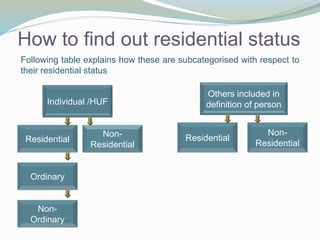

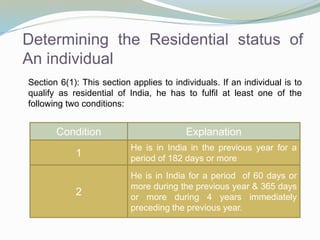

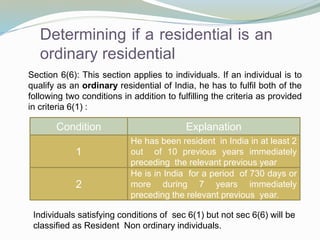

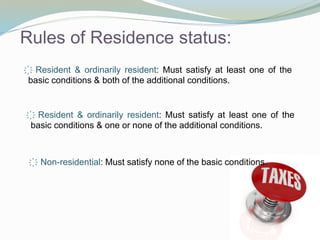

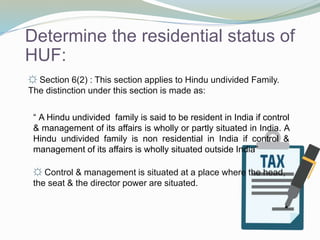

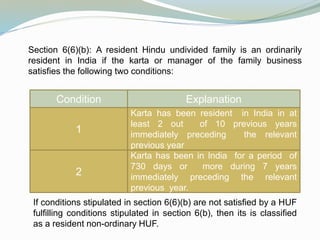

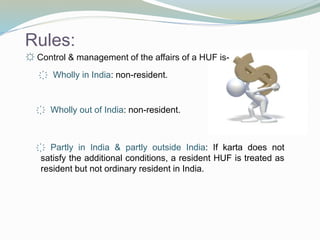

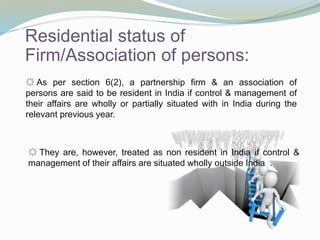

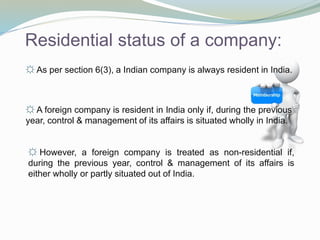

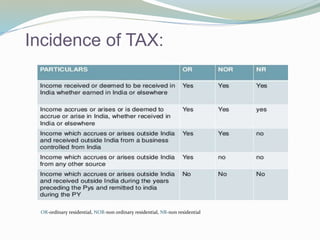

The document discusses residential status and tax incidence in India. It defines the different types of residential statuses - ordinary residential, non-ordinary residential, and non-residential. An individual's residential status depends on the number of days spent in India in the last year and last 4 years. A Hindu undivided family is resident if control and management is in India and non-resident if outside India. Firms and companies are resident if control and management is in India. Tax incidence depends on an entity's residential status rather than citizenship.