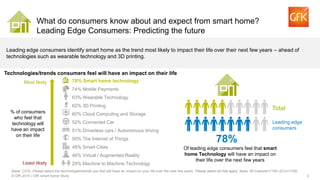

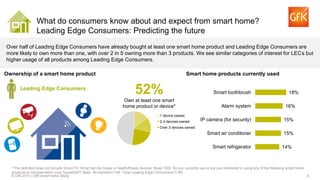

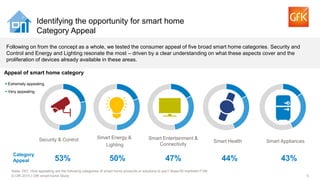

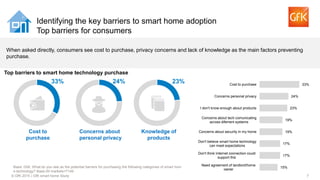

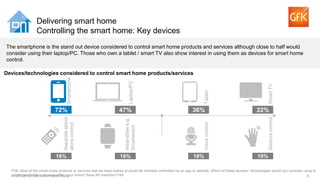

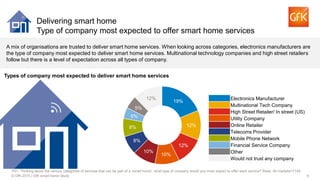

The document summarizes key findings from a GfK study on consumer attitudes towards smart home technology. It finds that leading edge consumers see smart home technology as having the biggest impact on their lives compared to other emerging technologies. Over half of leading edge consumers already own at least one smart home product. Security and home control are the most appealing smart home categories. The top barriers to adoption are cost, privacy concerns, and lack of knowledge about products. Smartphones are the preferred device for controlling smart home products, followed by laptops/PCs. Consumers expect electronics manufacturers and technology companies to be the main providers of smart home services.