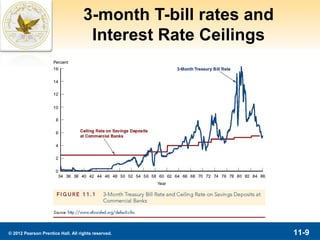

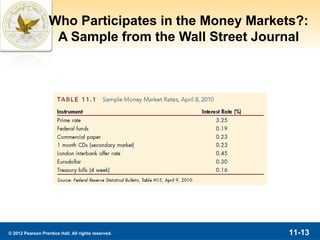

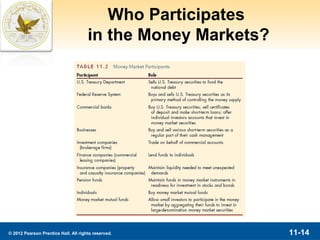

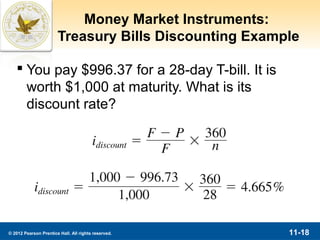

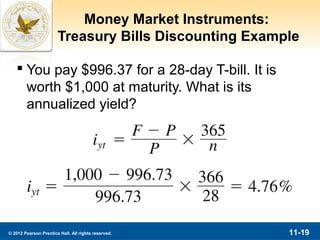

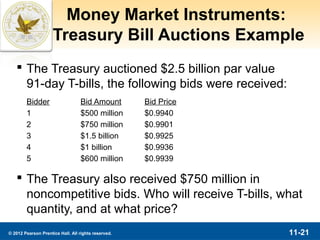

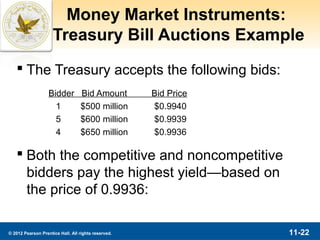

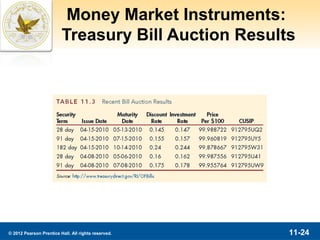

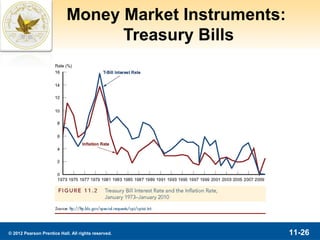

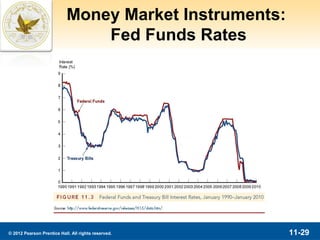

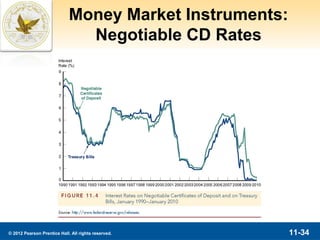

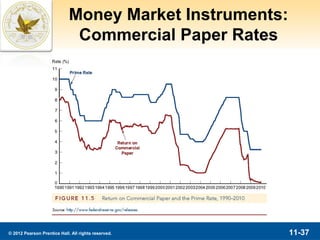

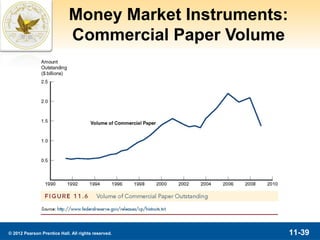

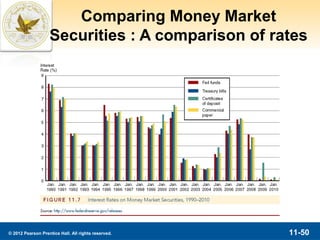

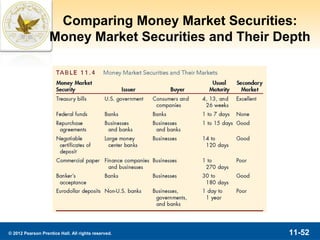

This document is a chapter from a textbook on financial markets that discusses money markets. It begins with an overview of the topics to be covered, including the definition of money markets, their purpose, participants, and instruments. Money market securities have short maturities of one year or less and high liquidity. Major participants include corporations, governments, banks, and investors. Key instruments discussed include Treasury bills, federal funds, repurchase agreements, certificates of deposit, commercial paper, and eurodollars. The chapter then examines these instruments in more detail through examples and illustrations.