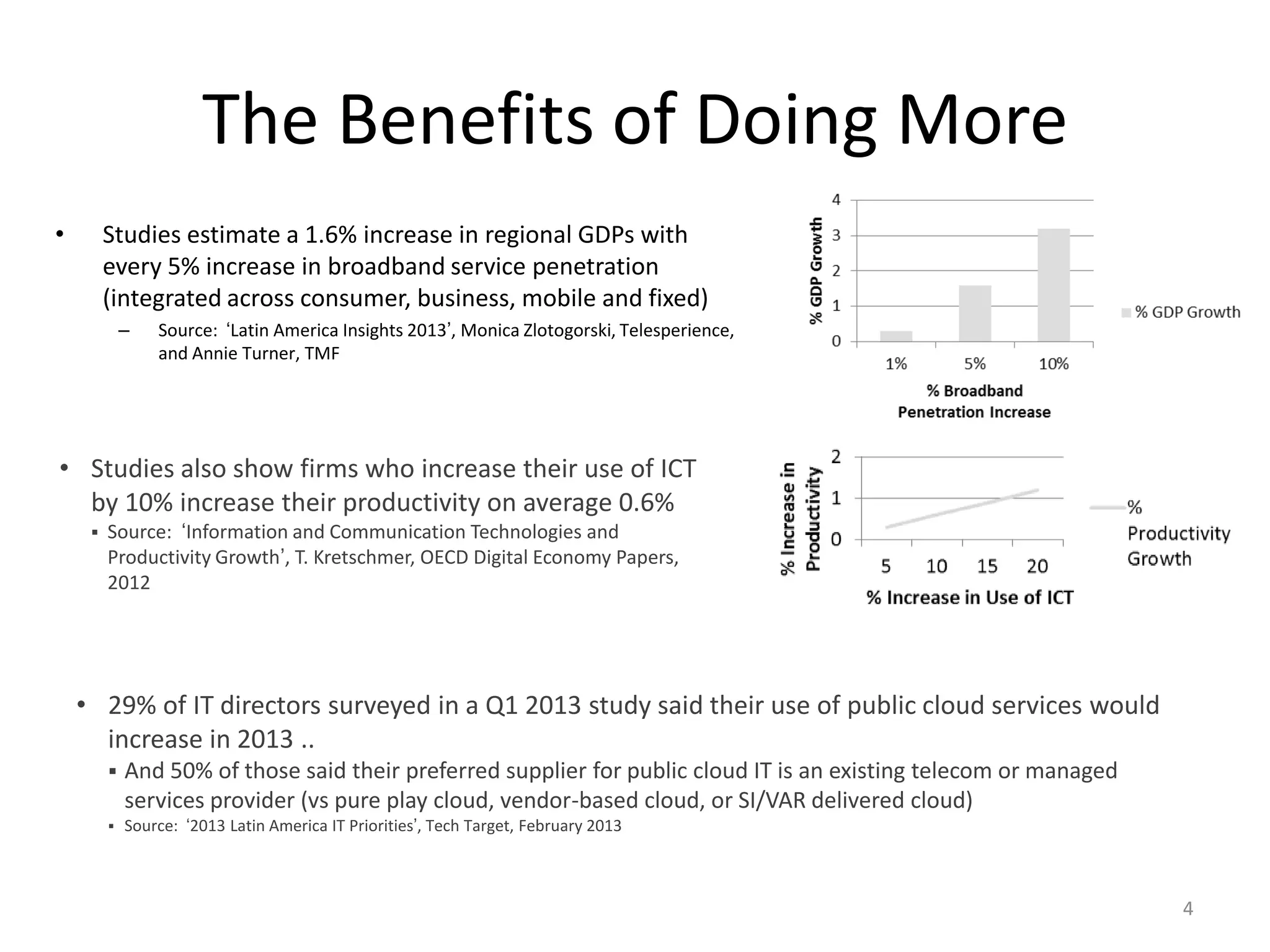

1) Studies show that a 5% increase in broadband penetration can increase regional GDP by 1.6%, and increasing ICT use by 10% can boost firm productivity by 0.6%.

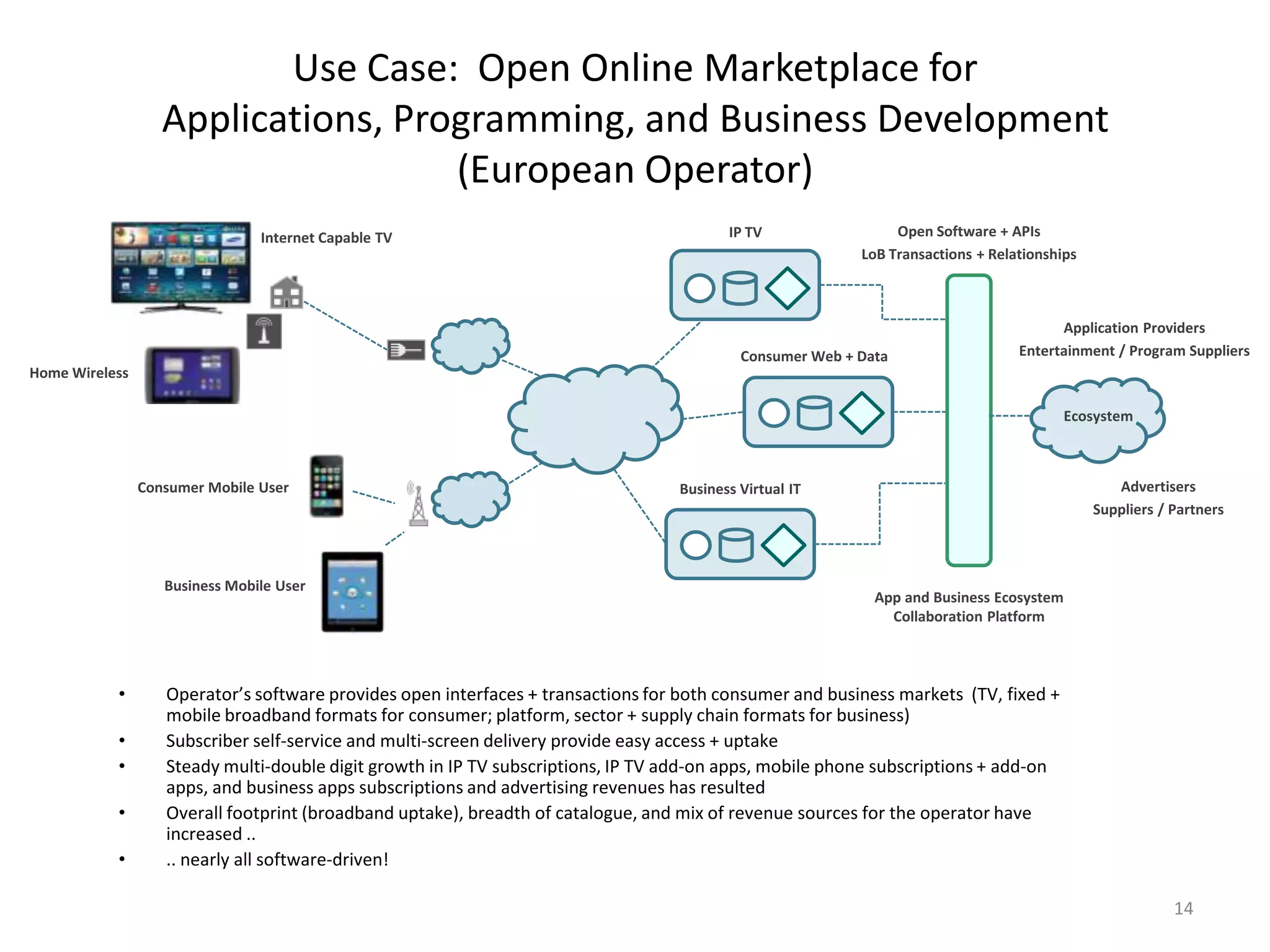

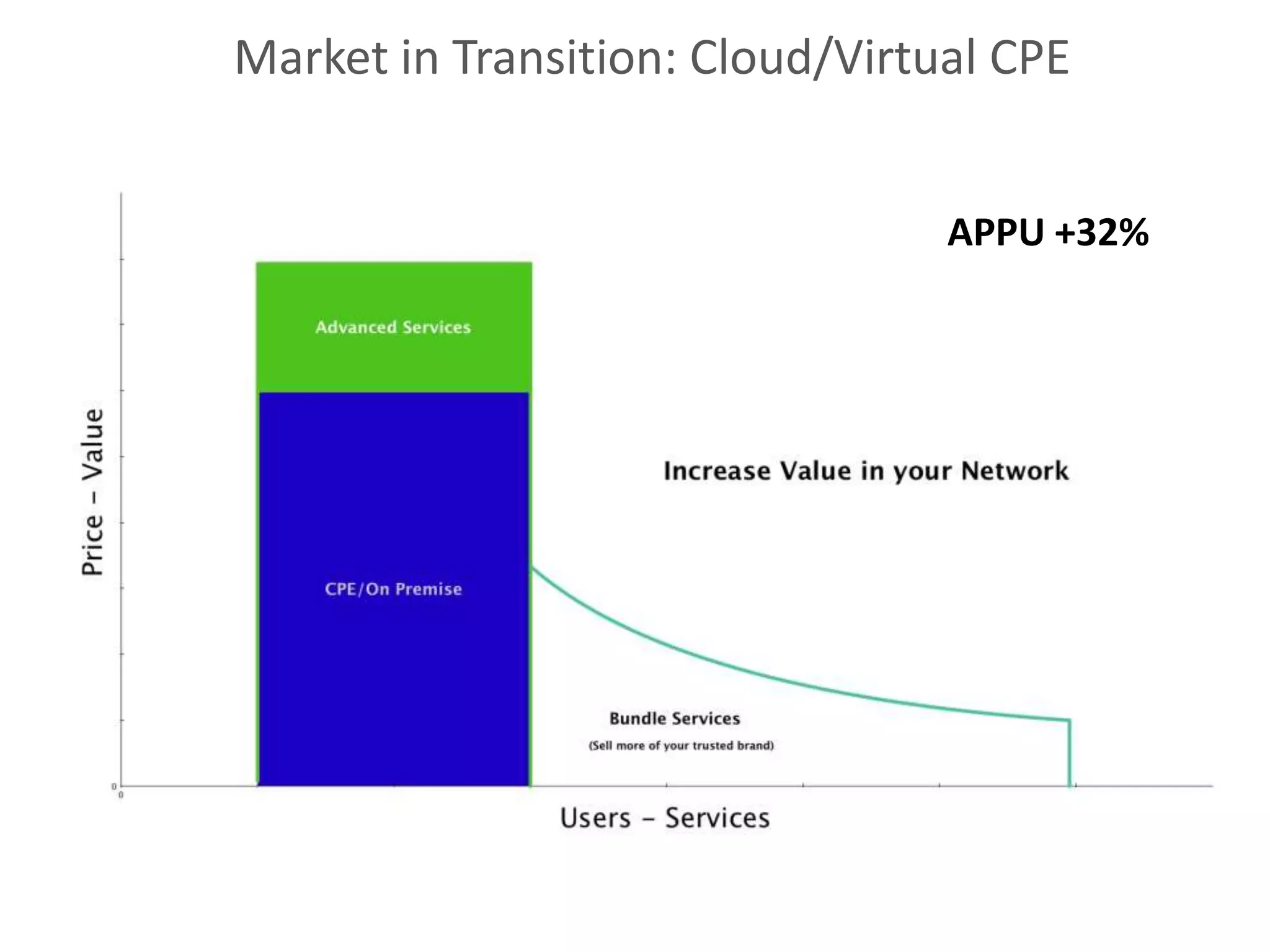

2) Nearly half of IT directors plan to increase public cloud usage in 2013, preferring telecom providers over pure play clouds.

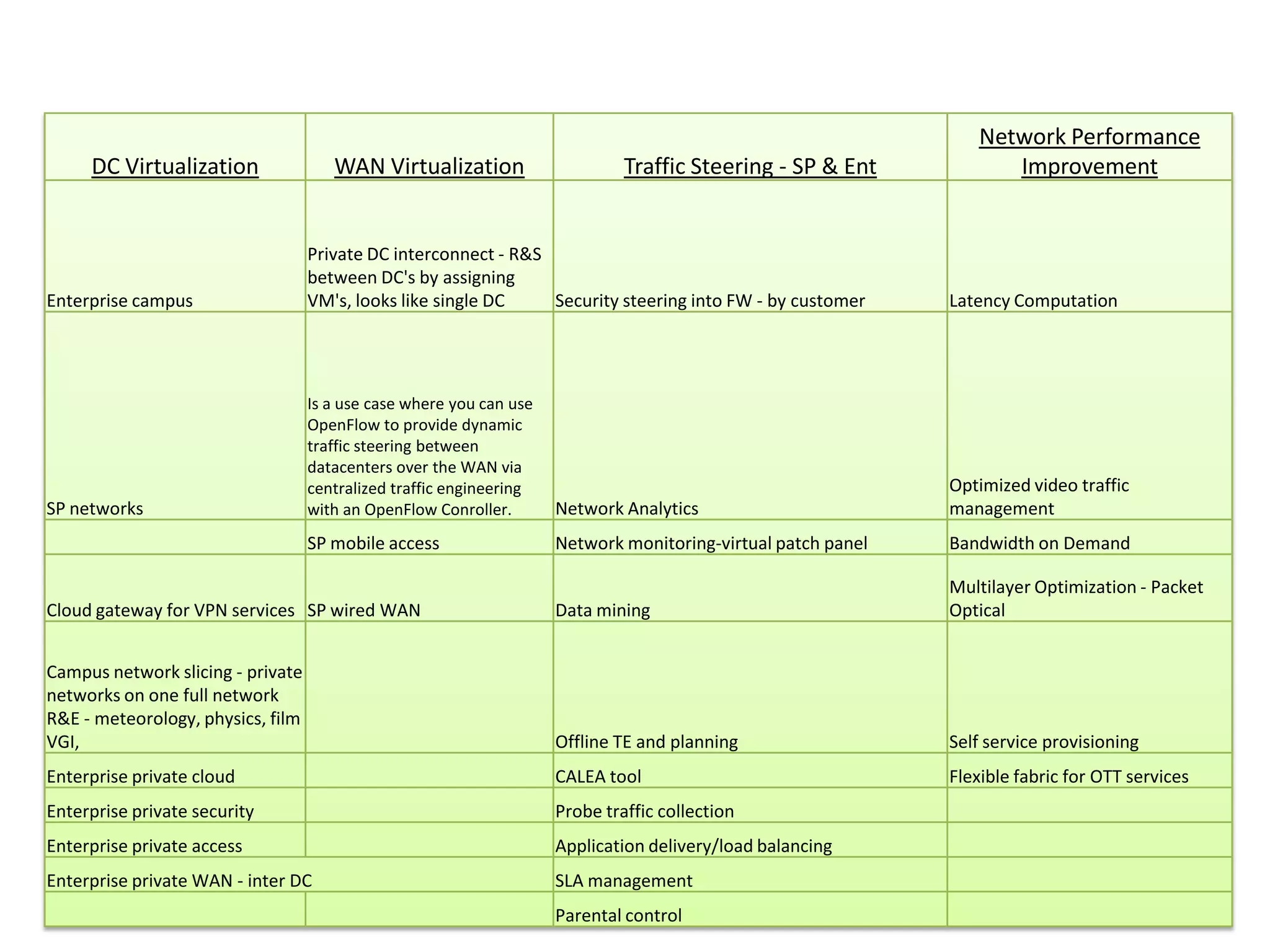

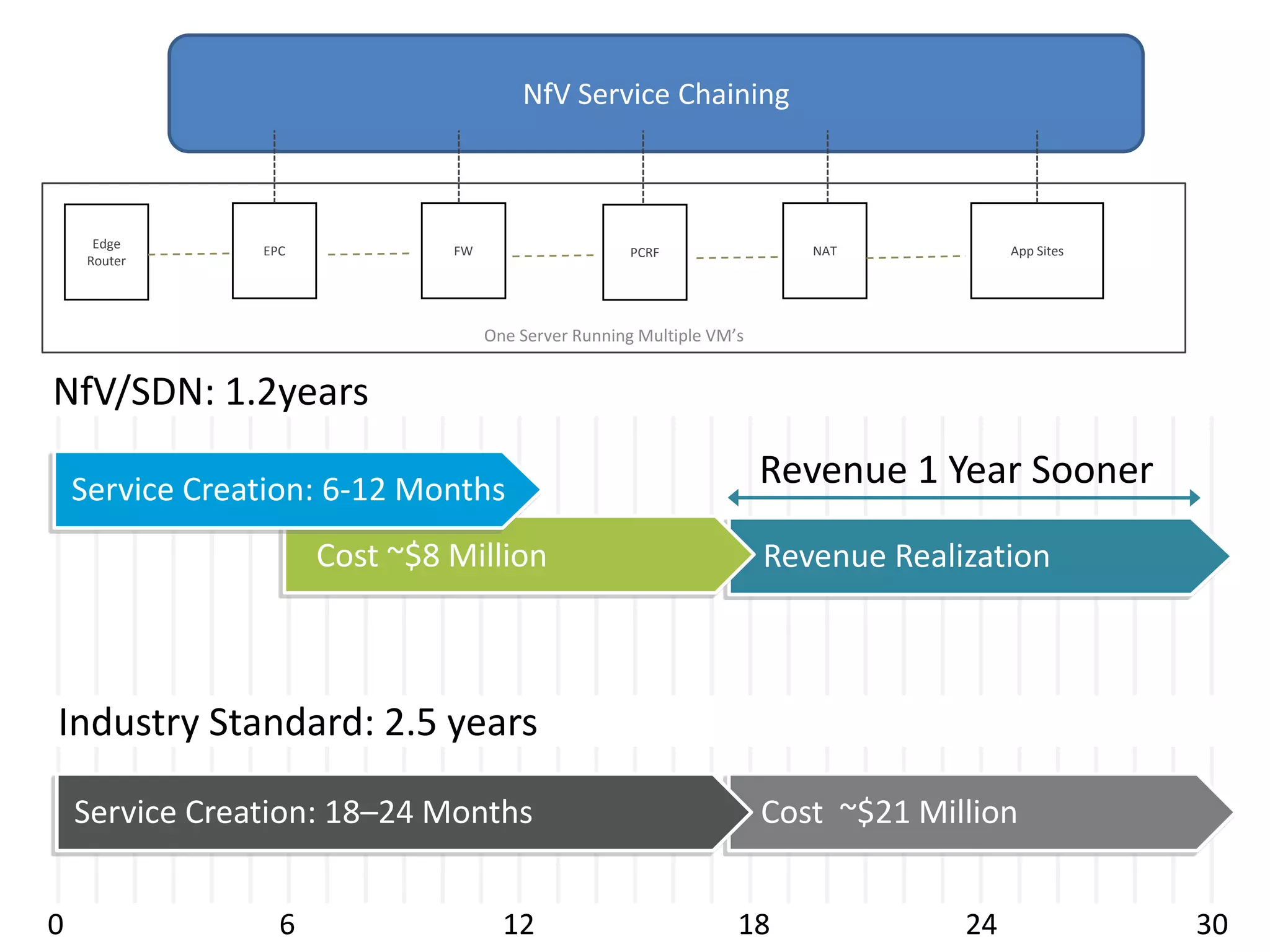

3) Virtualization allows services to be provisioned in months using NFV/SDN instead of years at half the cost via standard methods.