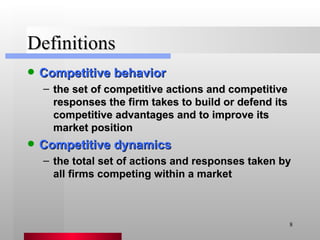

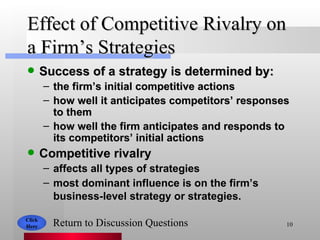

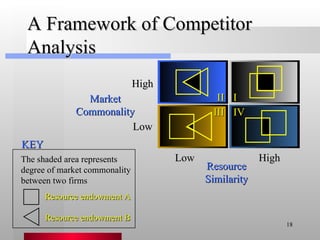

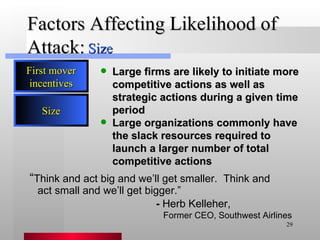

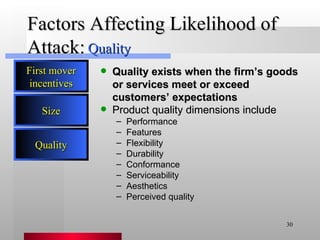

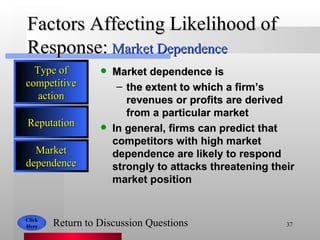

The document discusses competitive rivalry and competitive dynamics. It provides definitions of key terms like competitors, competitive rivalry, and competitive behavior. It explains that competitive dynamics refers to the total set of actions and responses taken by all firms competing in a market. Competitive rivalry influences a firm's ability to gain and sustain competitive advantages. The document also discusses factors that drive competitive behavior, like awareness, motivation, and ability, and factors that influence the likelihood of attack and response in competitive dynamics.