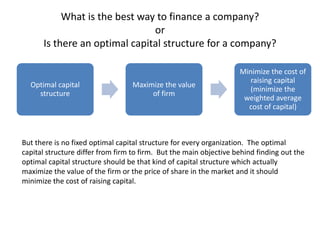

The document discusses capital structure, which is the mix of debt and equity a company uses to finance its long-term operations, emphasizing its significance and the factors affecting it. It explores various approaches (net income, net operating income, and Modigliani-Miller) to determine optimal capital structure and discusses its impact on risk and return. Additionally, it highlights that there is no universally optimal capital structure, as it varies by firm and market conditions, and outlines features of an appropriate capital structure.