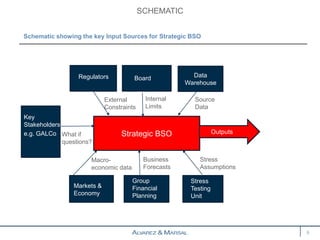

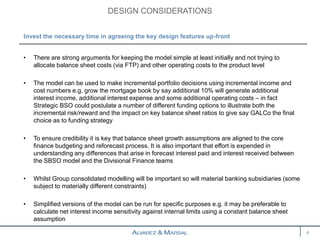

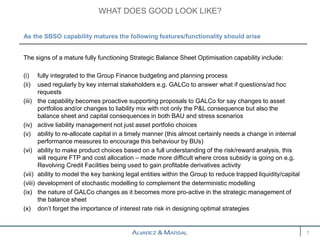

This document discusses strategic balance sheet optimisation for banks. It notes that regulatory requirements have increased complexity, with multiple capital and liquidity ratios to manage. Initially, banks focused on managing their most binding constraint, such as leverage ratios or stress capital ratios. Developing a strategic balance sheet optimisation capability requires integrating multiple teams and obtaining senior executive sponsorship. Key success factors include designing a model that can quickly answer questions while keeping the data set manageable. The model should be integrated with financial planning and allow evaluating portfolio and funding decisions based on risk, reward, and regulatory impacts.