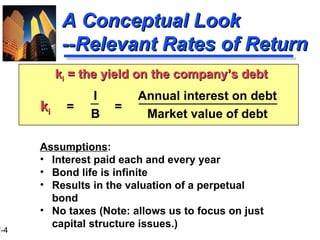

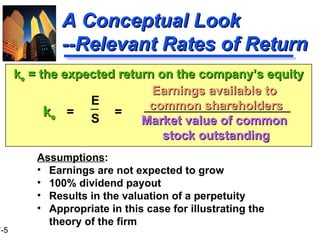

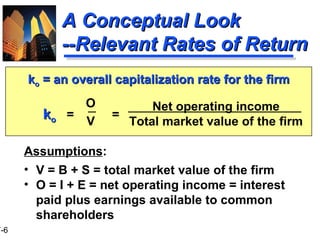

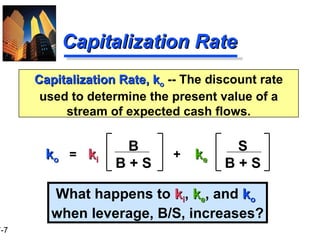

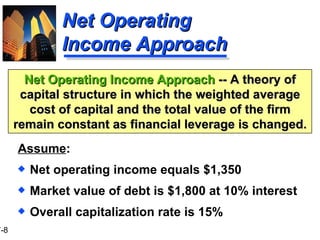

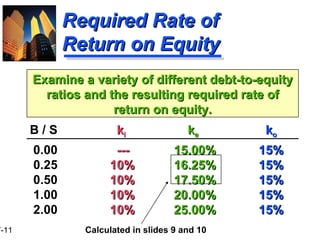

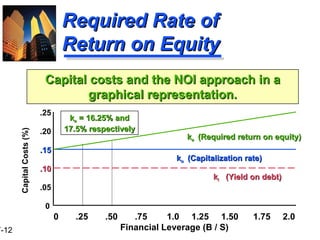

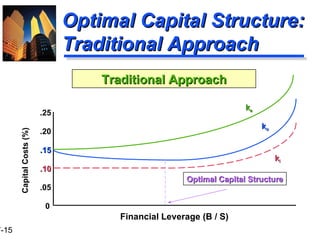

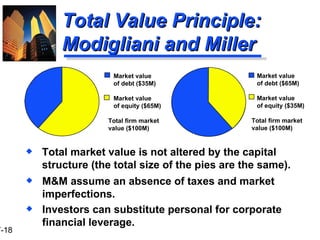

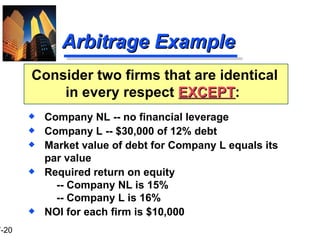

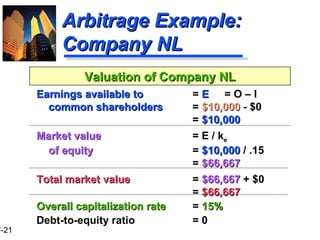

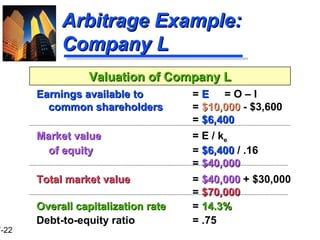

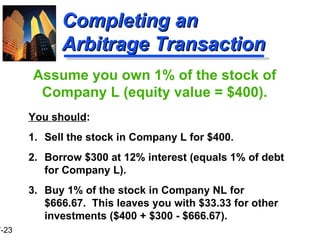

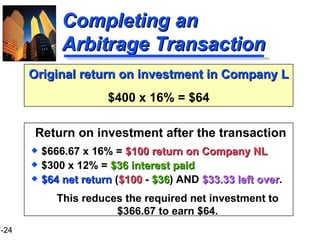

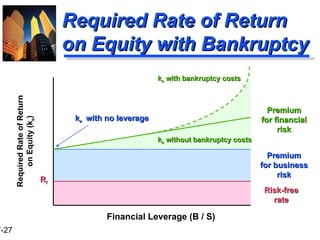

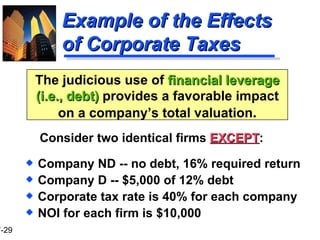

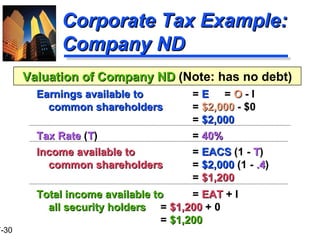

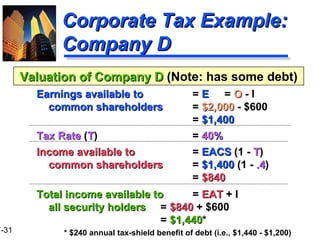

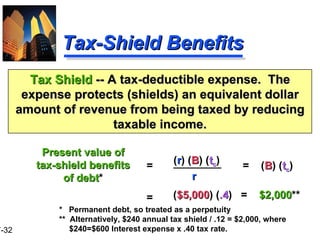

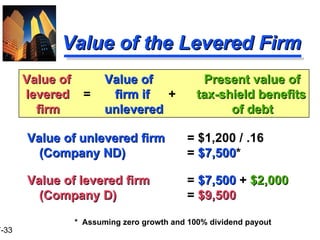

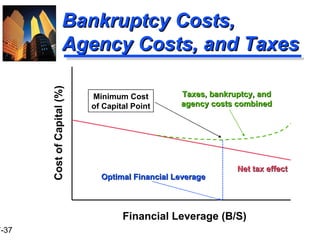

The document discusses capital structure determination and the total value principle from Modigliani and Miller. It examines different theories of capital structure, including the net operating income approach where the weighted average cost of capital remains constant, and the traditional approach where an optimal capital structure exists that minimizes costs. Market imperfections like taxes, bankruptcy costs, and agency costs are also discussed. Arbitrage is used to show how under certain assumptions, the total value of a firm is unaffected by its capital structure.