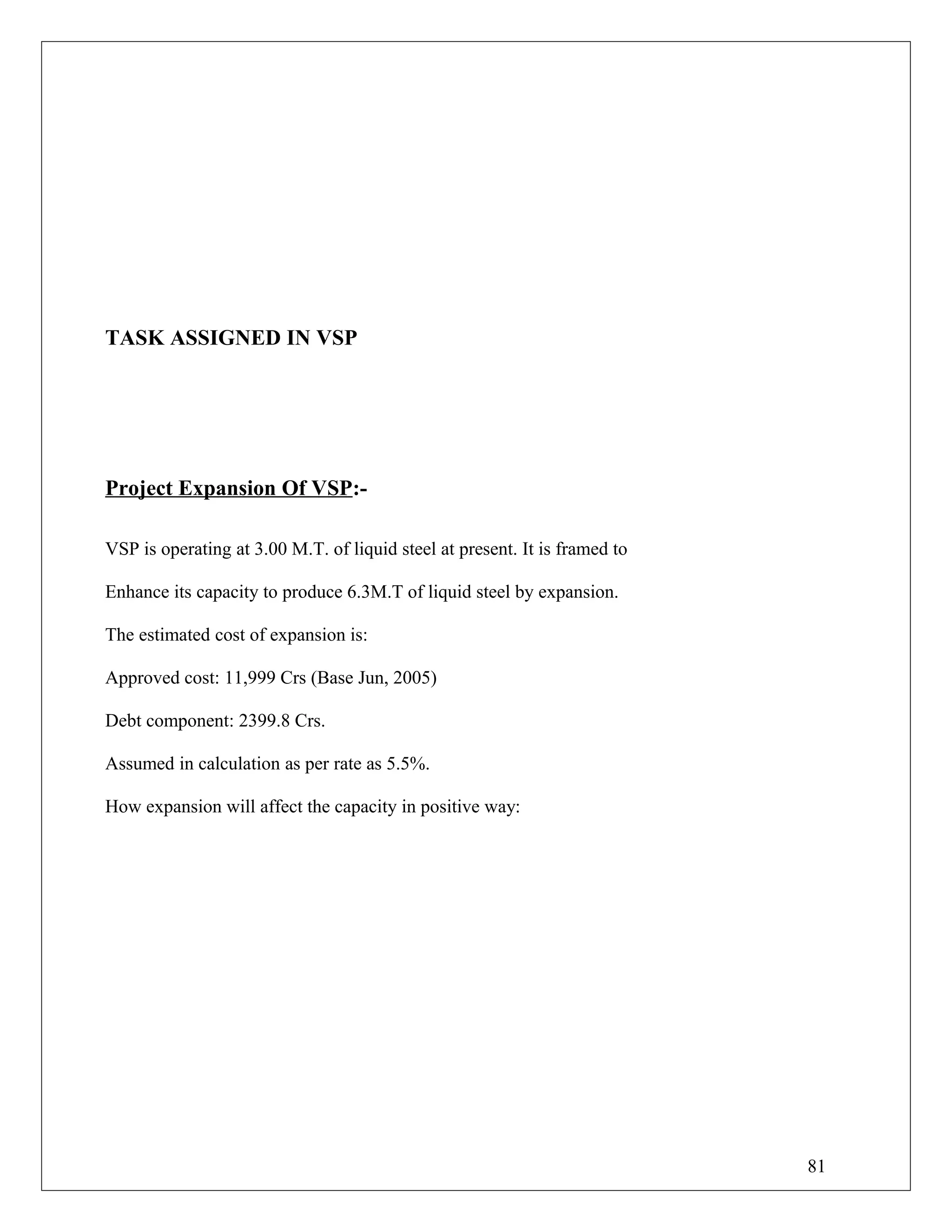

This document provides an overview of a study conducted on capital budgeting at Visakhapatnam Steel Plant in India. It includes an introduction describing the need, objectives, scope and methodology of the study. It also discusses limitations of the study. Chapter 2 provides an industry profile of the steel industry in India and its growth. The study aims to evaluate investment proposals using capital budgeting techniques and provide suggestions to management.

![EXTERNAL GUIDE CERTIFICATE

This is to certify that the project work entitled “CAPITAL

BUDGETING” at RASHTRIYA ISPAT NIGAM LIMITED,

VISAKHAPATNAMSTEELPLANT is a bonfire work done and submitted in

partial fulfillment for the award of the Post-Graduation Diploma And

Management by L.VARSHA NIHANTH bearing Registration No. 2013150015 of

CENTER FOR MANAGEMENT AND TECHNOLOGY, Affiliated by

A.I.C.T.E, Approved by Ministry of HRD, New Delhi under my guidance and

supervision during the period from 19-05-2014 to 12-07-2014 at Management

Development (MD), RINL-Visakhapatnam Steel Plant.

Sri C.A.Sudhakar Reddy

Manager [F&A]

Place: Visakhapatnam

Date:

3](https://image.slidesharecdn.com/t8rphlquqtele68u2qdh-signature-dfa81c39d689052c37c1742af6c167c5257b378cc0da8e69dbf683239c69fb1c-poli-150217075957-conversion-gate01/75/Varsha-project-3-2048.jpg)