The document summarizes the key findings of a research study conducted by the Center for Applied Research on how investor behavior is redefining performance in the investment industry. The summary is:

1) The study found that both retail and institutional investors are often not acting in their own best interests, exhibiting behaviors that do not align with their long-term goals. For example, retail investors said they need to be more aggressive but allocate heavily to cash, while institutional investors increased allocations to complex alternative assets despite not feeling prepared to handle the associated risks.

2) The behaviors seem to be driven by investors' growing awareness of instability in the financial system due to factors like extensive central bank interventions and increased global correlations.

3

![20x

TALLER

Why, then, does our study find that 64 percent of survey participants “somewhat” to “strongly” agree with the following statement: “Long-term decisions

are important to me”? 24 Certainly a focus on the long term would be in the best

interest of investors and providers, but the behavioral evidence suggests that

short-termism is much more prevalent. This misalignment of interests — and

self-perception — is one factor that is driving unhealthy decision-making.

Financial interest: Opacity versus transparency

The second dimension of misalignment is financial interest — specifically with

respect to the transparency of fees versus the value that is delivered. Opacity

and the lack of delivered value relative to fees is the cornerstone of the mistrust

investors harbor toward providers. Our research showed that 46 percent of

institutional investors believe the fees they pay are not commensurate with the

value that is delivered.25 And there is ample evidence for the reason: There are

only a handful of managers that have consistently outperformed their respective benchmarks. For example, in a recent study, “Measuring Luck in Estimated

Alphas”, [Also: The full title of the study is “False Discoveries in Mutual Fund

Performance: Measuring Luck in Estimated Alphas”] Barras, Scaillet and

Wermers conducted an analysis of US actively managed open-ended domestic

equity mutual funds that existed between 1975 and 2006. The authors found

that after risk adjustment, well under 1 percent of funds achieve superior results

after costs.26 Misalignment of financial interest is another barrier to healthy decision making.

While a flurry of new regulatory initiatives — Dodd-Frank, MiFID II and RDR,

to name a few — attempt to address issues around fee transparency, fiduciary

standards and unbundling investment advice from commissions, it remains to be

seen whether they will be effective. And although investment providers may not

relish the thought of regulatory oversight, transparency ranked No. 2 among the

areas most likely to be affected by regulation. (See Figure 6.) While well-intentioned, these regulatory initiatives may not produce appropriate transparency

— digestible forms of information that investors need.

THE GROWING PAPER TRAIL FORMED BY THE DODD-FRANK LAW

IS 20 TIMES TALLER THAN THE STATUE OF LIBERTY.

27

THE INFLUENTIAL INVESTOR: HOW INVESTOR BEHAVIOR IS REDEFINING PERFORMANCE

13](https://image.slidesharecdn.com/the-influential-investor-140102094946-phpapp02/85/The-influential-investor-15-320.jpg)

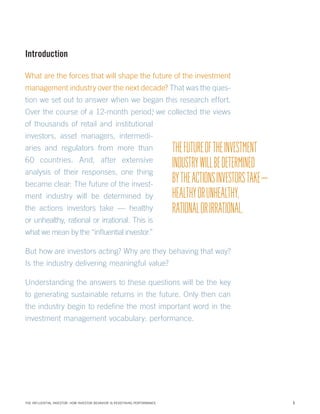

![FIGURE 9A.

Investors are moving away from benchmarking as a measure of success —

and failure.

Top Strategic Model Preference: Absolute Returns (Percentage of Survey Respondents,

Rank Ordered by Total)

Overall

Institutional investor

Intermediary

My focus will be more towards absolute return away from benchmarking

40%

36%

44%

My focus will be more on beating the benchmark

31%

30%

32%

My focus will be more on replicating the benchmark

15%

17%

19%

Not applicable

12%

12%

12%

n= 202

Note: Question asked: What changes do you expect to make to your strategic model and investment

strategy? Please select one. Source: Center for Applied Research analysis.

As one European-based executive from a fund manager told us:

“THERE IS AN AGENT VERSUS PRINCIPAL PROBLEM IN OUR INDUSTRY.

THE BEST MEASURE I HAVE COME ACROSS OF MEASURING A PROVIDER WOULD

BE TO LOOK AT HIS OR HER OVERALL PERFORMANCE AND THEN COMPARE

THAT TO WHAT WOULD HAVE HAPPENED IF HE OR SHE HAD GONE ON HOLIDAY

FOR THE PERIOD AND LEFT FLOWS TO BE ALLOCATED PARI-PASSU TO THE

ORIGINAL PORTFOLIO AT THE BEGINNING OF THE PERIOD. THIS WILL GIVE A

TRUE MEASURE OF THE ONE ASPECT OF PORTFOLIO MANAGEMENT NEVER

MEASURED, BUT YET [IS] A HUGE COMPONENT OF PERFORMANCE:

PERFORMANCE, IT SEEMS,

0.000000 TIMING AND FRICTION COSTS — IN SHORT, THE REAL VALUE ADDED.” 36.666679 OF THE BEHOLDER.

INVESTMENT 9.166670 18.333340 27.500010

IS IN THE EYE 45.833349

THE INFLUENTIAL INVESTOR: HOW INVESTOR BEHAVIOR IS REDEFINING PERFORMANCE

19](https://image.slidesharecdn.com/the-influential-investor-140102094946-phpapp02/85/The-influential-investor-21-320.jpg)