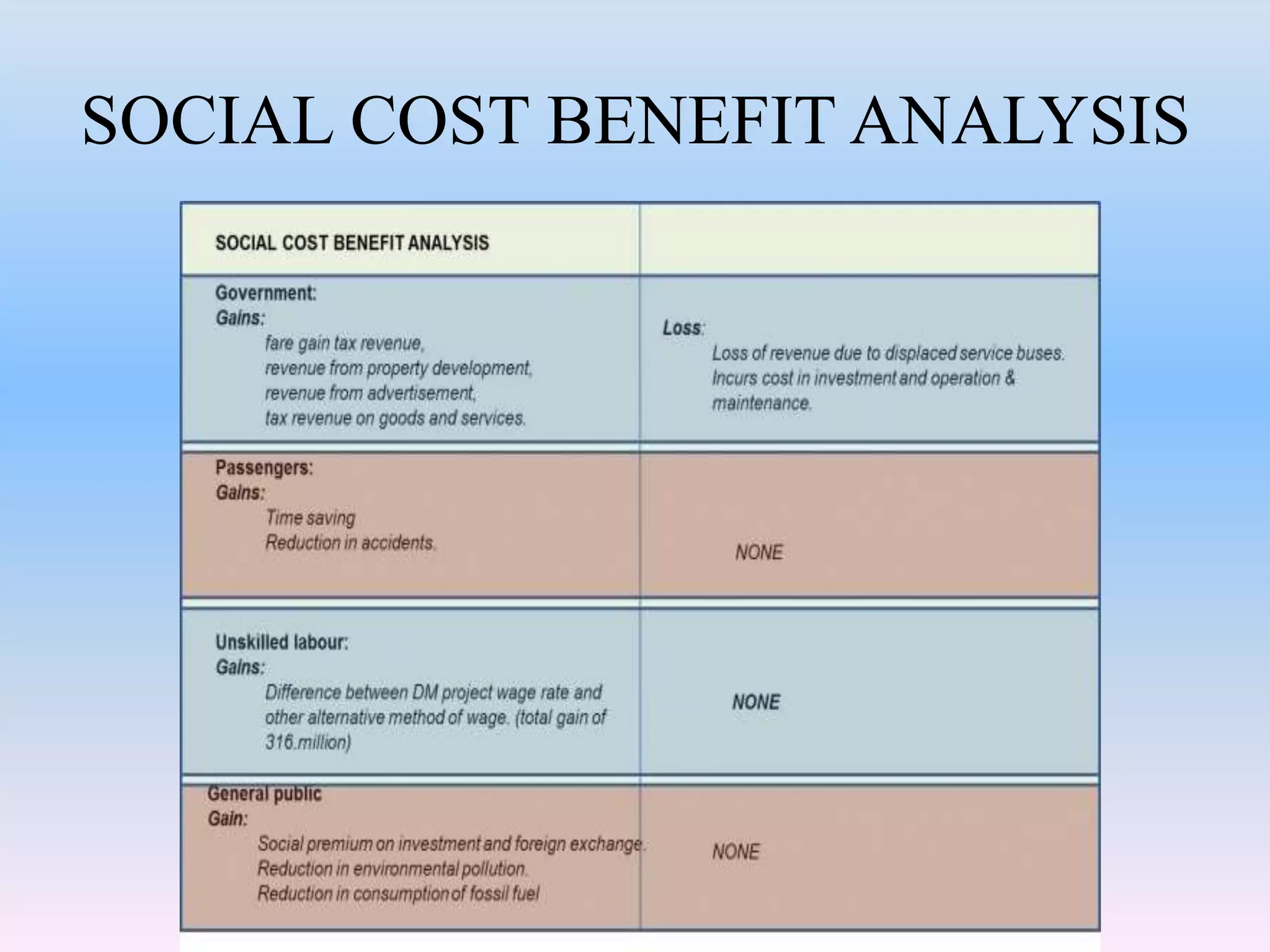

This document provides an overview and introduction to Delhi Metro Rail Corporation Ltd (DMRC). It discusses the history and development of metro systems globally and in India. It then summarizes the key details about DMRC, including that it was established in 1995 as a joint venture between the central and Delhi governments to implement a metro system in Delhi. The document also outlines DMRC's vision, organization structure, funding sources, and provides introductions to concepts like capital budgeting and investment decision rules.