The document discusses various topics related to mergers, acquisitions, and restructuring strategies including:

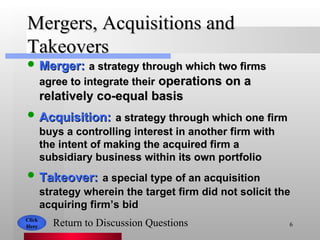

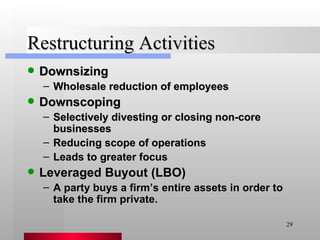

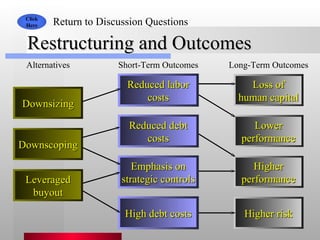

- The differences between mergers, acquisitions, and takeovers. Restructuring refers to changes in a company's operations or strategy.

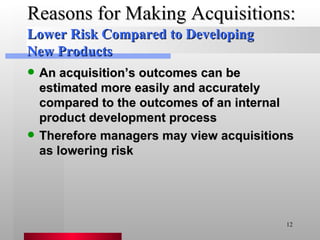

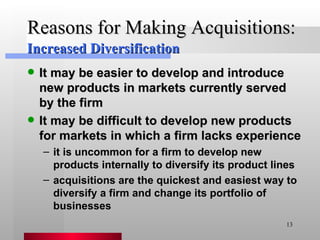

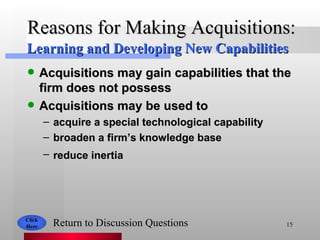

- Common reasons why firms pursue mergers and acquisitions, such as increasing market power, overcoming barriers to entry, and learning new capabilities.

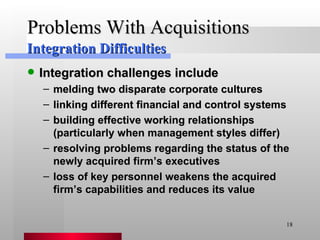

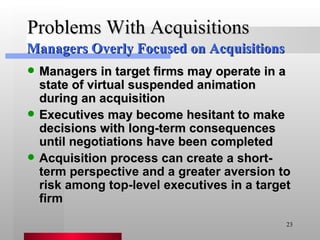

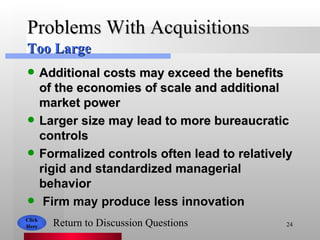

- Potential problems with mergers and acquisitions like integration difficulties, inadequate target evaluation, inability to achieve synergies, and managers becoming too focused on acquisitions.

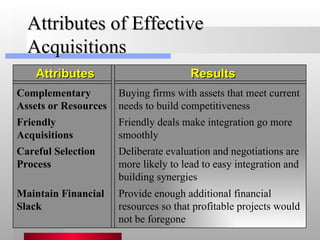

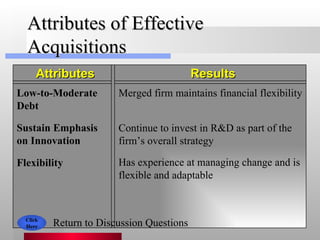

- Attributes of effective acquisitions like complementary assets/resources and careful selection processes.