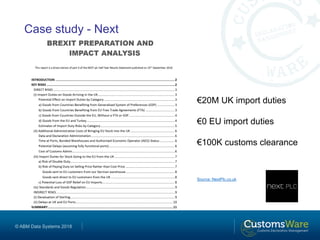

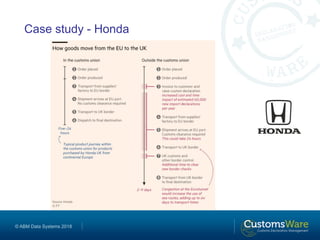

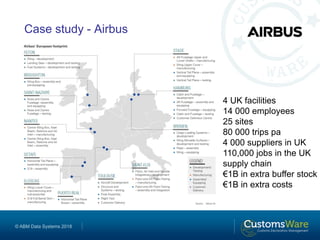

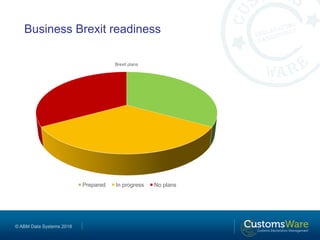

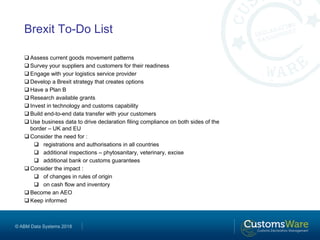

The document discusses the implications of Brexit and how businesses can prepare for customs changes when the details are still uncertain. It summarizes that national authorities are preparing border controls and supporting businesses, while businesses are identifying supply chain risks, engaging with logistics partners, and investing in technology and customs capabilities to automate processes and remain compliant with new rules. The key message is that businesses need to take action now to assess risks and prepare flexible strategies despite unknown Brexit outcomes.