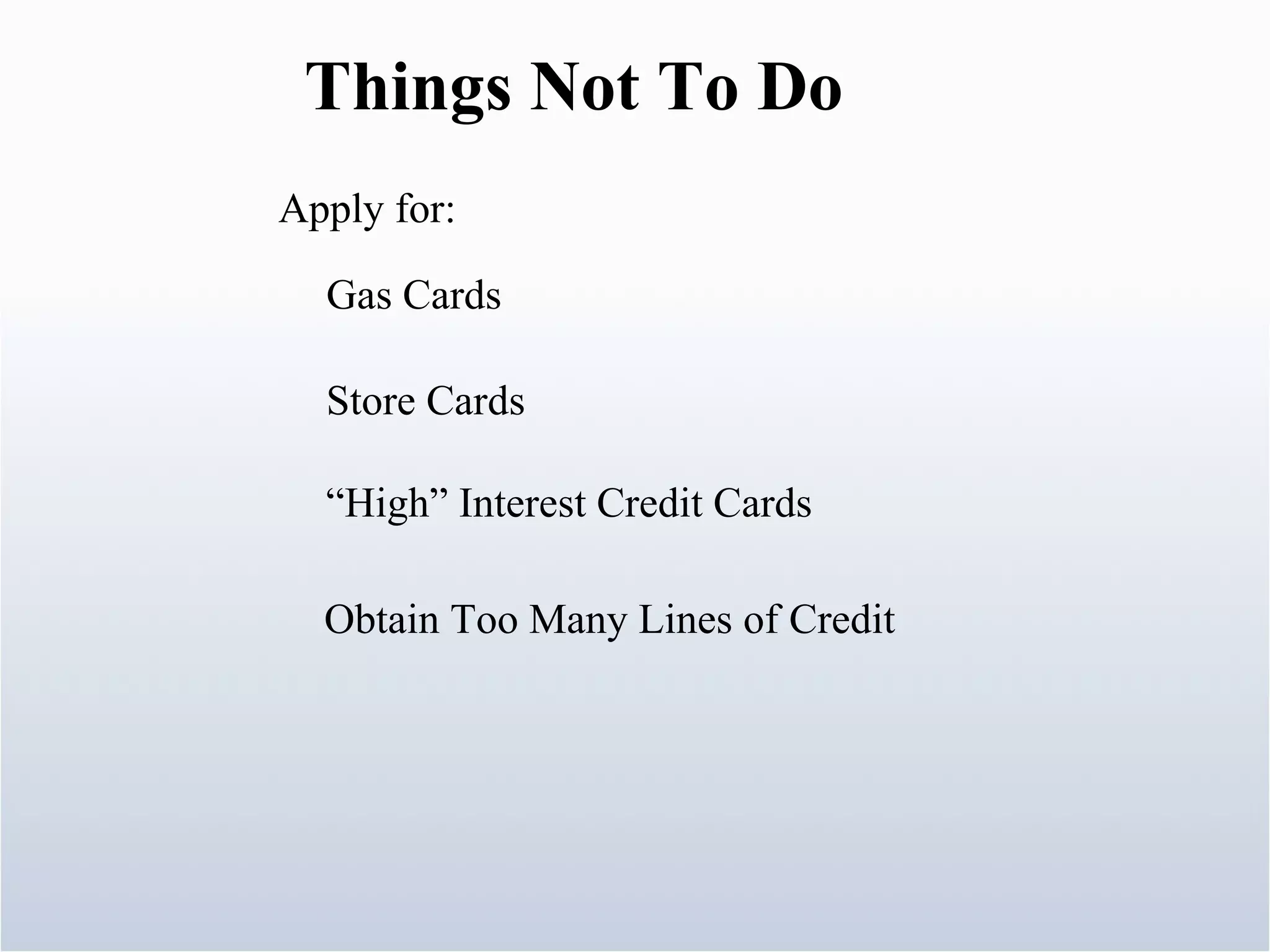

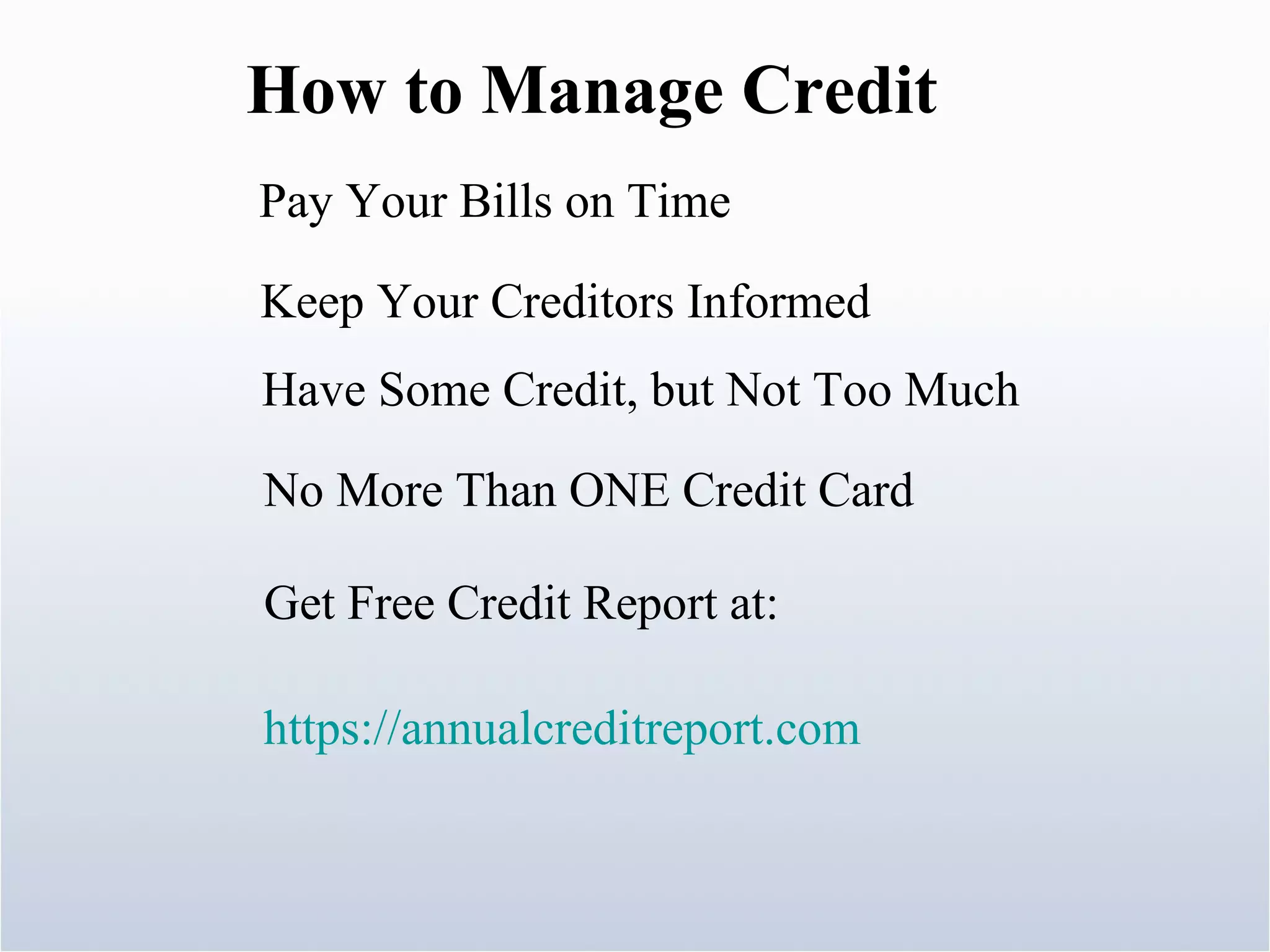

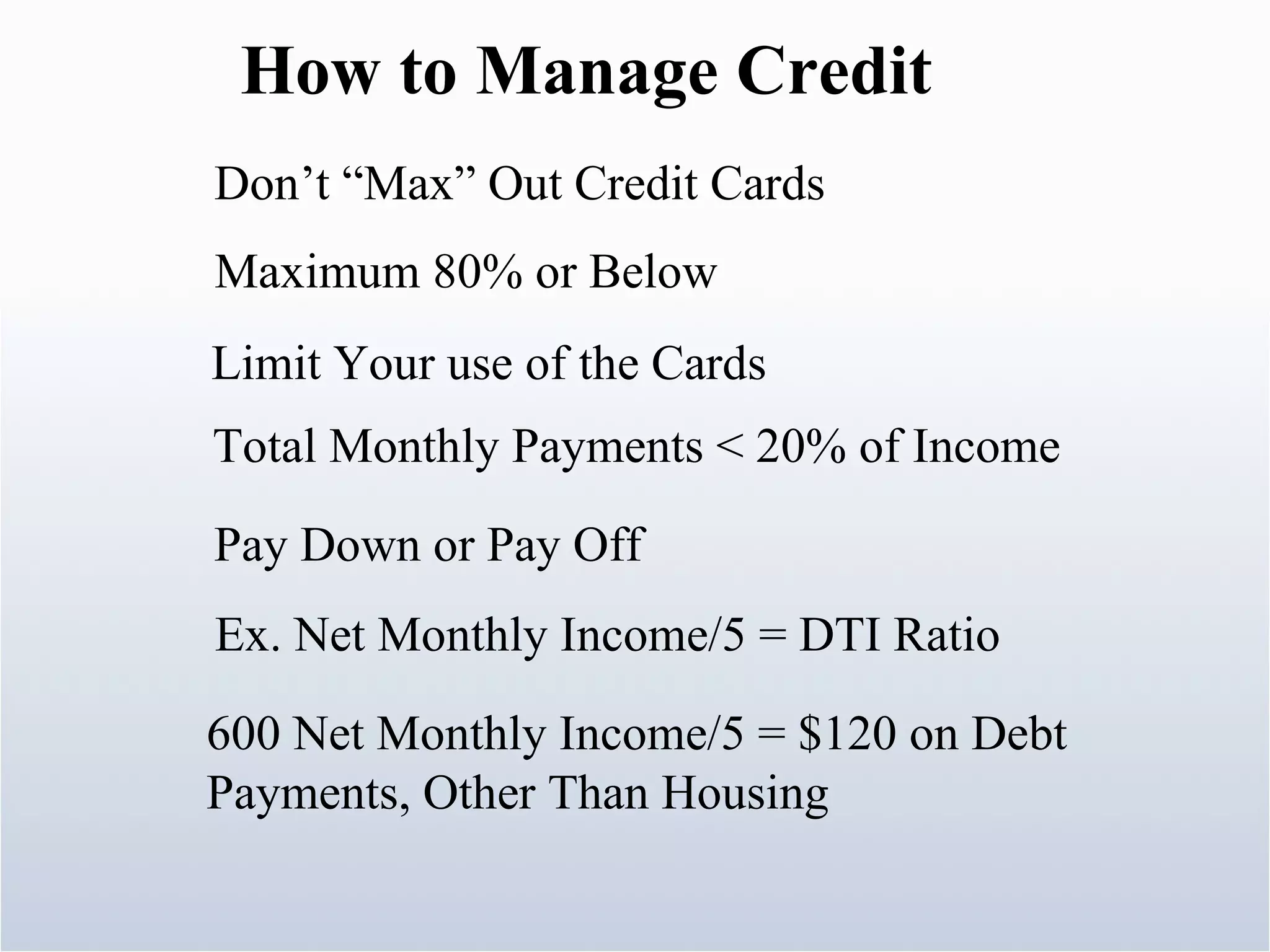

1. The document provides information on how to establish good credit, manage finances through budgeting, and tips for financial literacy. It discusses the importance of credit, how to build credit history, and maintaining a budget to avoid debt issues.

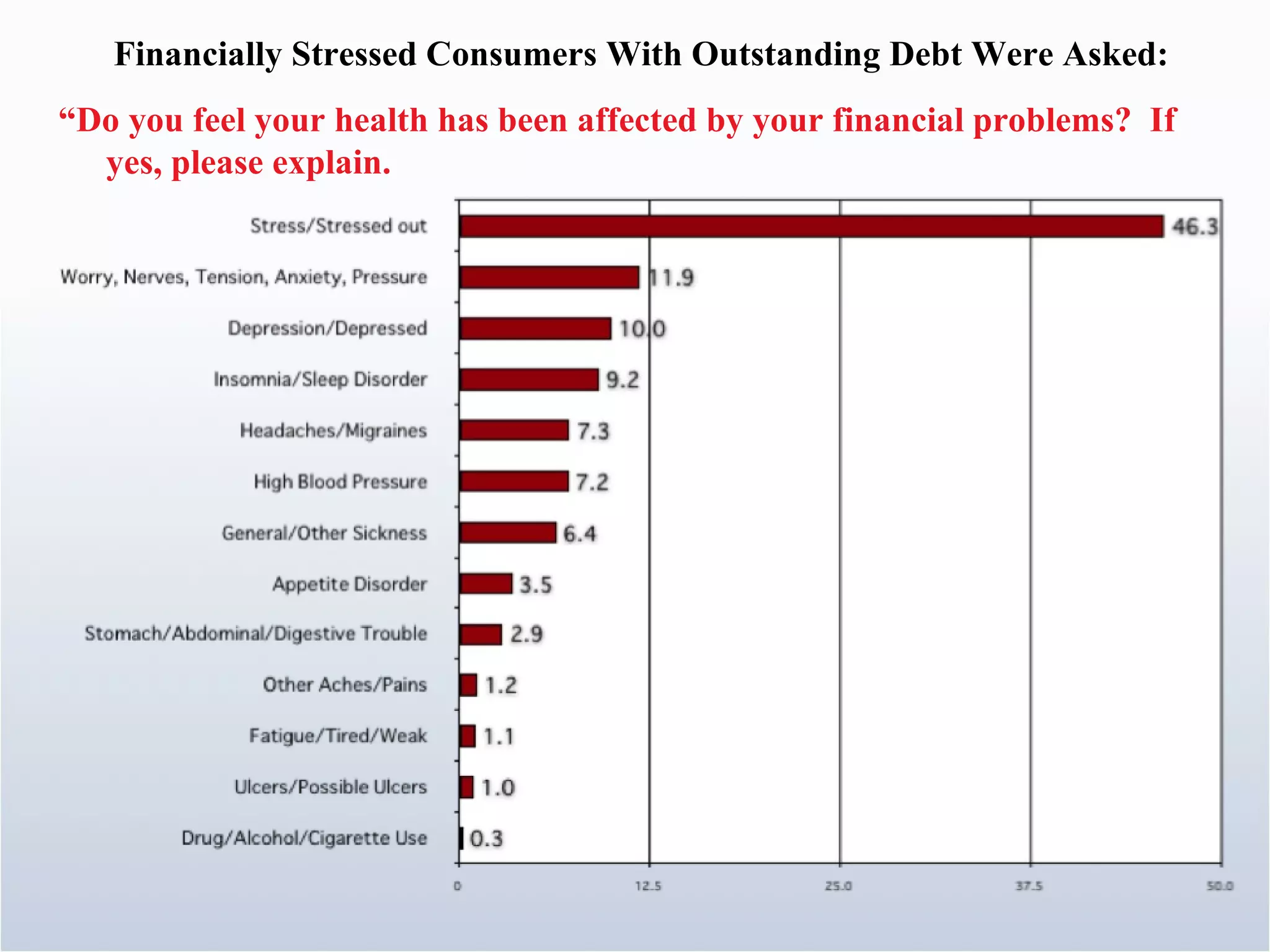

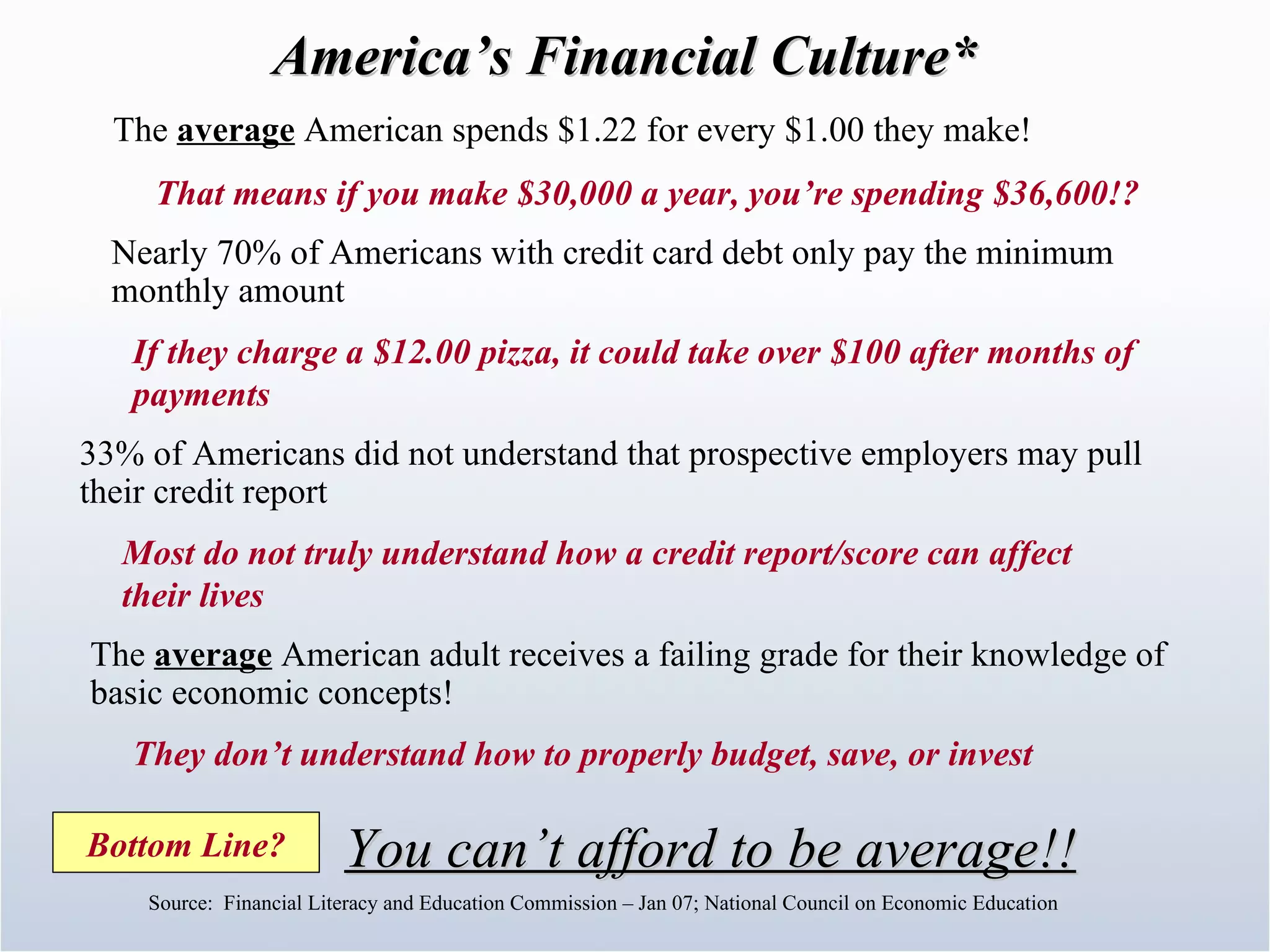

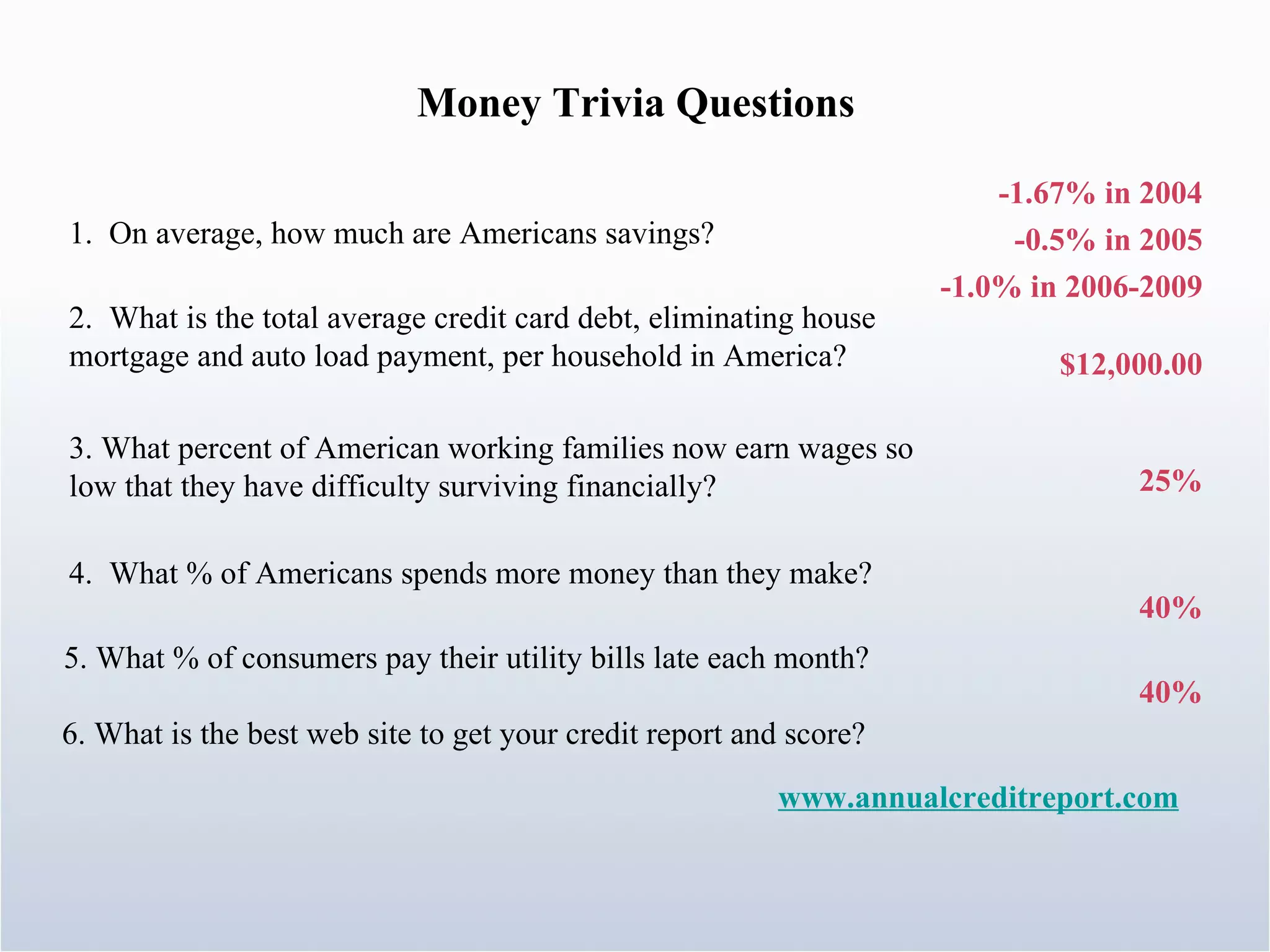

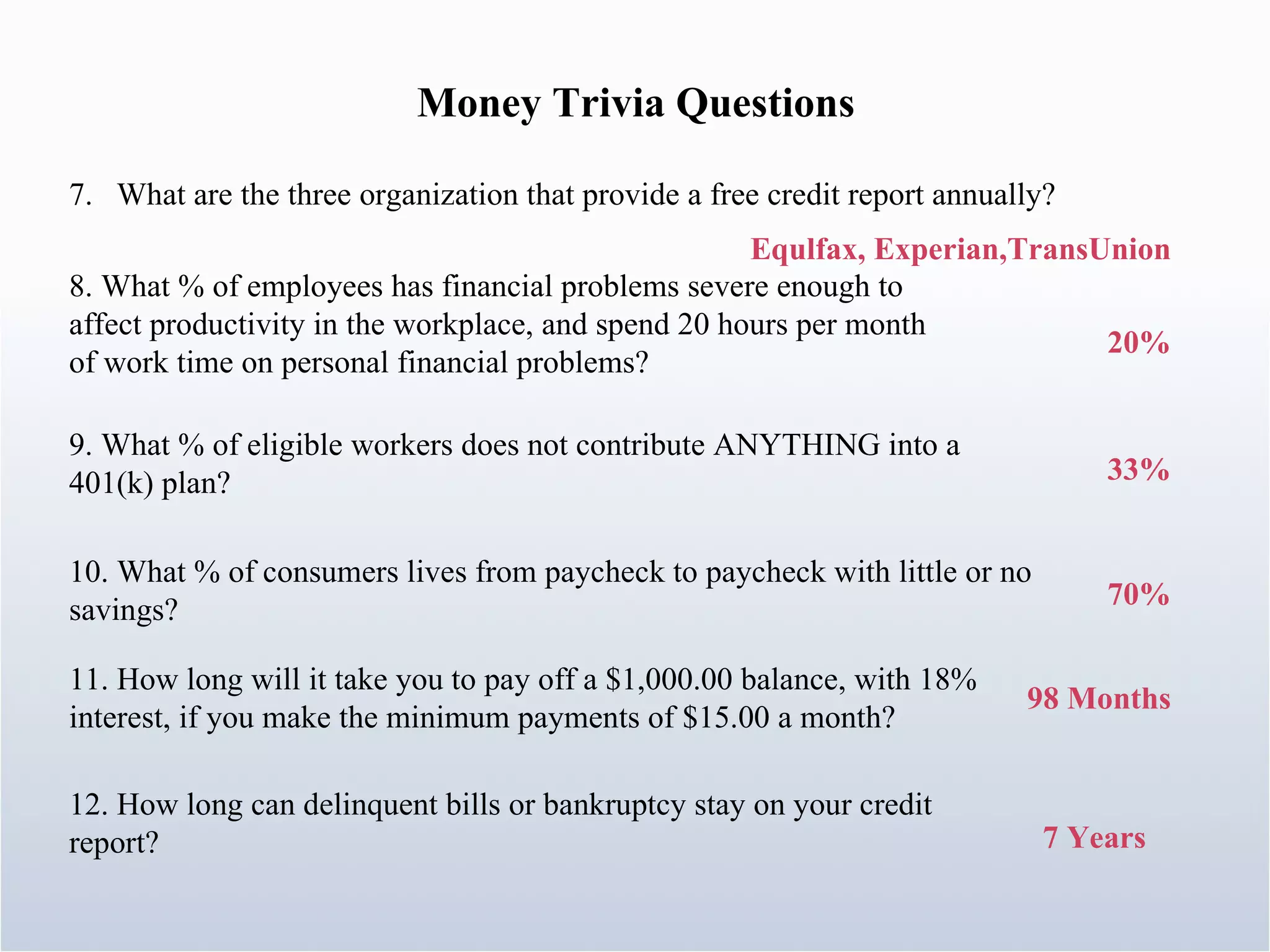

2. Statistics are presented on Americans' lack of financial knowledge and spending habits, including that the average American spends more than they earn and most live paycheck to paycheck without savings.

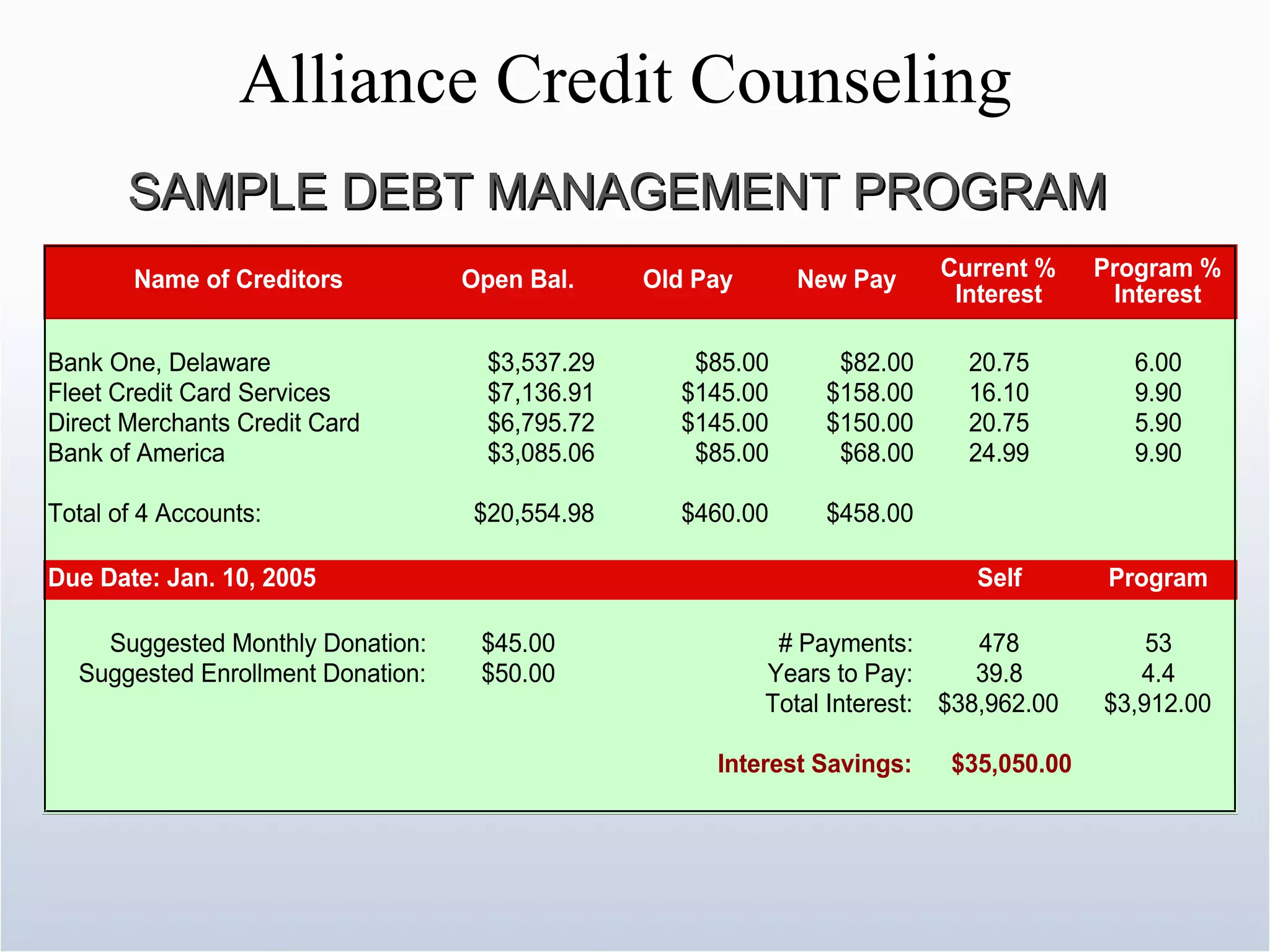

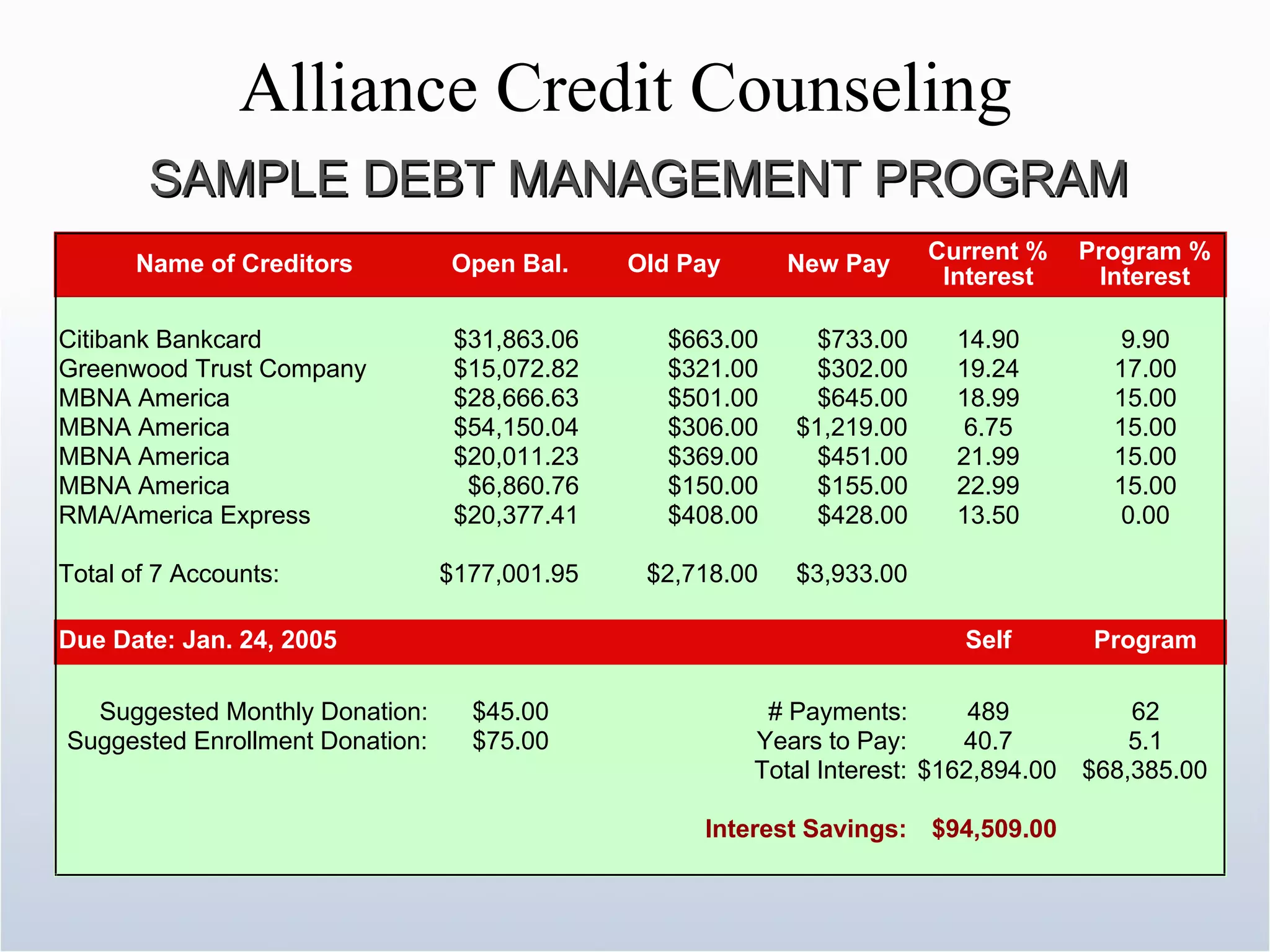

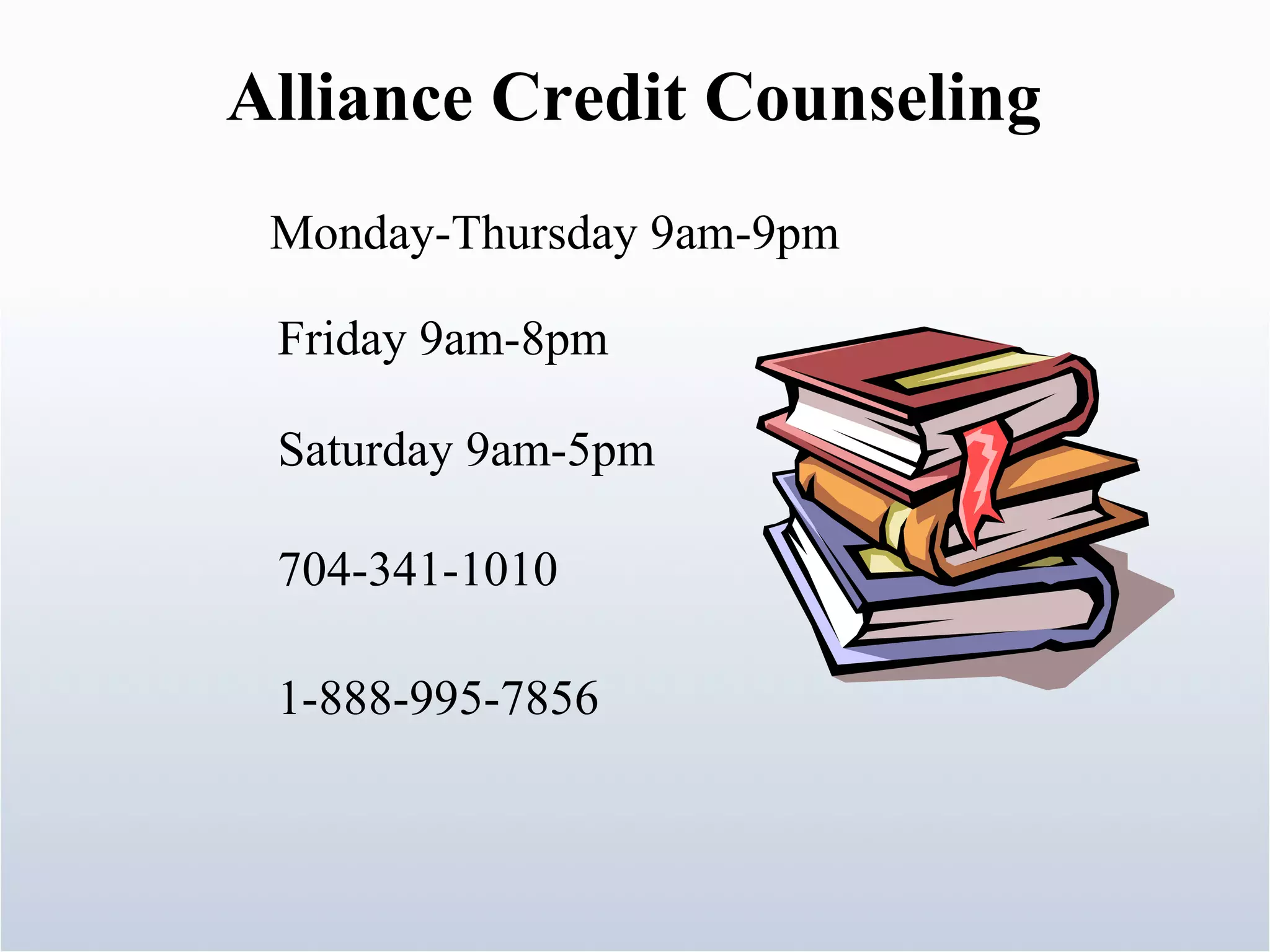

3. Information is also given on Alliance Credit Counseling, a nonprofit organization that provides financial counseling and education programs.