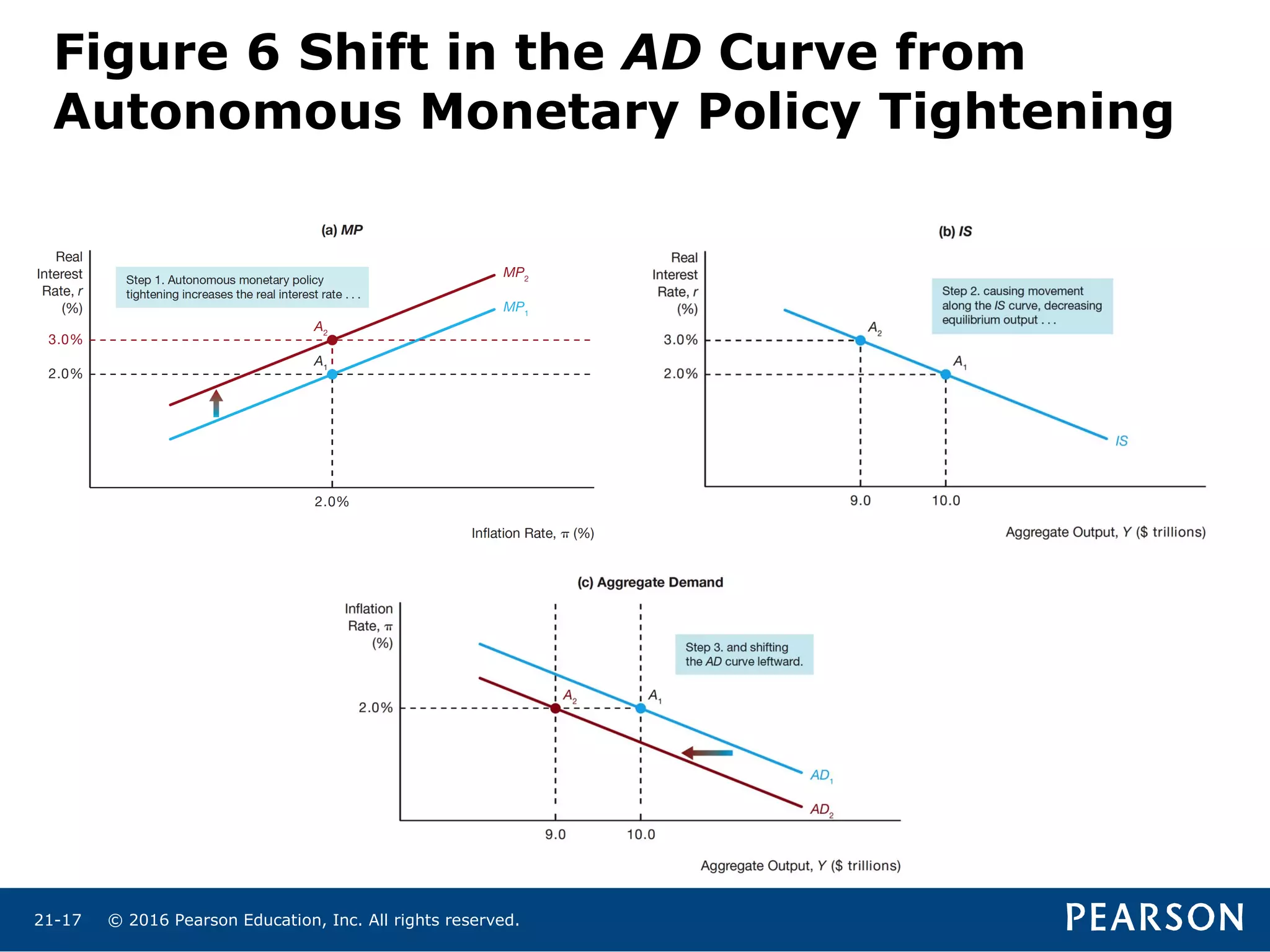

This chapter discusses monetary policy and the aggregate demand curve. It introduces the monetary policy curve, which shows how interest rates react to inflation. The monetary policy curve slopes upward due to the Taylor principle - that central banks raise rates more than inflation to stabilize prices. From the monetary policy curve and the IS curve, the aggregate demand curve can be derived, which slopes downward as inflation increases interest rates and reduces output. The chapter explores how shifts in the monetary policy curve and IS curve cause the aggregate demand curve to shift.