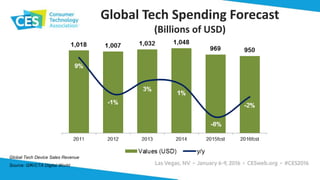

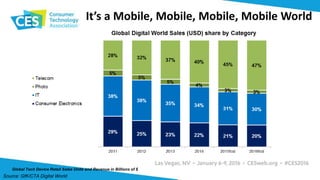

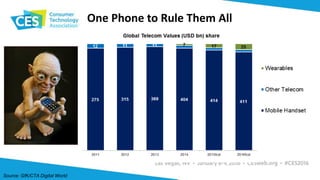

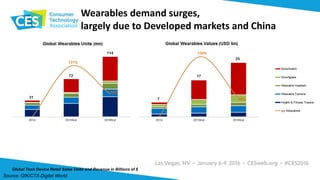

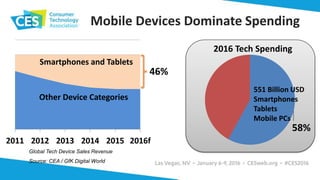

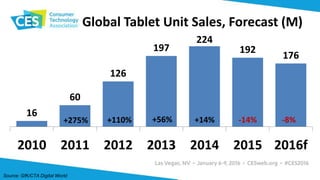

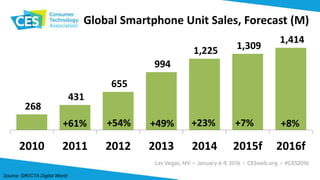

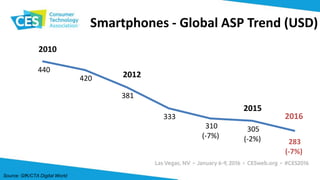

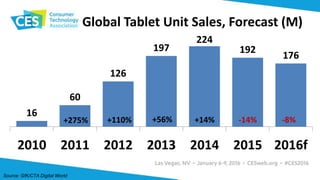

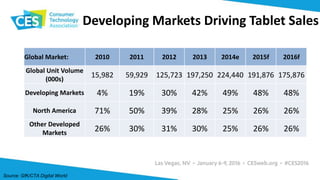

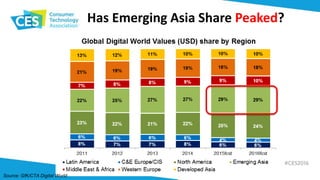

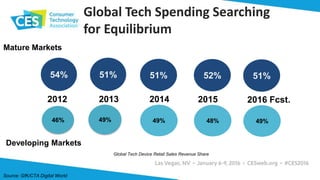

Global technology spending is forecast to continue growing but at a slower pace as unit sales level off. Emerging markets now account for over 70% of smartphone sales and nearly half of tablet sales, driving the global shift away from mature markets. Within devices, mobile devices led by smartphones and tablets will continue to dominate spending, comprising over 75% of the global market in 2016. However, new categories like smart home devices, VR/AR, and drones are poised for future growth.