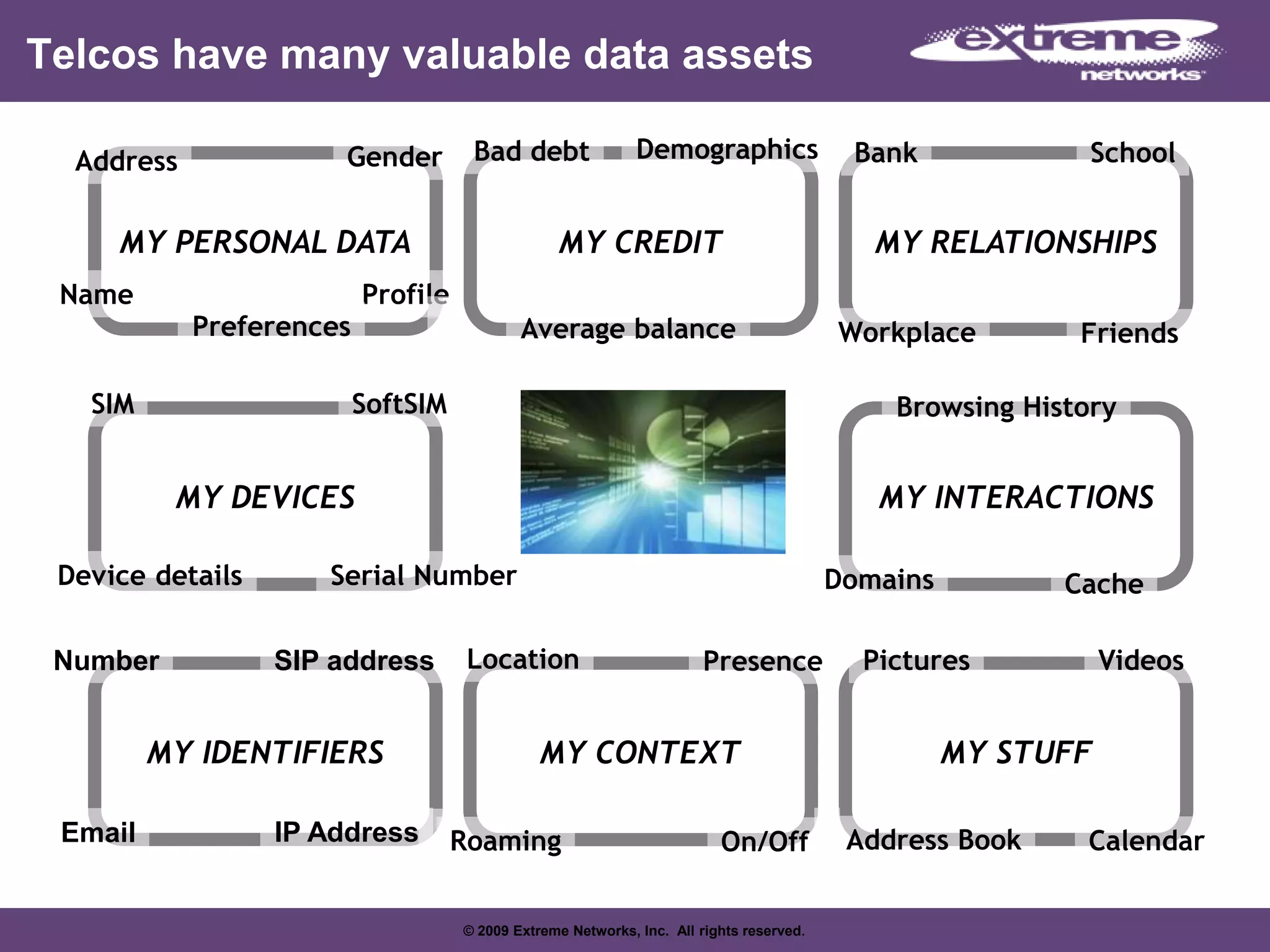

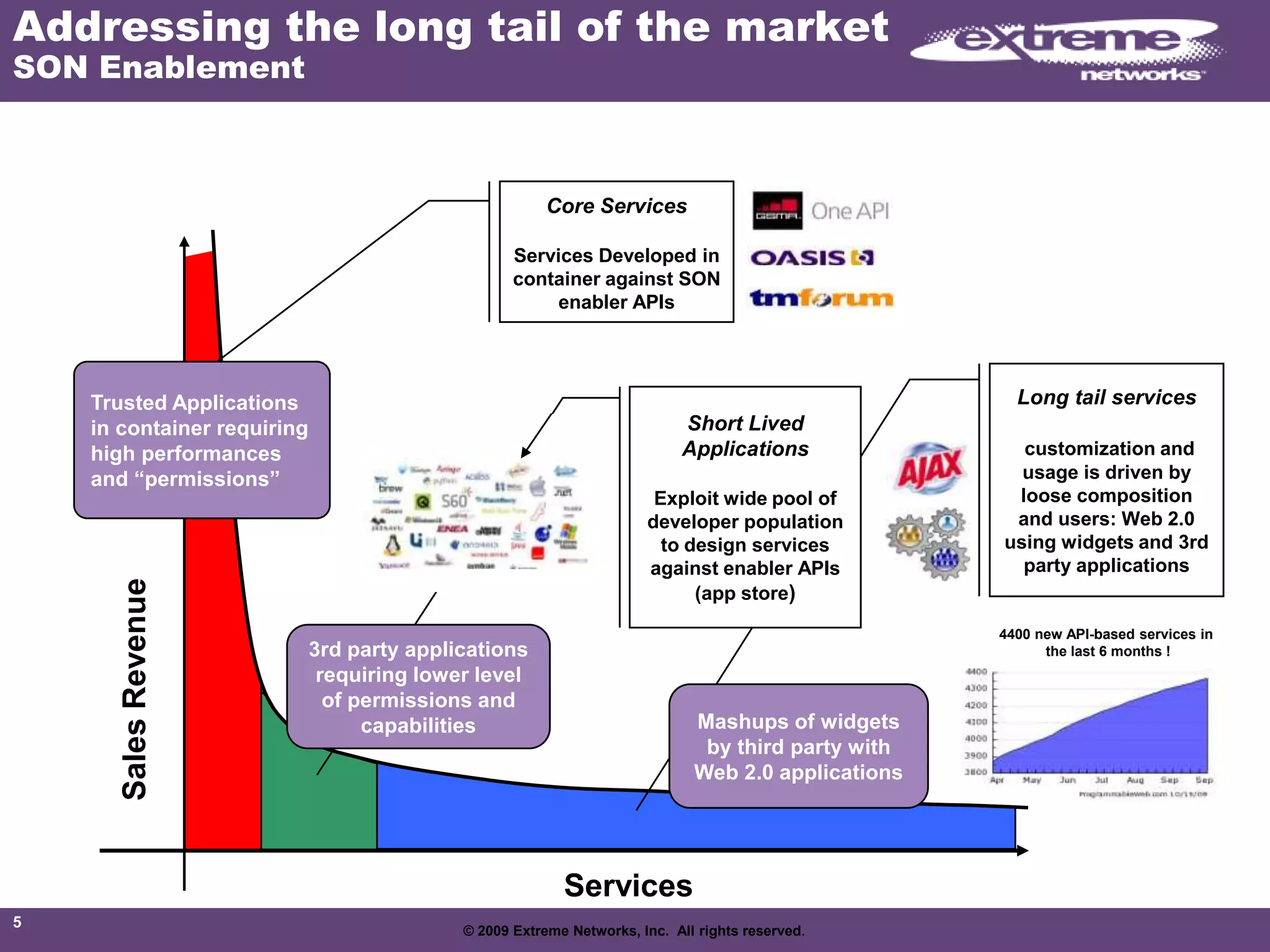

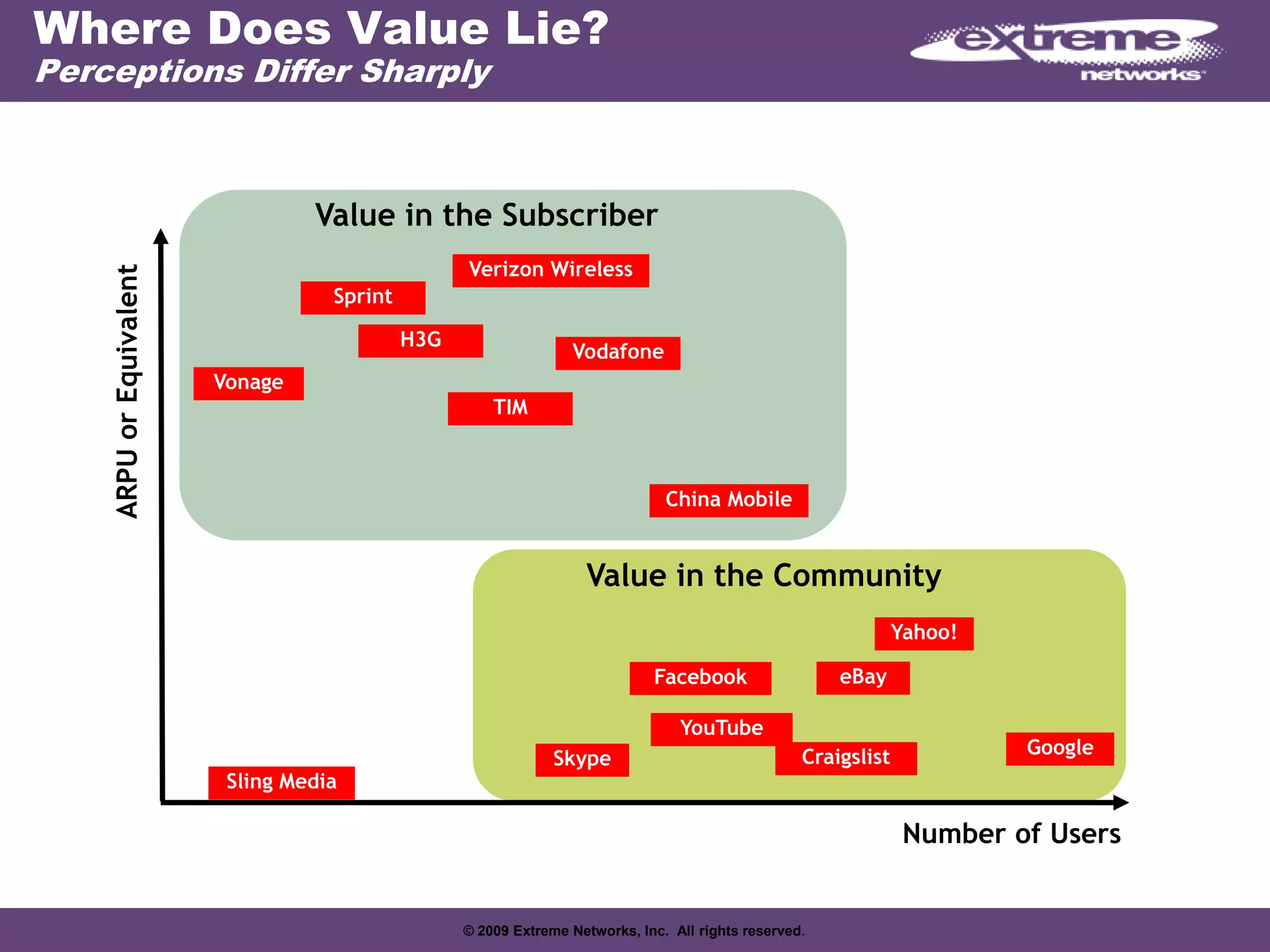

This document discusses the potential for carriers to offer their network assets and data assets as services in the cloud through a "Carrier as a Service" model. It outlines how carriers possess valuable network infrastructure like servers, routers, switches as well as valuable subscriber data. The document then discusses how carriers can leverage Software Defined Networking and network functions virtualization concepts to offer these assets as APIs and services. This would allow third parties to build applications that utilize the carriers' networks and data, while also creating new revenue opportunities for carriers.