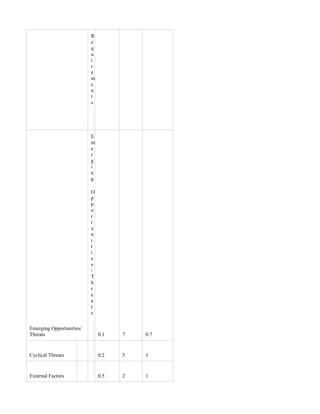

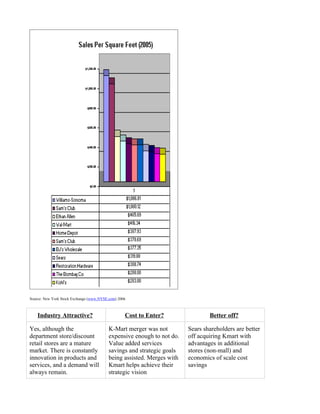

Kmart filed for bankruptcy in 2002 due to inventory issues, price competition and poor customer service over many years. Sears acquired Kmart in 2004 to form Sears Holdings and benefit from Kmart's non-mall stores and scale. While the department store industry is mature, innovation continues and the merger positioned Sears Holdings for shared logistics savings and brand diversification.