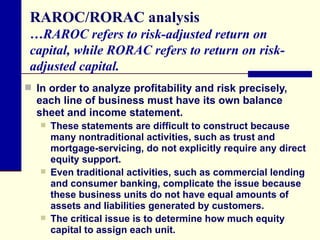

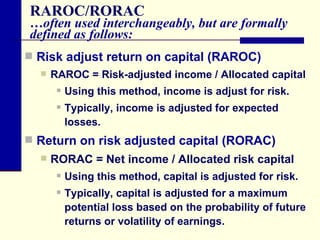

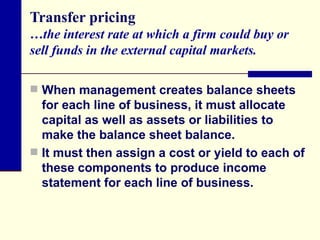

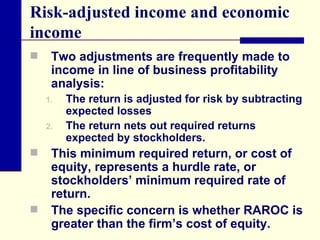

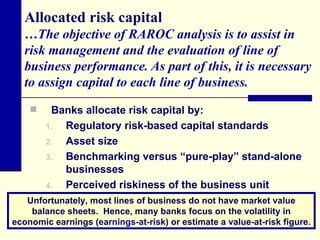

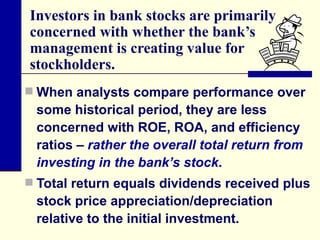

Traditional bank performance analysis has flaws when banks engage in diverse strategies and off-balance sheet activities. Return on assets and equity do not capture how activities create shareholder value. Alternative models allocate capital and income to business lines to calculate risk-adjusted return on capital. This helps evaluate performance and risk by business to identify best strategies and create shareholder value.

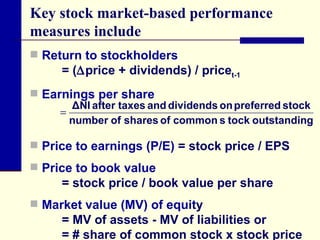

![Example: buy 100 shares of PNC Financial at the beginning of 2001 for $73.06. The bank paid $1.92 per share in dividends that generated reinvestment income of $.09. At the end of 2001, the price of stock was $56.20. Return to stockholders in 2001 was -20.3%. 0.203 = [$56.20 - $73.06 + $2.01] ÷ $73.06](https://image.slidesharecdn.com/ch04-110919110614-phpapp02/85/Ch04-18-320.jpg)