1. The document defines key terms related to competition including competitors, competitive rivalry, competitive behavior, and competitive dynamics.

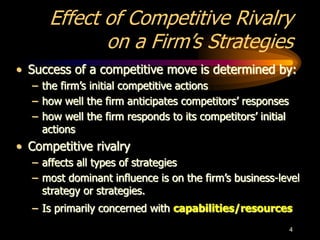

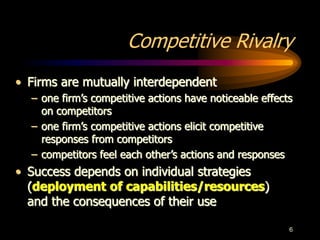

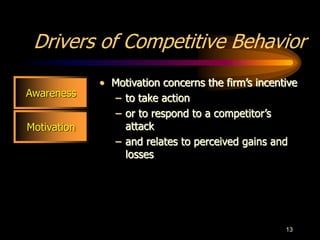

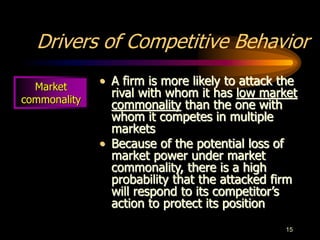

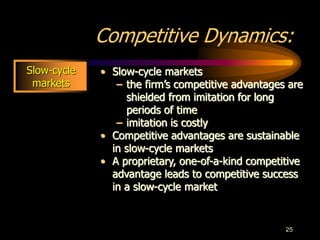

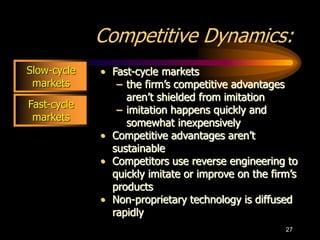

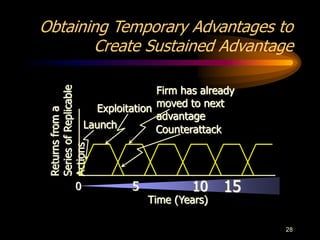

2. It explains that competitive rivalry affects firms' ability to gain and sustain competitive advantages through their competitive actions and responses to other firms.

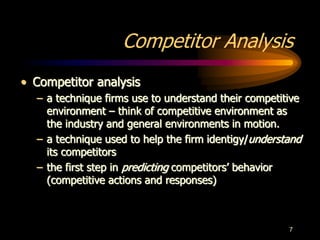

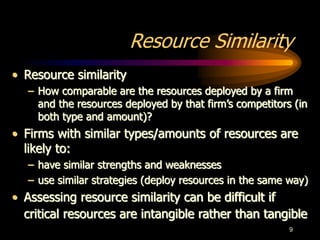

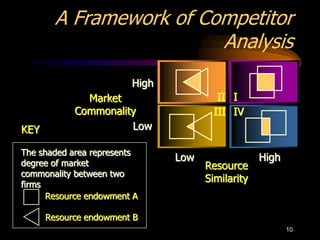

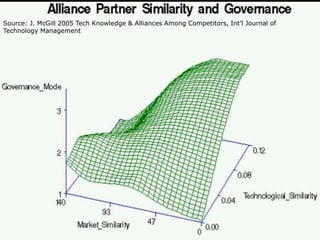

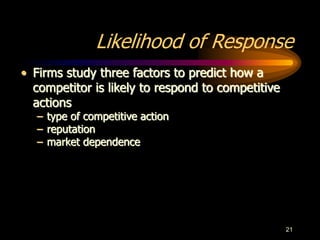

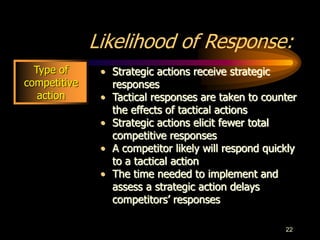

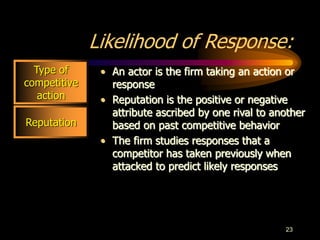

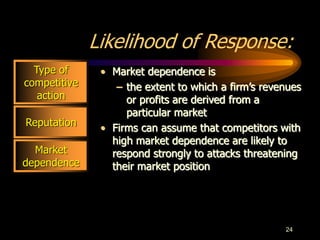

3. Firms engage in competitor analysis to understand their competitive environment and predict competitors' behaviors in order to develop effective strategies.