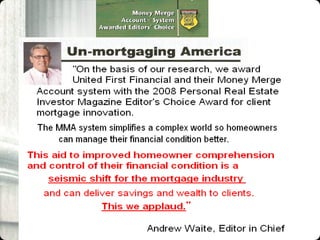

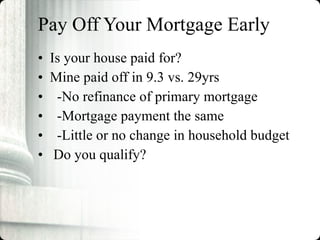

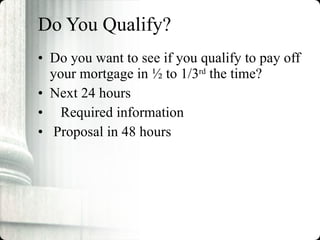

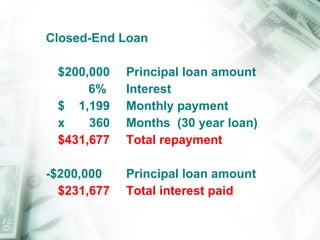

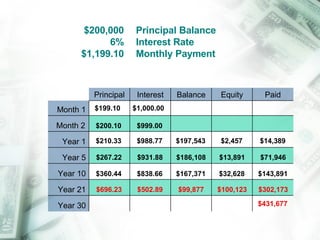

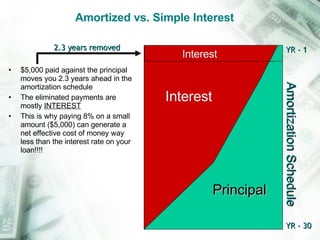

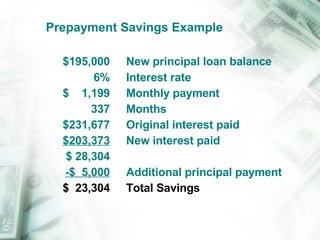

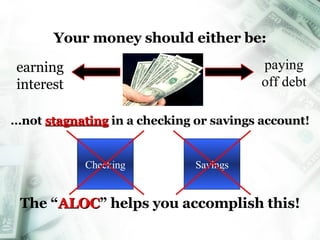

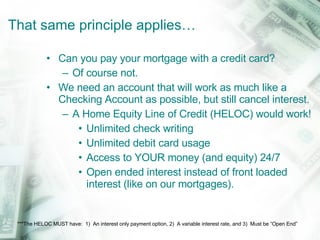

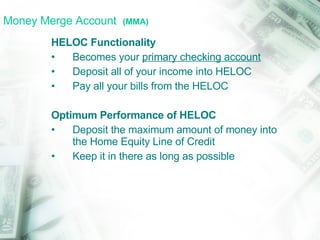

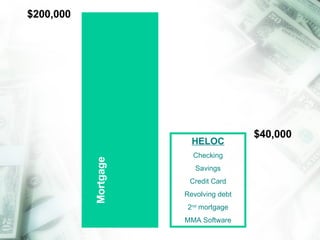

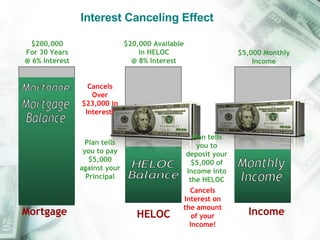

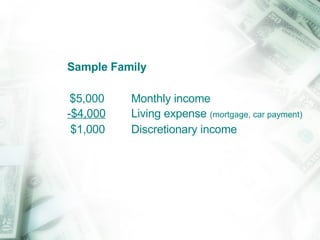

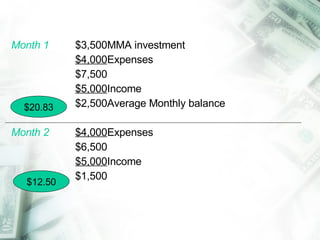

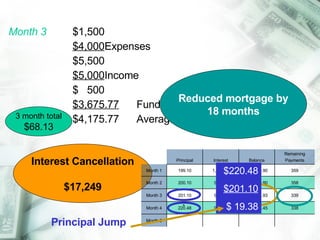

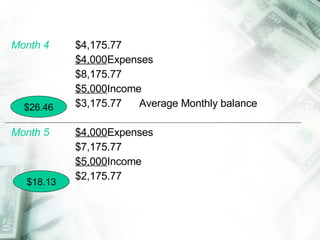

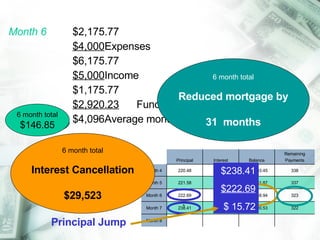

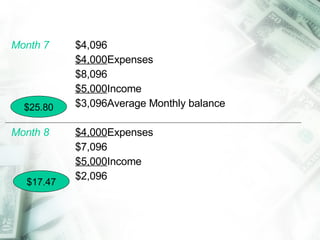

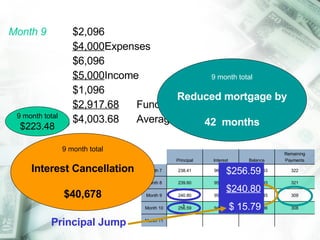

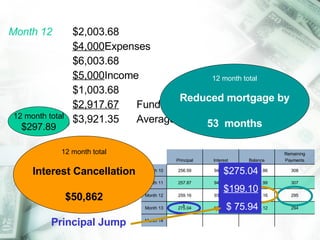

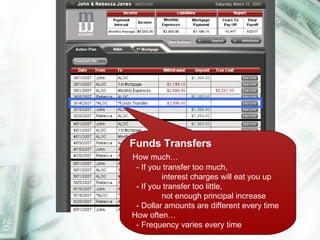

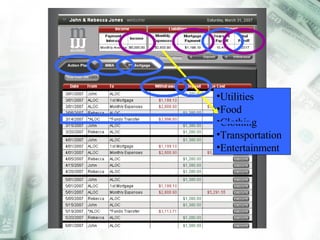

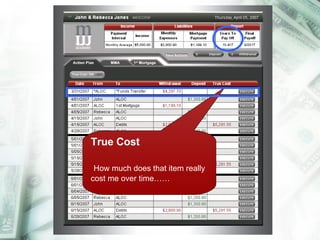

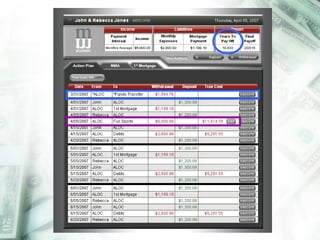

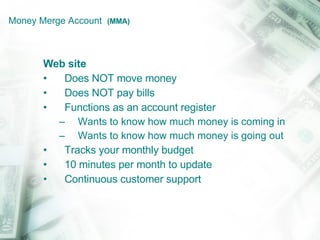

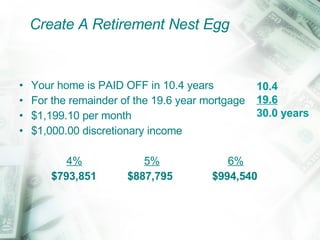

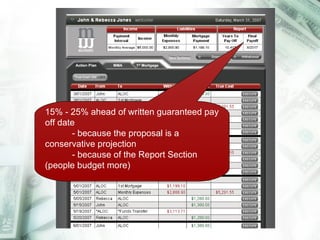

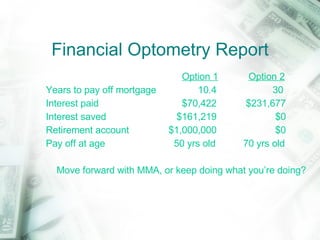

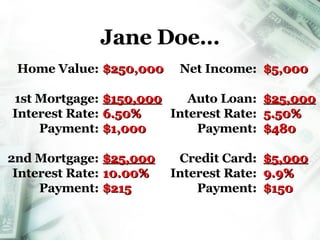

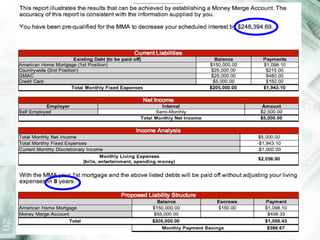

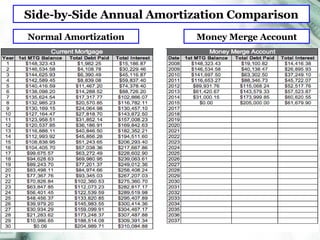

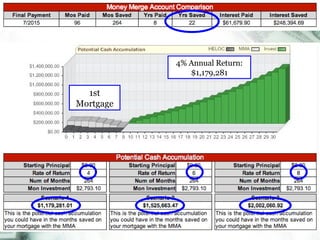

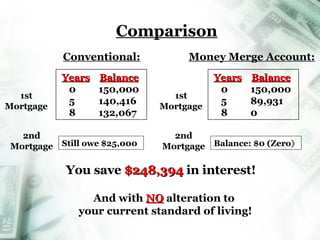

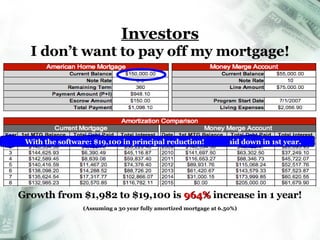

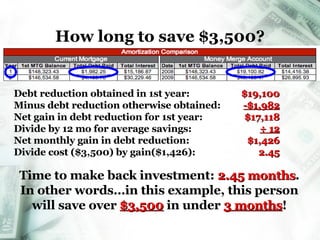

The document discusses a software program called the Money Merge Account (MMA) that helps homeowners pay off their mortgages much faster by leveraging the interest-canceling effects of a home equity line of credit (HELOC). It provides examples of families eliminating 30-year mortgages in 10-12 years while maintaining their standard of living. The MMA software analyzes users' financial situations and recommends monthly funds transfers and prepayments that reduce interest costs substantially.