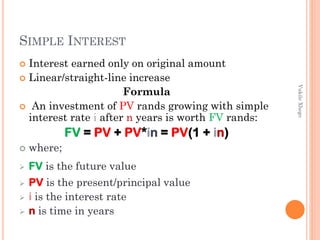

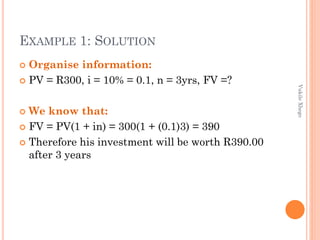

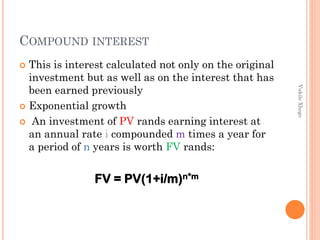

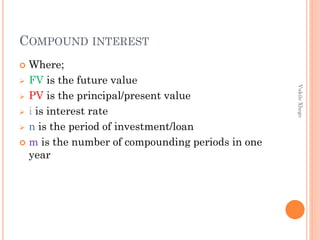

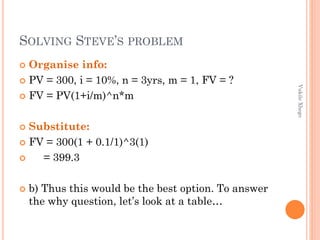

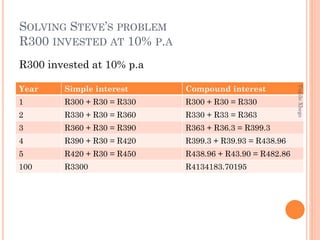

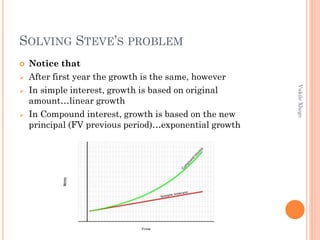

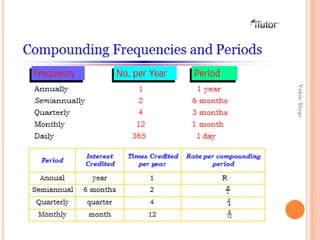

The document discusses simple and compound interest. It defines both types of interest and provides formulas to calculate future value under each. An example is shown where a learner named Steve invests R300 at 10% interest annually under simple and compound interest over 3 years. Compound interest provides a higher return due to interest earning interest each period. The document encourages choosing investments that use compound versus simple interest.