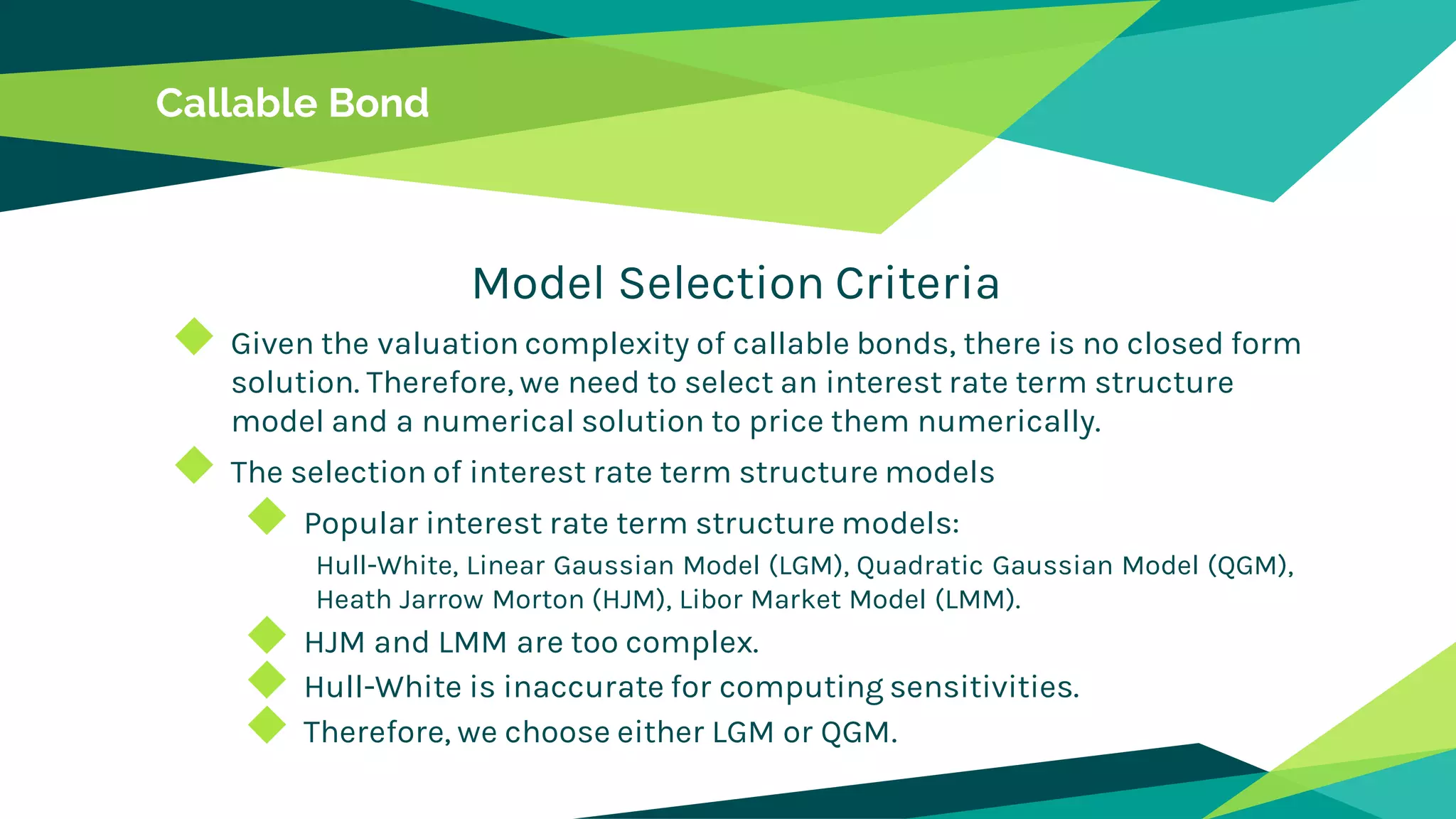

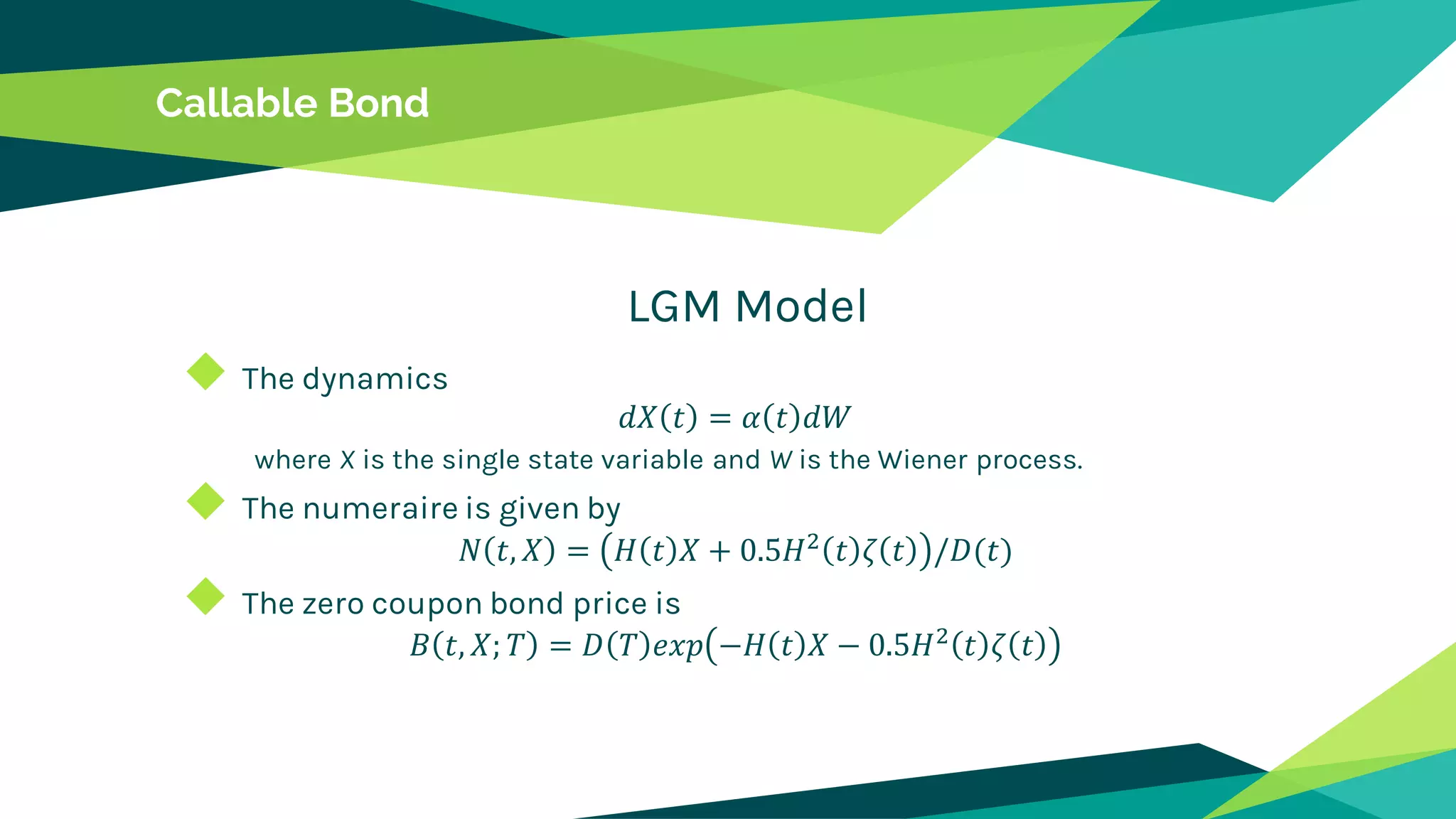

The document provides a comprehensive overview of callable bonds, which are bonds that issuers can redeem at specified dates for a set price. It discusses the advantages for both issuers and investors, such as reduced interest costs for issuers and higher returns for investors, and outlines the valuation process, including model selection and numeric approaches. A real-world example is provided to illustrate callable bond specifications and relevant dates.