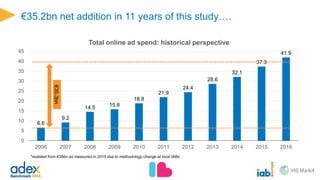

This document provides a summary of online advertising spend in Europe in 2016. Some key points:

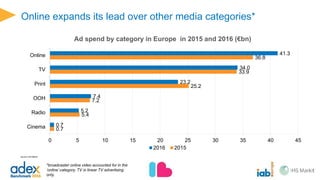

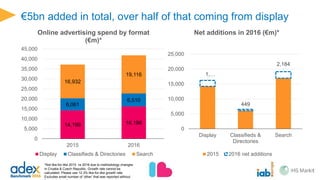

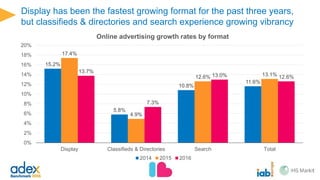

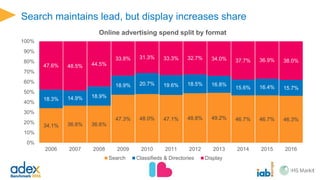

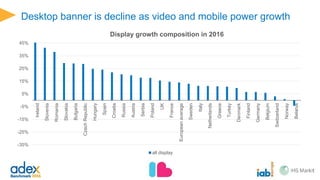

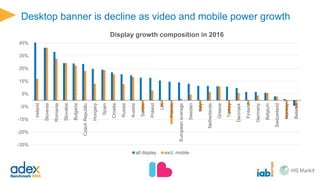

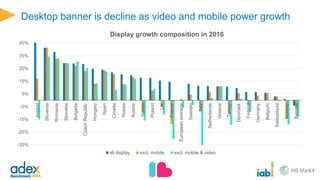

- Total online ad spend in Europe grew 12.3% to €41.9 billion in 2016, with display format growing the fastest at 15.6%.

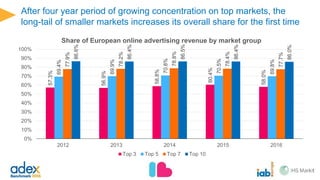

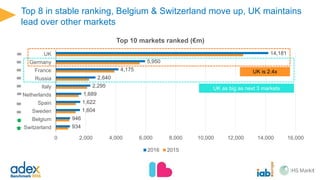

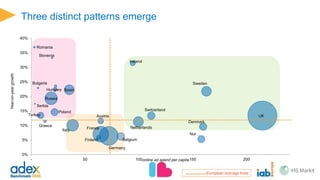

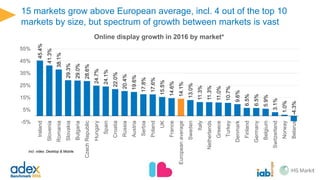

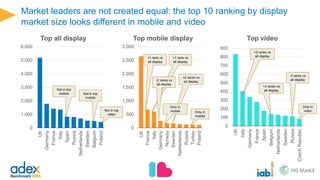

- The top 10 markets accounted for 77.7% of total spend, led by the UK with €14.2 billion, more than double the next largest, Germany.

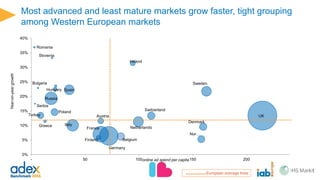

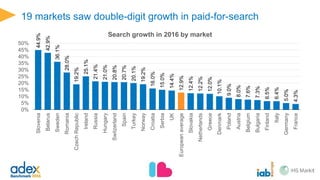

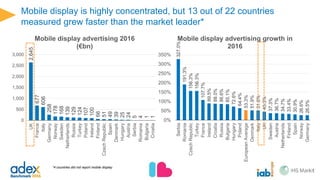

- Growth was strongest in smaller Central and Eastern European markets like Romania, Slovenia and Ireland, while Western European markets saw more modest single-digit growth.

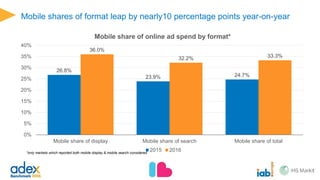

- Mobile advertising continued to rise rapidly, accounting for one-third of search spending and nearly one-quarter of display