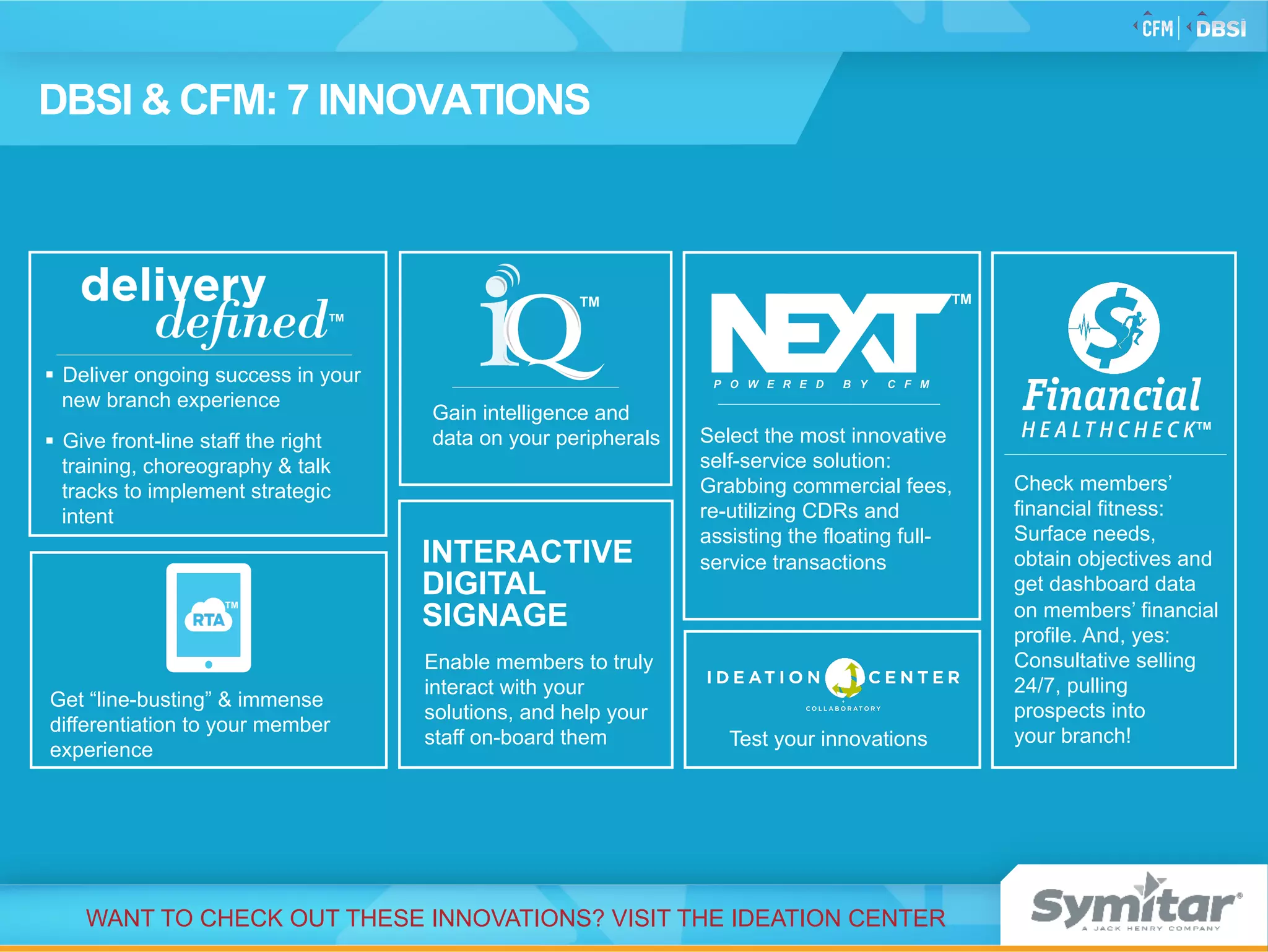

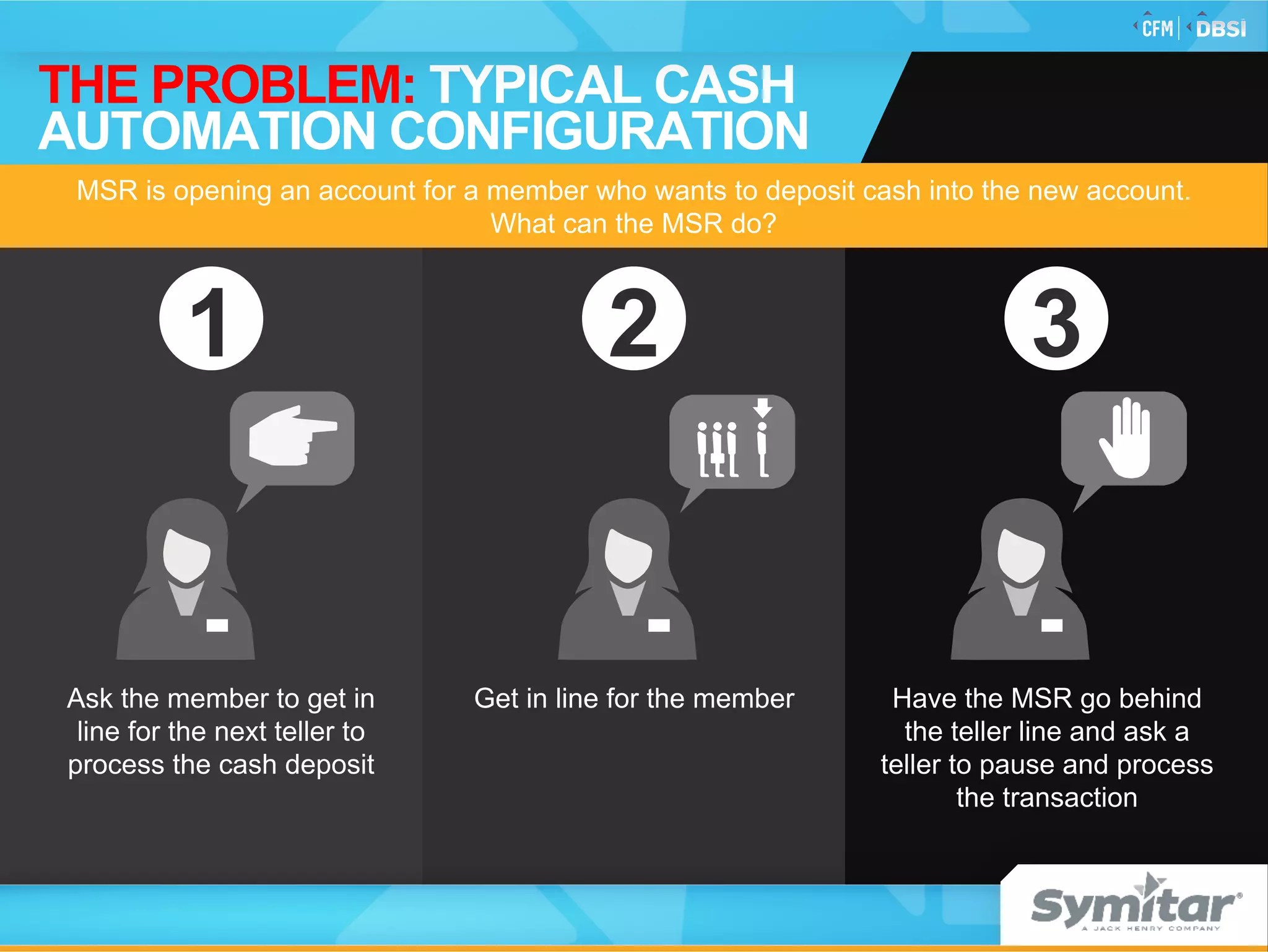

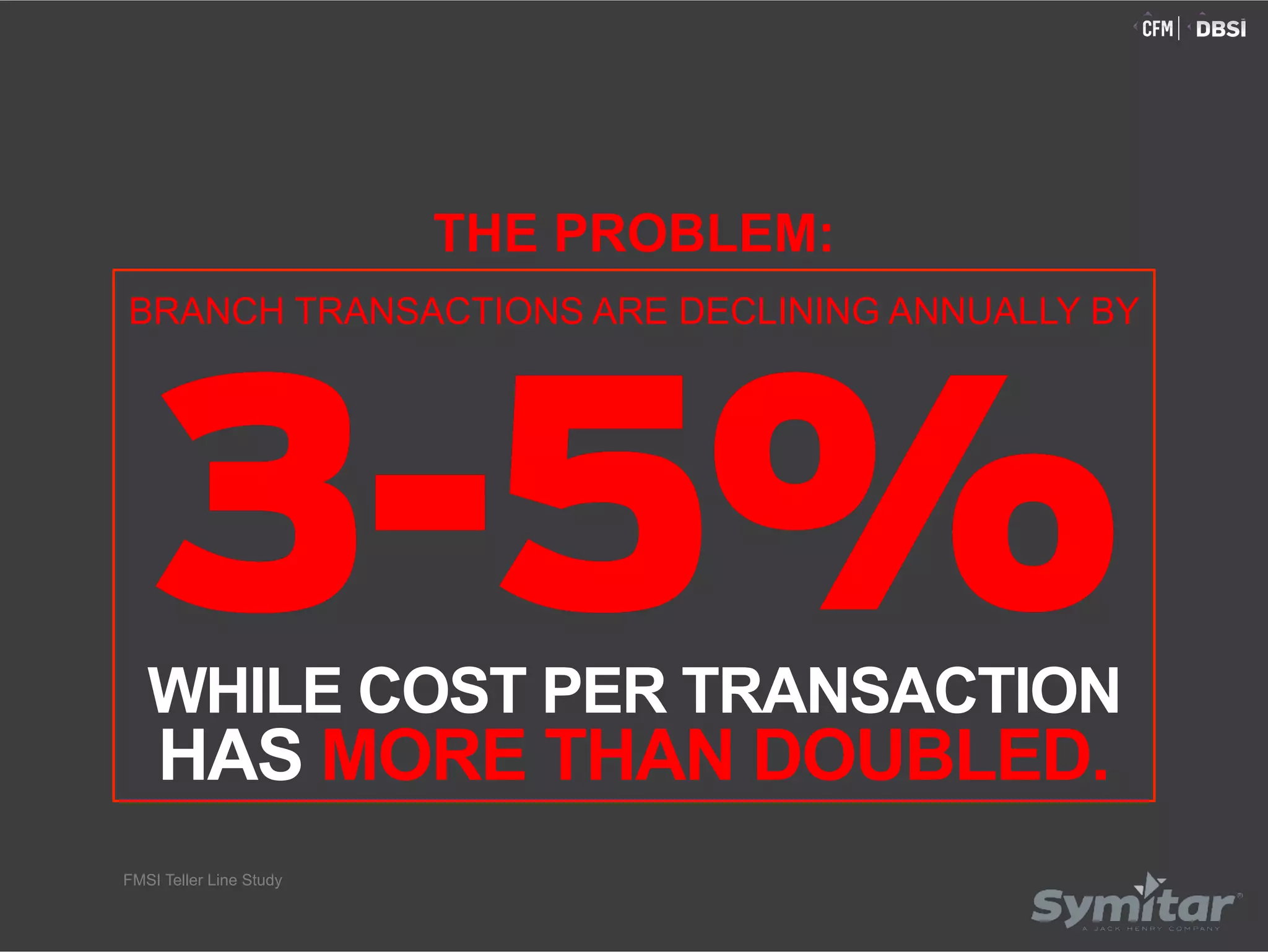

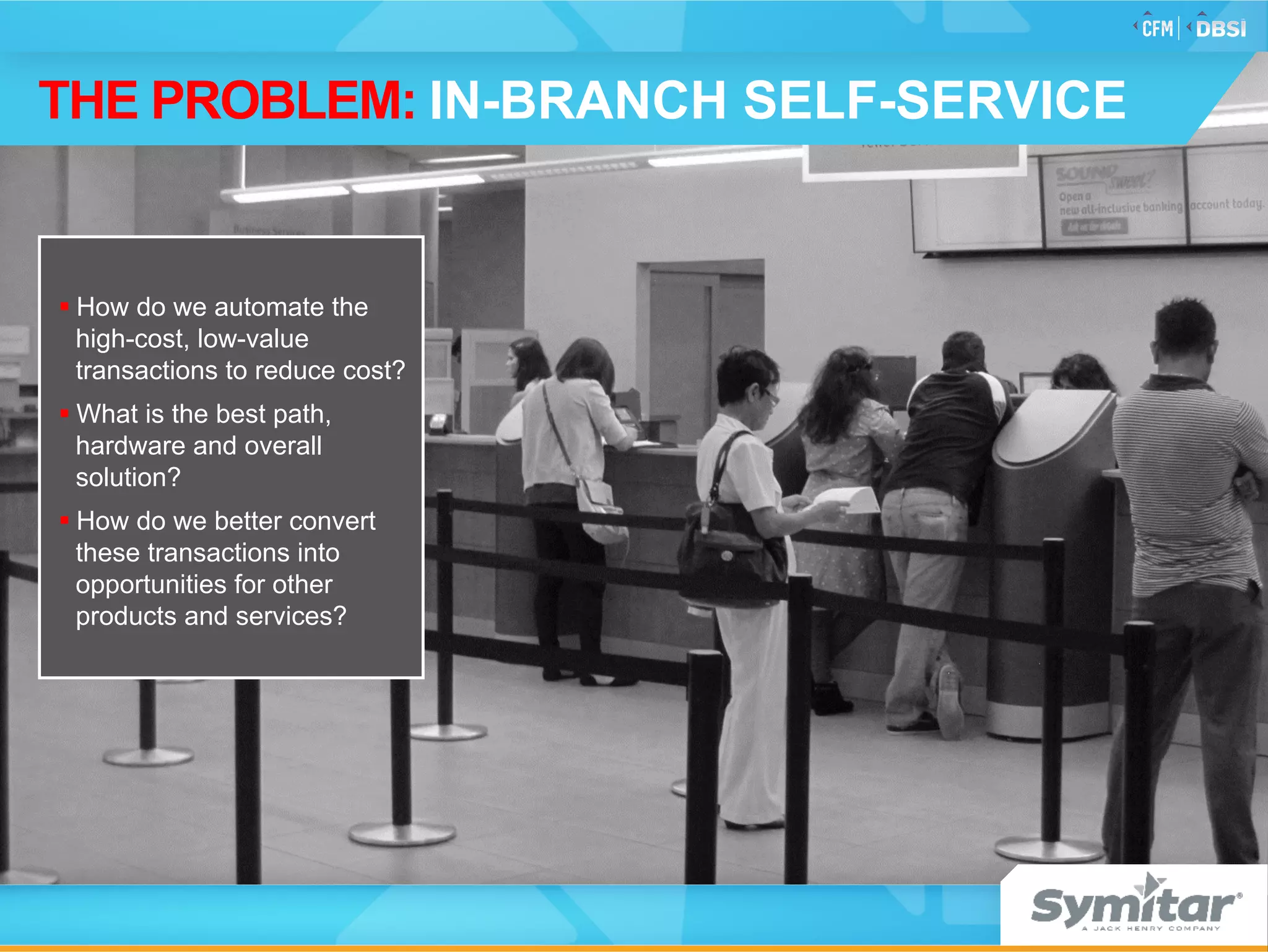

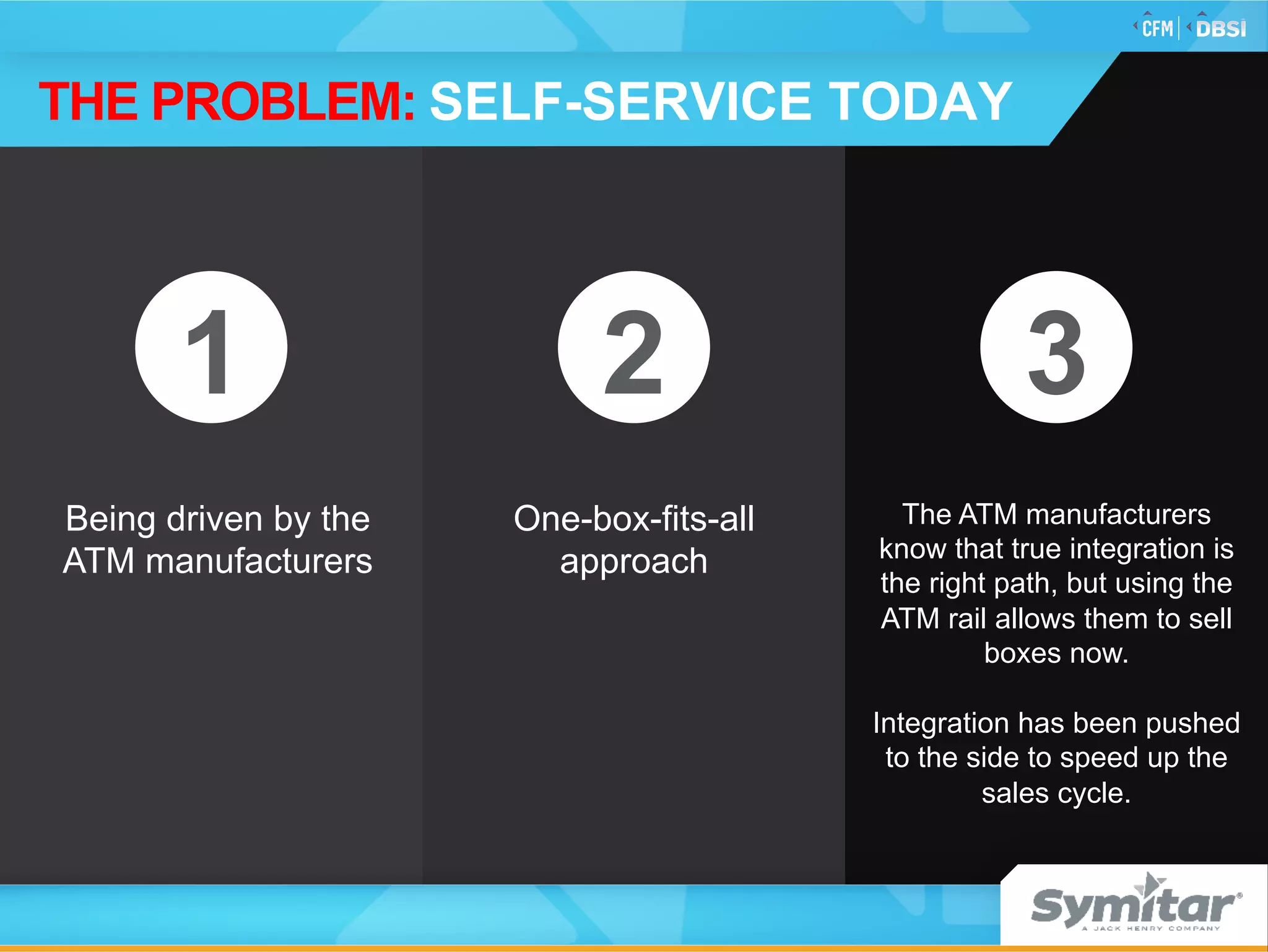

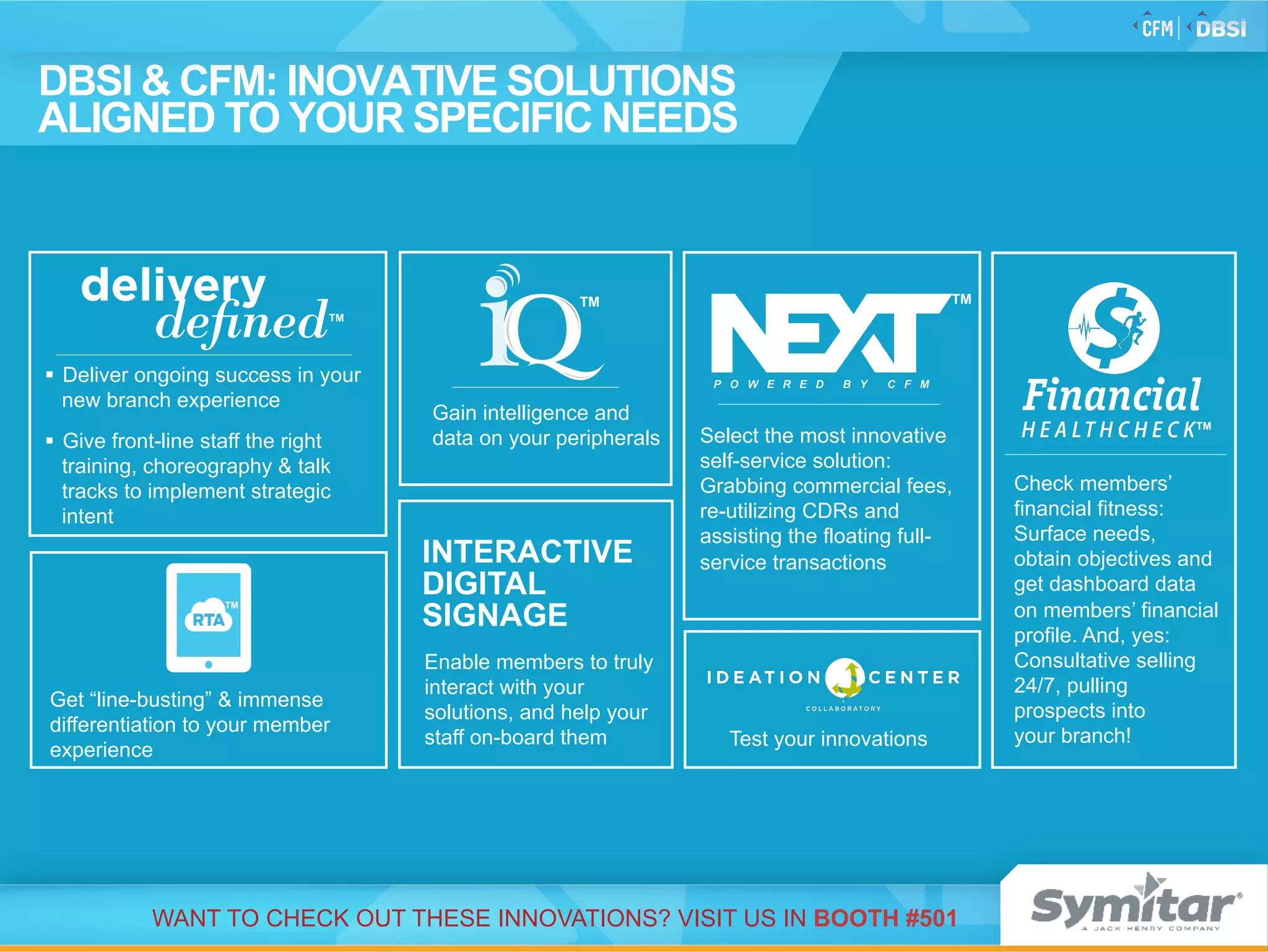

This document discusses innovations to transform branch experiences and better connect with members. It identifies challenges such as declining branch traffic and rising costs. Five innovations are presented to address problems like high-cost transactions, discovering products and services, and delivering new branch experiences. The innovations include interactive digital signage, remote transaction assistance, self-service analytics, connecting members to offerings, and training for new branch models. Attendees are invited to learn more about these solutions at an event booth.