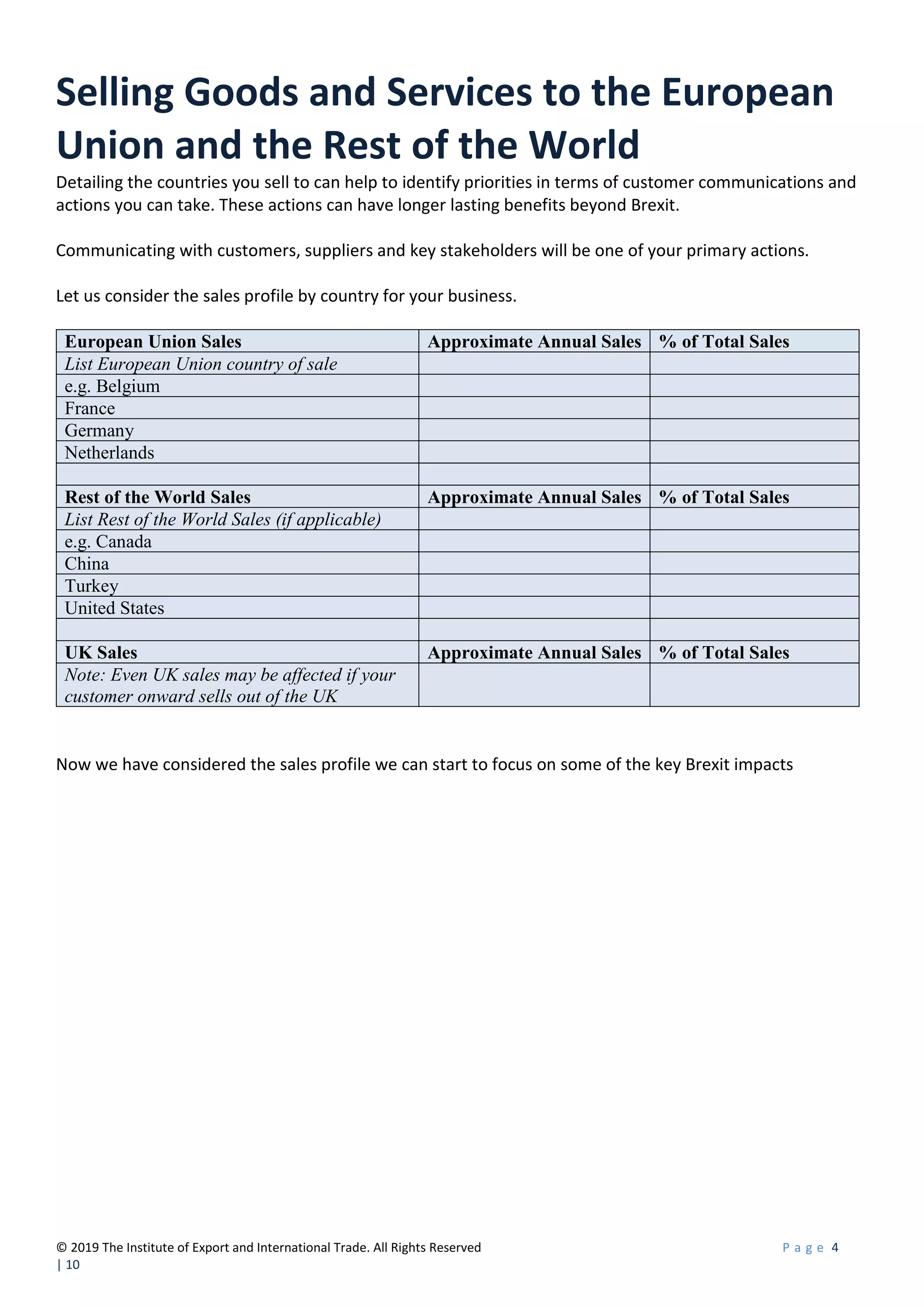

This document provides information from a workshop on navigating Brexit and winning new business. It discusses key Brexit impacts on sales and purchases of goods and services within the EU and rest of world. Sections cover calculating tariffs, customs procedures, regulations, and intellectual property. An action plan template is included to help businesses address impacts. Useful Brexit information websites are also listed. The workshop is facilitated by experts from the Institute of Export and International Trade and aims to help businesses minimize Brexit impacts and identify opportunities.