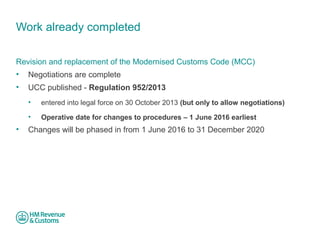

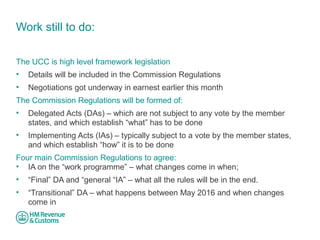

This document summarizes a webinar on the draft implementing provisions for the Union Customs Code (UCC). The speakers were Jennifer Revis of Baker & McKenzie and Peter Starling from UK customs authorities. Negotiations on the implementing provisions are ongoing and will establish rules for centralised clearance, self-assessment, guarantees for duty, and temporary storage. Trade input is needed on the draft proposals to shape what the new rules will be. The implementing provisions must be agreed by the end of 2014 for changes to start being phased in from 2016 to 2020.