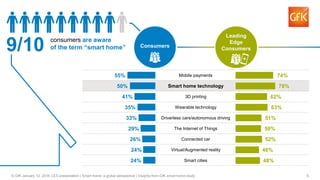

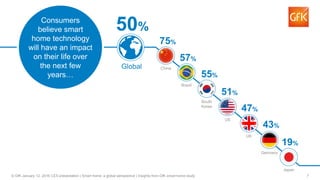

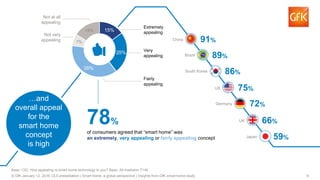

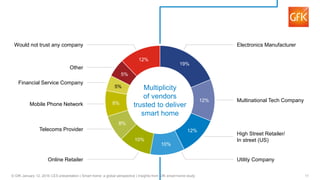

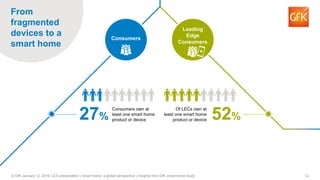

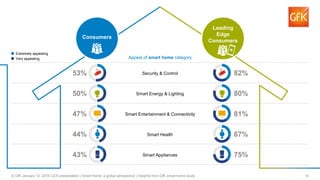

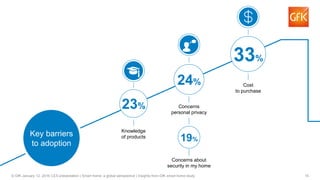

The document summarizes the findings of a GfK study on consumer perspectives on smart homes globally. It finds that while awareness and appeal of smart home technology is high, adoption remains low due to barriers like cost and privacy/security concerns. Additionally, the market lacks interoperability between different vendors' devices. The study suggests the smart home market will grow more slowly than expected until these challenges are addressed by creating easy to use and integrated solutions.